In a market where mortgage interest rates are still above 6%, all-cash offers are gold. That’s especially true at the two market extremes: the most affordable homes and the luxury segments. About one-third of all homes sold during the first half of 2025 were paid for in cash, down only 0.6% from the same period a year ago, according to Realtor.com’s new report on all-cash trends, “Cash Is King: Trends in All-Cash Home Sales.”

Cash buyers hit their heyday at the height of COVID-19, when competition among buyers reached a fever pitch, and many resorted to all-cash offers as a way to win bidding wars. Cash buyers are a seller’s dream because they can come to the closing table faster and sidestep appraisal and financing contingencies. So it’s no surprise that when mortgage rates began climbing in mid-2022, cash offers emerged as a way for buyers with deep pockets to avoid large borrowing costs.

That said, all-cash transactions vary widely across regions; they’re most common in busy second-home markets and lower-priced metros.

“Their persistence underscores both the wealth concentration driving housing demand and the challenges faced by mortgage-dependent buyers in today’s high-cost housing market,” said Hannah Jones, Senior Economic Research Analyst at Realtor.com.

All-cash transactions might not be as popular today as in the years after the mid-2000s Great Recession, but given a choice, many sellers will still go for the all-cash offer.

What does a cash buyer look like?

Cash buyers fall into four categories:

- Investors

- Second-home buyers

- High net worth individuals

- Older home shoppers

Investors dominate cash deals, particularly big institutional players, while limited liability companies and corporations account for a greater-than-average share of all-cash sales. For instance, the share of investors who paid all cash sales in 2024 was nearly double the share of overall cash sales, per a recent report from Realtor.com.

Homeowners shopping for second address, especially in popular coastal vacation markets, also make all-cash deals. Older and/or more well-off buyers are more likely to offer cash than younger/lower-income buyers, because they tend to be longtime homeowners armed with accumulated equity they can apply toward their next home purchase without having to take out a mortgage.

Analyzing the U-Shaped Market

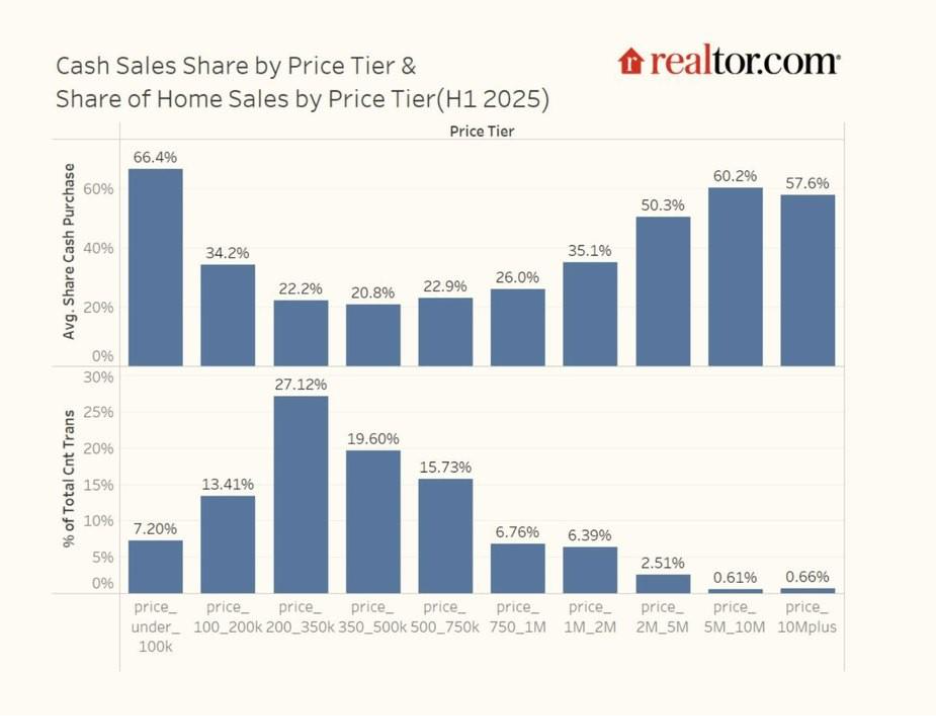

All-cash home purchases are concentrated at the two extremes of the market, with about two-thirds of properties sold under $100,000 paid in cash, while over 40% of >$1 million properties were cash deals.

In the luxury segment, over half of homes priced between $2 million and $5 million were sold for cash, as were more than 60% of properties in the $5 million to $10 million range.

“This creates a U-shaped relationship between price and cash prevalence, suggesting wealth-driven purchases at the high end and credit/income barriers, lack of financing availability, or the presence of investors at the low end,” Jones said.

Which metros lead in all-cash sales?

The number one market for all-cash sales in the first six months of 2025 was Miami, where an estimated 43% of home sales were nonfinanced. More than half of the homes priced above $1 million in this luxury and second-home market were purchased in all-cash transactions.

“Liquidity rules Miami’s super prime luxury market,” said Ana Bozovic, a Miami-based real estate agent and Founder of Analytics Miami. “Past $2,000 a square foot, over 80% of single-family and condo deals are all cash.”

Bozovic says that in Miami, the higher the price, the more all-cash the market becomes. For example, 70% of sales for condos priced above $1 million are cash, but when you look at condos going for under $500,000, that number drops to around 46%.

“Cash is appealing to sellers because it means certainty,” Bozovic explained. “There is no appraisal risk, no financing contingency, and no delay. For buyers at the high end, paying cash eliminates friction and signals strength.”

Those at the top of the real estate market, Bozovic said, tend to be “globally mobile, highly liquid individuals” who may prefer to move money without involving lenders.

“Purchasing with cash confers privacy, speed, and negotiating power,” she concluded.

The remaining top metros are San Antonio, TX (39.6%) in second place, then Kansas City, MO (39.2%), Birmingham, AL, and Houston (tying at 38.8% each), and St. Louis (38.1%).

“These metros combine strong investor interest with either relatively affordable housing or significant high-end, wealth-driven, and international demand,” Jones said. “Buyers in these markets are often motivated by speed and competition, making cash offers especially effective.”

Future of all-cash sales

For first-time and lower-income buyers who rely on financing to break into the housing market, elevated mortgage rates and ongoing affordability challenges have made life more difficult—which gives cash buyers the upper hand.

The powerful influence of cash buyers is especially seen in markets where sellers might be reluctant to list their properties due to ultralow mortgage rates; here, cash buyers can swoop in and quickly set the price tone.

Jones does note that if mortgage rates decrease substantially in the next year, the balance between cash and financed buyers could shift, with more mortgage-dependent buyers re-entering the market. That would cause all-cash purchases to become less frequent, and therefore cash buyers would lose their dominant share of sales.

To read more, click here.

The post Cash Buyers Call the Shots in the First Half of 2025 first appeared on The MortgagePoint.