Most consumers agree when asked in surveys if they support the idea of creating houses to assist cut rents or generate more affordable buying choices. To the best of Fannie Mae knowledge, no well-known studies have inquired about consumer support for the building of additional homes in their local communities, which are defined as being a few blocks or streets away from their home address.

Fannie Mae has looked to the National Housing Survey for answers to that and numerous other questions. Consumers were particularly asked about their thoughts on zoning and housing density increases in their actual communities, as well as the kinds of housing supply they are most likely to favor and the anticipated effects on local property prices, rentals, and taxes. The poll also examined the opinions of renters and homeowners regarding whether and how housing density should rise.

Report Highlights: National Housing Survey 2024

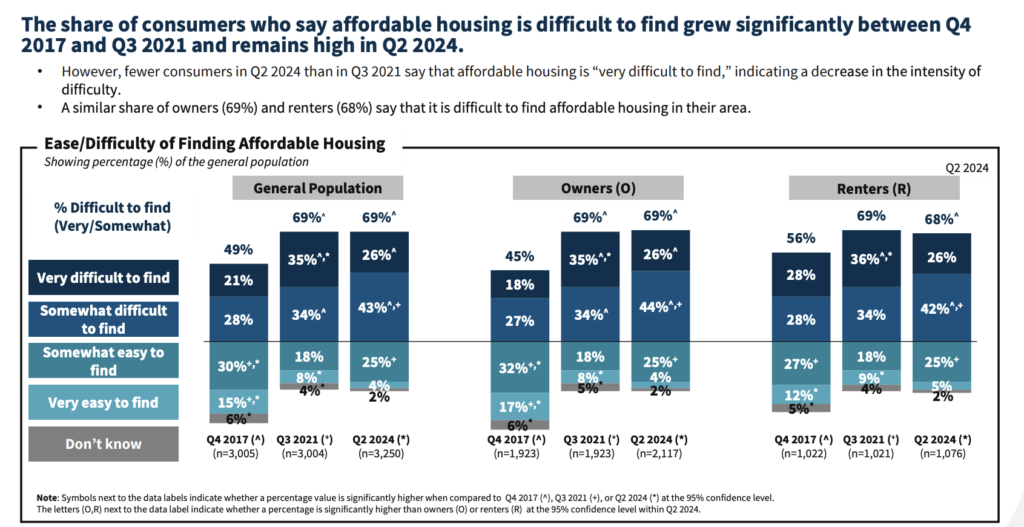

- Due to sharp rises in property prices and mortgage interest rates, a much larger percentage of consumers now feel it is difficult to locate affordable housing than when we originally posed the topic in 2017.

- The number of renters who favor the construction of affordable housing in their local communities is far higher than that of homeowners. Additionally, creating denser housing types like townhomes, apartments, or condos is supported by renters far more often than by owners.

- Fannie Mae found it particularly noteworthy that over half of consumers think that if more homes are built in their neighborhood, home prices, rent prices, and local taxes will rise. This goes against the conventional economic theory that says that as supply increases, prices will decrease.

Renters, Homeowners Often Disagree Strongly on Potential Solutions, Despite Agreeing on Unaffordability

As anticipated, consumers are significantly more likely to believe that it is hard to get cheap housing now (69%) than they were in our 2017 survey (49%); nevertheless, the 2024 proportion has been virtually constant since late 2021. Consumers have faced years of high housing prices and rapidly increasing mortgage rates since the epidemic, which has made the home-buying market extremely difficult.

The opinions of homeowners and renters on the potential remedy of increasing housing construction in their neighborhood to alleviate affordability issues differ noticeably. Even while the majority of consumers (82%) in our poll support the construction of additional housing of some kind in their community, renters were far more inclined to support the construction of more “affordable” housing than homeowners (73% vs. 44%).

Additionally, renters are far more likely to support the construction of other housing types, such as townhomes, apartments, or condos, than homeowners, even though both are inclined to support the construction of more single-family detached homes in their neighborhood.

Another obvious point of contention between the two groups that frequently arises at local government meetings is that nearly two-thirds of renters (63%) say they would support changes to local zoning codes or regulations to allow more housing development, compared to just 37% of homeowners.

Many Consumers Don’t Think New Supply Will Make Housing More Affordable

Consumers are less convinced, despite the fact that the majority of economists concur that increasing the number of homes built will help slow price increases for both buying and renting. In fact, only 13% of respondents think that if more homes are developed in their community, home prices will fall, whereas 59% think that they will rise. The fact that many people believe the homes being constructed would not be within their means could be one reason for this disparity.

Further evidence of the perceived financial disadvantages of new construction comes from the fact that 61% of consumers believe local taxes would rise and 59% of consumers believe rent prices will rise as more homes are constructed.

The Type of Housing Consumers Desire Doesn’t Match What’s Available

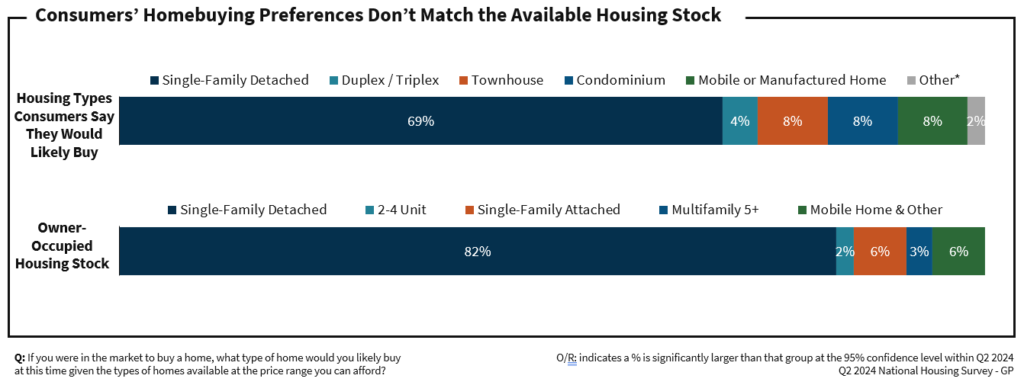

Approximately one-third of consumers (31%) say they would purchase a home other than a single-family detached home if they were in the market, taking into account what is available and what they can currently afford.

We are aware, meanwhile, that just 18% of the housing stock mix consists of non-single-family detached homes. Consumer demand for this specific dwelling type clearly seems to be significantly greater than supply, which we believe could have significant ramifications for homebuilders.

Diverse Customer Attitudes May Make New Development Difficult

Policymakers and homebuilders may find it difficult to agree on suggested advancements and reforms due to consumers’ conflicting opinions about housing affordability and building. Although the majority of consumers do not support the development of housing types in their community that most experts believe would have the greatest positive influence on affordability, they do recognize the need for improved affordability.

However, survey participants think that more housing is a net good when taking into account the wider implications of new development. The survey’s findings also hint to a possible need for more supply, indicating that pent-up demand from homebuyers for denser dwelling types is higher than what is currently available in the housing stock.

To read the full report, including more data, charts, and methodology, click here.

The post Consumers Agree to Disagree When It Comes to New Neighborhood Construction first appeared on The MortgagePoint.