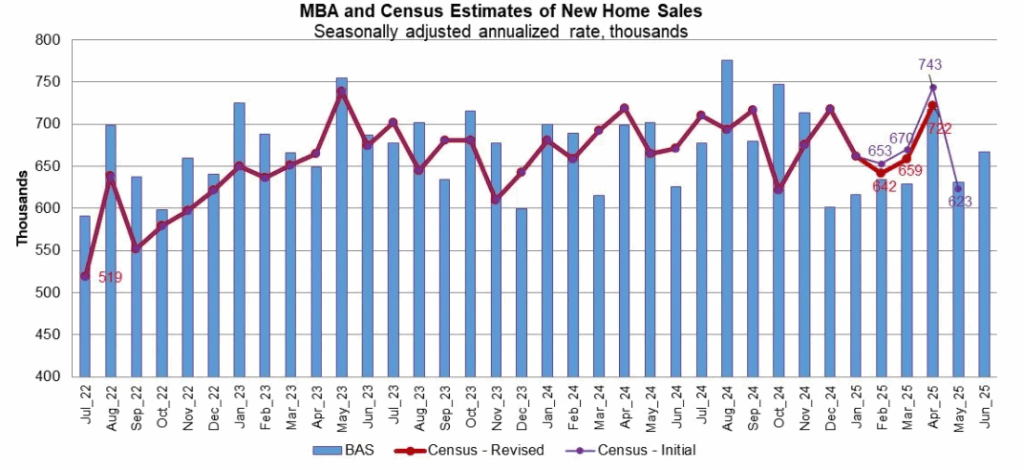

The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) latest data for June 2025 shows that mortgage applications for new home purchases increased 8.5 % year-over-year. Month-over-month, however, a different story was painted as applications decreased by 4% from May 2025. This change does not include any adjustment for typical seasonal patterns.

“Applications to purchase new homes fell in June, consistent with typical seasonal patterns, but remained ahead of last year’s pace,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “A cloudier economic outlook and elevated mortgage rates continue to weigh on potential buyers, while growing inventory, builder incentives, and lower prices have brought some buyers back to the market. As a result, we continue to see home sales ebb and flow. MBA’s estimate of new home sales increased to a sales pace of 667,000 units, up on a monthly and annual basis.”

According to the National Association of Realtors (NAR), home builders are showing more willingness to offer incentives, such as price reductions, credits for closing costs, and mortgage rate buy-downs, which are assisting buyers overcome affordability issues. Also, new-home prices are coming closer in line with the resale market. NAR reports that the median sales price of a new home was $430,700 in March, compared to $393,500 for existing-home sales. Approximately 22% of builders said they cut prices in April, with an average reduction of 6%, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

“Although home prices and mortgage rates remain high, prices have been rising more slowly, and home builders have been introducing a broader mix of smaller homes in order to bring prices within reach of more home buyers,” said Gregg Logan, a Housing Analyst and Managing Director at RCLCO Real Estate Consulting. “As rates come down later this year, we expect that trend to continue.”

MBA reports that by product type, conventional loans composed 50% of loan all applications, FHA loans composed 35.1%, RHS/USDA loans composed 1.2%, and VA loans comprised 13.8%. The average loan size for new homes decreased from $379,209 in May to $376,077 in June.

One major market adjustment has been uncovered in the housing inventory space, as Realtor.com’s June housing data reveals the housing market offered buyers more options, with inventory climbing for the 20th consecutive month and new listings increasing year-over-year across every major region.

Buyers found more options available in June, with the number of actively listed homes rose 28.9% compared to the same time last year, building upon May’s 30.1% increase, and marking the 20th consecutive month of year-over-year inventory gains. The number of homes for sale topped one million (1.08 million) for the second consecutive month, and exceeded 2020 levels for the third straight month, a stat seen by many as a key pandemic recovery benchmark. Still, June inventory remains 12.9% below typical 2017-2019 levels, down from 14.4% in May, indicating the market is closing the pre-pandemic inventory gap at an accelerating pace.

Housing inventory rebounded in all four major U.S. regions in June, though the pace varied as the West reported a 38.3% rise; the South a 29.4% rise; the Midwest a 21.3% increase; and the Northeast reported a 17.6% increase in housing stock.

Another major driver of purchase apps, a low mortgage rate environment, offered buyers some relief in June. Mortgage rates, driven by investor speculation and economic data, have been impacted by the Trump administration’s tax cuts and tariff policies. And if the fallout of high tariffs winds up falling upon the shoulders of consumers as anticipated, central bank policymakers may delay dropping the fed funds rate.

In June, for the fourth consecutive meeting of the Federal Reserve’s Open Market Committee (FOMC), the federal funds rate was held steady at 4.25%-4.50%, amid an environment with tariff backlash, a rise in inflation, and a weakening economy.

“Increased uncertainty about the inflation picture lessens the chances of a cut in rates by the Fed,” said Keith Gumbinger, VP at HSH.com. “Greater inflation would argue against cutting rates, absent any significant deterioration in labor conditions.”

The post New Home Purchases Surge YoY first appeared on The MortgagePoint.