The September 2024 commentary from the Fannie Mae Economic and Strategic Research (ESR) Group states that existing home sales are not expected to pick up significantly through the remainder of 2024, with the annual pace now forecast to be the slowest since 1995, despite a significant decline in mortgage rates and improved supply in some parts of the country.

Recent data continues to point to a limited demand for house purchases at the current affordability levels, including softening in pending home sales and purchase mortgage applications. Despite a roughly 20% rise in properties available for sale from year-ago levels, the ESR Group reports that existing home sales have not increased, partly because of local variances.

“Increasingly, regional variations in housing supply are creating divergent affordability conditions and experiences for consumers on both sides of the home sales transaction; however, taken as a whole, home sales activity, particularly on the existing side, remains near what we consider to be the floor of basic demographic and household mortgage demand,” said Doug Duncan, Fannie Mae Senior VP and Chief Economist. “Supply has risen significantly in many Sun Belt states, where such factors as ease of new home development and increasing insurance costs are having an impact, but at the national level the supply shortage still very much applies.”

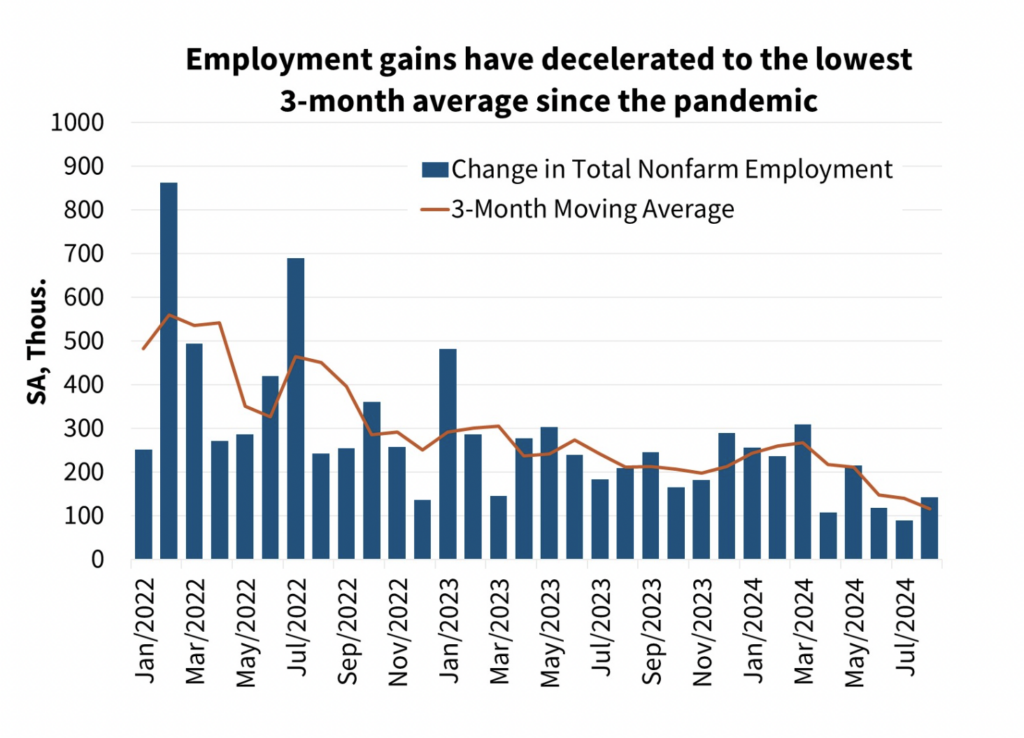

U.S. Economy Forecast to Shift Onto Slower Path

The Sun Belt and Mountain West regions have seen a significant increase in for-sale inventories. These areas have also seen some of the biggest increases in home prices in recent years, along with a strong rate of new home development. This results in increased competition for existing house sales due to the new building as well as a significant relative affordability shock in some states.

According to the ESR Group, before existing home sales start to significantly increase, a combination of lowering mortgage rates and modest home price increases in comparison to income growth in these areas would be required.

This month, the ESR Group’s forecast for economic growth remained basically unaltered since incoming data has generally met forecasts. The Federal Reserve is expected to alter monetary policy toward a more neutral position as inflation approaches the 2-percent objective, according to the ESR Group, which also adds that the economy is probably moving toward a slower growth path. However, the ESR Group thinks that real gross domestic product growth would likely remain muted in the upcoming quarters due to the lag effect of monetary policy, before eventually reverting to the long-term trend by the end of 2025.

“Although mortgage rates have fallen considerably in recent weeks, we’ve not seen evidence of a corresponding increase in loan application activity, nor has there been an improvement in consumer homebuying sentiment,” Duncan said. “We think it’s likely that many would-be borrowers are waiting for affordability to improve even further, and that some may be anticipating additional declines in mortgage rates given expectations that the Fed will lower the federal funds target rate. Others may be waiting for household incomes to improve further to offset some of the recent home price growth, or they may be thinking that future supply growth will ease affordability. Regardless of the lever, we expect affordability to remain the primary constraint on housing activity for the foreseeable future, and we now think full-year 2024 will produce the fewest existing home sales since 1995.”

To read the full release, click here.

The post Fannie Mae Forecast: Existing Home Sales Near 30-Year Low first appeared on The MortgagePoint.