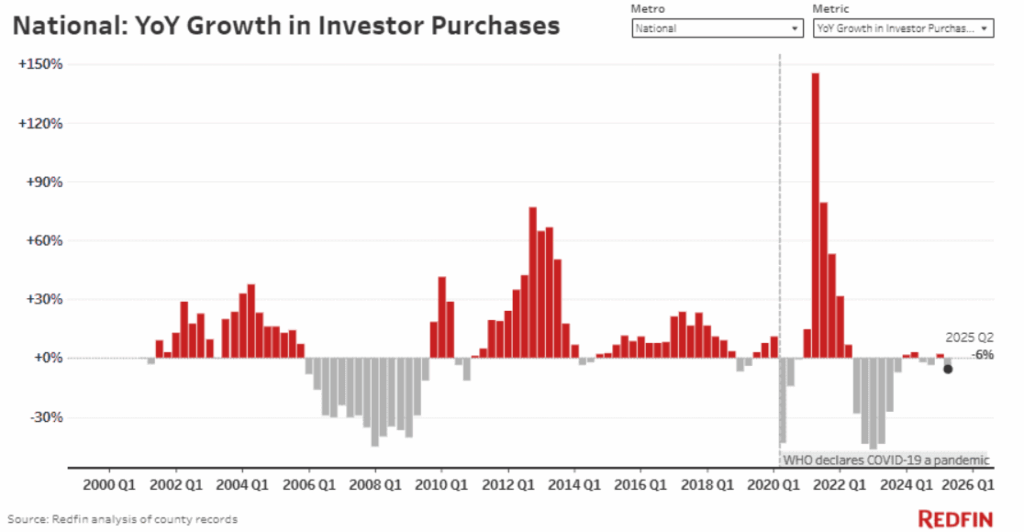

Redfin reports that U.S. real estate investors purchased roughly 52,000 homes in Q2, the lowest level for that time of year since 2020—down 6% from a year earlier, the biggest drop since Q4 of 2023. Redfin defines an investor as any institution or business that purchases residential real estate, meaning its report covers both institutional and mom-and-pop investors.

For the report, Redfin analyzed county-level home purchase records across 39 of the most populous U.S. metropolitan areas going back through 2000.

Real estate investors are reportedly pulling back for the very same reasons that individual homebuyers are pulling back: high borrowing costs, elevated home prices, and overall economic uncertainty. Asking rents have also declined from their peak in much of the country. Additionally, the short-term rental market has cooled in some areas amid tightened regulations, a huge negative for investors who buy properties strictly for the sake of renting.

Decline in Profits Turning Away Investors

The typical investor earned $195,934 in capital gains via selling a home in Q2, up 1.7% year-over-year. For comparison, at the start of 2021, investor capital gains were up more than 30% year-over-year as investors snapped up properties and quickly sold them for a big profit during a time of booming homebuying demand. It’s also worth noting that the share of homes investors sell at a loss rose slightly in Q2. Just under 7% of homes investors sold in Q2 brought in less than it was bought for, up from 5% a year earlier.

“For real estate investors, the numbers just don’t pencil out the way they did a few years ago, whether they’re looking to flip a home or rent it out,” said Redfin Senior Economist Sheharyar Bokhari. “It costs a lot to buy a home, and potential returns are simultaneously softening. That doesn’t mean investors are disappearing—they’re still buying nearly one in five homes in the country—but they’re being choosier about their home purchases, just like individual homebuyers.”

Many investors are taking advantage of the buyer’s market and purchasing homes for under their asking price and/or successfully getting concessions from sellers. In a market in which there are hundreds of thousands more home sellers than buyers, investors—just like regular buyers—have a chance to get a deal on certain homes.

