Nearly three-quarters of Americans (74%) with annual incomes under $50,000 occasionally, frequently, or significantly struggle to make their regular rent or mortgage payments according to a new report from Redfin.

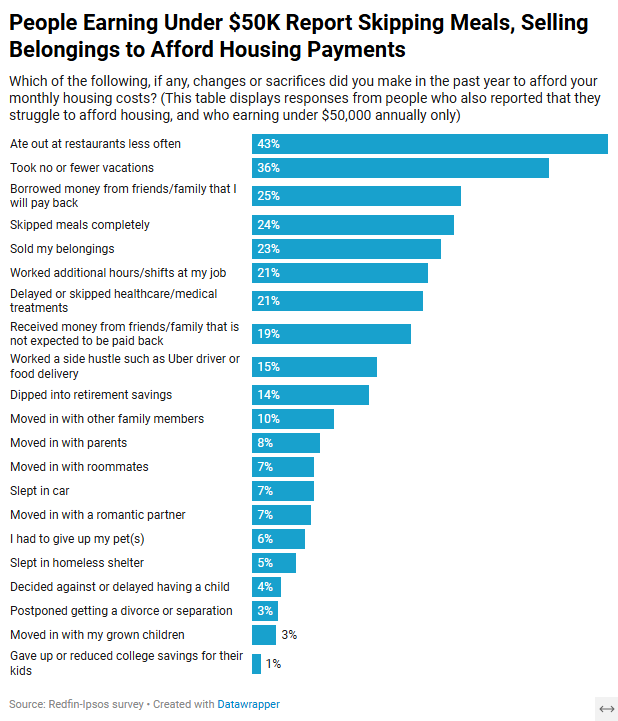

Almost a quarter (24%) of those individuals say they have skipped meals in order to pay their monthly housing expenses. Among those in that wage range, dining out less frequently (43%), having no or few vacations (36%), and borrowing money from friends or family (25%), it is one of the most frequently mentioned compromises.

Over the past five years, both rental and home-sale costs have soared, and although earnings have grown during that time, they haven’t kept pace with the cost of housing. Renters make up the majority of those with incomes under $50,000, and although rents in the US have leveled down in the past year, they are still 20% higher than they were before to the pandemic. According to a recent Redfin report, the percentage of apartments in the U.S. that cost less than $1,000 per month has fallen to its lowest point ever, making it more difficult for Americans with lower incomes to obtain affordable housing.

Purchasing a home has become even more expensive in recent years; the median cost of housing in the U.S. has climbed by almost 40% since the epidemic began. Costs have approached a record high due to skyrocketing prices and rising mortgage rates. People who make less than $50,000 a year in many parts of the nation are unable to purchase a home: As of this summer, a household must make $77,000 annually to buy the median-priced starter home, according to a September Redfin analysis.

In order to make payments, nearly 25% of Gen Zers who struggle to pay for housing have sold possessions.

Generally speaking, Gen Zers make less money than previous generations, and many of them feel that their financial security is less secure than that of their parents at the same age. A little more than 25% of Gen Zers are homeowners, and they are coming of age to purchase a home at a time when housing costs are skyrocketing.

The largest percentage of any generation, about seven out of ten (71%) of Gen Zers say they occasionally, frequently, or significantly struggle to pay their regular rent or mortgage. Sixty-five percent of millennials find it difficult to pay their rent.

Almost a quarter (24%) of Gen Zers who have trouble paying for housing have sold possessions to cover their monthly rent. 10% have postponed or chosen not to have children, 19% have moved in with a romantic partner, and just over one in five (21%) have skipped meals.

In terms of millennials … those who have trouble paying for housing, almost a quarter (23%) say they have skipped meals in order to pay their bills each month. 13% have taken money out of their retirement account, 19% have done a side job, and 21% have postponed or avoided a medical procedure.

Almost a quarter (24%) of Gen Zers who have trouble paying for housing have sold possessions to cover their monthly rent. 10% have postponed or chosen not to have children, 19% have moved in with a romantic partner, and just over one in five (21%) have skipped meals.

Now let’s talk about millennials. Of those who have trouble paying for housing, almost a quarter (23%) say they have skipped meals in order to pay their bills each month. 13% have taken money out of their retirement account, 19% have done a side job, and 21% have postponed or avoided a medical procedure.

This survey is based on a Redfin-commissioned study that Ipsos performed in September 2024 with 1,802 Americans between the ages of 18 and 65.

The post How Much Are U.S. Homeowners Struggling to Make Mortgage Payments? first appeared on The MortgagePoint.