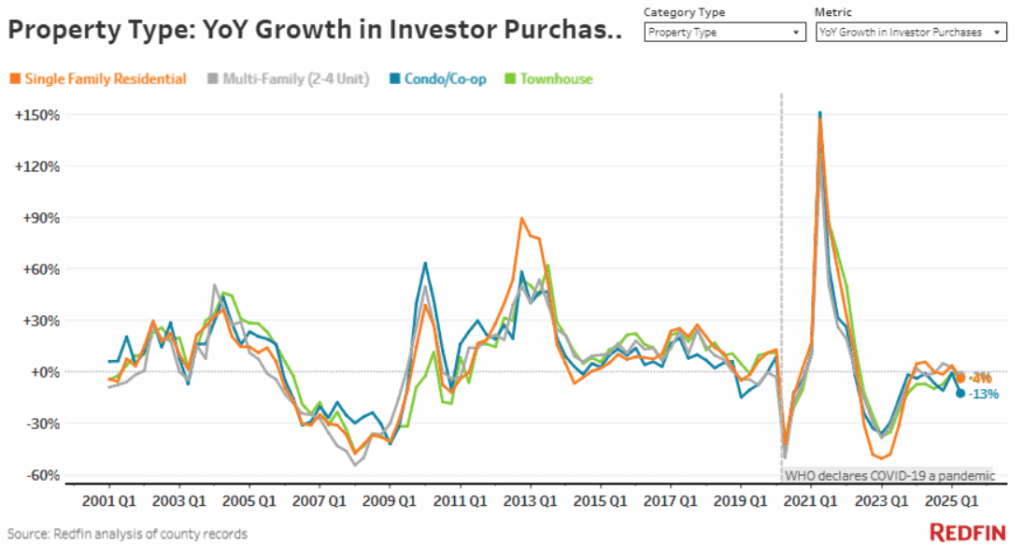

Investor Purchases of Condos on the Decline

The decline in investor purchases is especially big for condos. Investors bought roughly 9,500 condos nationwide in Q2, the lowest level for that time of year since 2013, aside from the onset of the pandemic in 2020, when the housing market came to a standstill. That’s down 13% year-over-year, the biggest drop in nearly two years. It’s also at least triple the decline for any other property type: Investor purchases of single-family homes and townhouses fell 4%, and purchases of multi-family properties fell 2%.

Investor purchases of condos are falling for many of the same reasons why individual purchases of condos are falling. Many condo buildings come with high HOA fees and special assessments for maintenance, which exacerbate already-high sale prices and mortgage rates. Condos are viewed as an increasingly risky investment because those costs have been rising, so a lot of individuals and investors are shying away, nervous that the value of their condo will go down in the future.

For investors, there are additional factors making condos less attractive than they used to be. Many investors buy condos specifically to rent them out as apartment-style homes, but slowing rent growth and rising vacancies in certain cities is making that investment strategy less attractive. Condos also typically rise in value more slowly than single-family homes—and in some places, they’re falling in value—which makes them less attractive to investors who buy properties to hold onto them and sell them later. While investors typically try to buy low and sell high, many believe condo prices will fall and are trying to time the bottom of the market.

Apartments.com recently examined the tactics landlords are using to attract renters in today’s marketplace. With affordability still top of mind for many, incentives like a free month of rent are emerging as leverage for property owners seeking to house tenants. The study found that 36% of renters said a free first month or rent would be the strongest factor to signing a lease when choosing between comparable apartments.

With the strength of concessions as a driver for landlords, the Apartments.com survey found that 88% of renters said they would consider overlooking minor flaws in an apartment for a good rent concession, while nearly a third of renters value a rent concession that provides ongoing value throughout the term of their lease, and 95% of renters said a concession mentioned in a listing would make them more likely or potentially more likely to inquire about the property.

And while renters may be enjoying success asking for such concessions, those perks could dry up as the apartment supply begins to shrink. With the median asking rent ticking upward, it’s worth noting that it remains $70 below the July 2022 record high of $1,860. Wages are also growing faster than asking rents, indicating that rental affordability is actually improving.

“The condo market is the slowest I’ve seen in at least a decade,” said John Tomlinson, a Redfin Premier Agent in Fort Lauderdale, Florida. “Buyers are wary of putting offers on condos—and many are cancelling contracts after they’ve made offers—because costs have increased so much and they’re nervous that they’ll continue rising in the future. HOA fees are high, a lot of insurance companies won’t cover condo buildings on the coast, and some mortgage lenders are quoting higher rates for condos. If you’re an investor, you can’t count on making money from a condo right now.”

Investors Purchases Flat Year-Over-Year

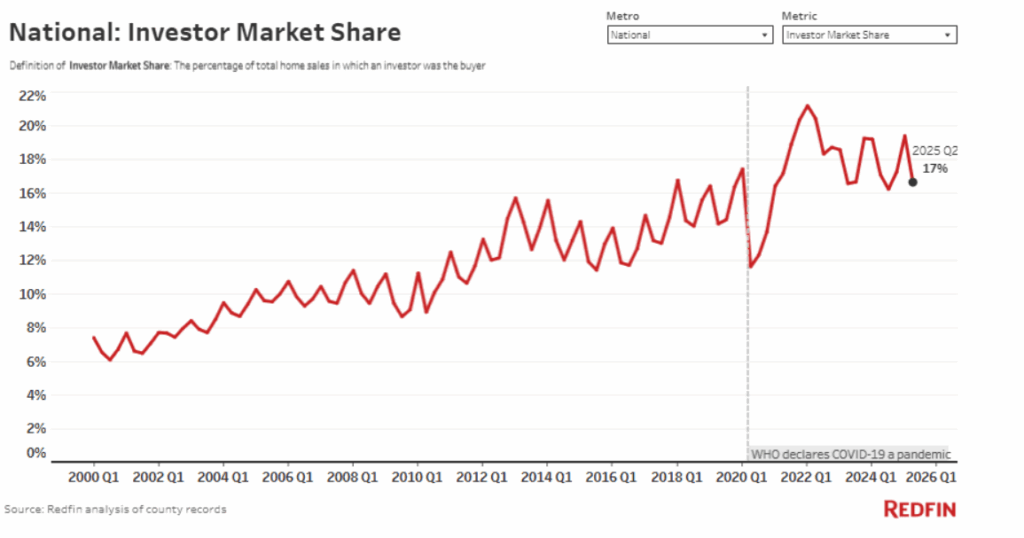

Redfin reports that real estate investors purchased 17% of U.S. homes that sold in Q2, unchanged from a year earlier.

Focusing on condos, investors purchased 17% of condos that sold in the second quarter. That’s down just marginally from 18% a year earlier. Investors purchased 16% of single-family homes that sold in Q2, flat from a year earlier, and 15% of townhouses, also flat. They purchased 33% of multifamily properties, unchanged year over year.

Investor market share overall and for condominiums is essentially unchanged year-over-year, while investor purchases are falling. That illustrates that the decline in investor activity mirrors the decline in overall homebuying activity.

What States Are Experiencing the Largest Decline?

In Orlando, Florida, investor purchases fell 25% year-over-year in Q2—the biggest decline among the metros in Redfin’s analysis. It is followed by Fort Lauderdale, where investor purchases fell 21%. Investor purchases also fell in several other Florida metros, having declined 16% in Jacksonville, 15% in West Palm Beach, 13% in Tampa, and 12% in Miami.

In Florida, investors have been backing off for years because buying a home to rent it out or flip is not nearly as appealing as it once was. Home prices are dropping, inventory is high, and HOA fees and insurance costs are soaring amid the increasing frequency of natural disasters.

Flooding is the most common and costly natural disaster in the U.S. and highly prevalent in the Sunshine State, yet 96.7% of homes lack flood insurance, according to a report by ValuePenguin. In 2024, the average home sustained nearly $34,000 in flood damage, with the most significant losses linked to Hurricanes Helene and Milton, which devastated parts of Florida, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, and Virginia.

“Climate change continues to drive sea-level increases and make weather more extreme,” said ValuePenguin Insurance Expert and Spokesperson Divya Sangameshwar. “Flood-prone areas around the country are expected to grow by nearly half in just this century.”

Despite the rising threat, flood insurance is not mandatory unless a home is in a FEMA-designated Special Flood Hazard Area (SFHA). This leaves many homeowners financially vulnerable. Just one inch of floodwater can cause $25,000 in damage, yet many still choose to go uninsured.

On the other side of the coin, investor purchases rose most on the West Coast, led by Seattle, where they increased 51% year-over-year. Next come San Francisco (24%) and Portland, Oregon (14%).

Click here for more on Redfin’s report on Q2 home investor purchases.

The post Q2 Investor Purchases Fall to Five-Year Low first appeared on The MortgagePoint.