According to a new report from Realtor.com, while sky-high mortgage rates remain, homebuyers don’t have to give up just yet. This is due to the fact that, despite the fact that mortgage rates are currently nearing two-decade highs, borrowers have the ability to reduce their rates by as much as 150 basis points. That’s the difference between receiving a 6.0% or 7.5% rate, which might make a significant difference in their mortgage payment each month.

Realtor.com looked through loan-level mortgage information to find out which borrower, property, and lender attributes have the biggest and smallest effects on mortgage rates in order to arrive at these estimations.

The loan-to-value ratio should be lowered by borrowers who want to cut their mortgage rates next. To do this, buyers would either lower the price of the house they are buying or increase their down payment so that the down payment funds represent a higher portion of the purchase price. Mortgage rates for applicants with a loan-to-value ratio of less than 80% are, on average, 18 basis points lower than those for applicants with a ratio of more than 95%.

Further, the removal of the requirement for mortgage insurance results in additional savings when loan-to-value ratios are lowered to below 80%. For borrowers taking out a 30-year fixed-rate mortgage, this can amount to saving from 0.19% to 1.68% of the original mortgage balance every year until the loan-to-value ratio falls below 80%.

Reducing one’s debt-to-income ratio surprisingly has no effect on mortgage rates. According to our research, mortgage rates are typically only 4.5 basis points lower for applicants with debt-to-income ratios under 30% than for those with ratios over 43%.

Even while there isn’t much of a direct benefit to lowering one’s debt-to-income ratio, it’s crucial to remember that this doesn’t mean one shouldn’t make an effort to do so. This is because, given the strong correlation between debt-to-income and credit scores, there may be ancillary benefits. Reducing debt can indirectly result in improved mortgage rates through the direct improvement of credit score, since a borrower with a greater debt-to-income ratio is also likely to have a lower credit score.

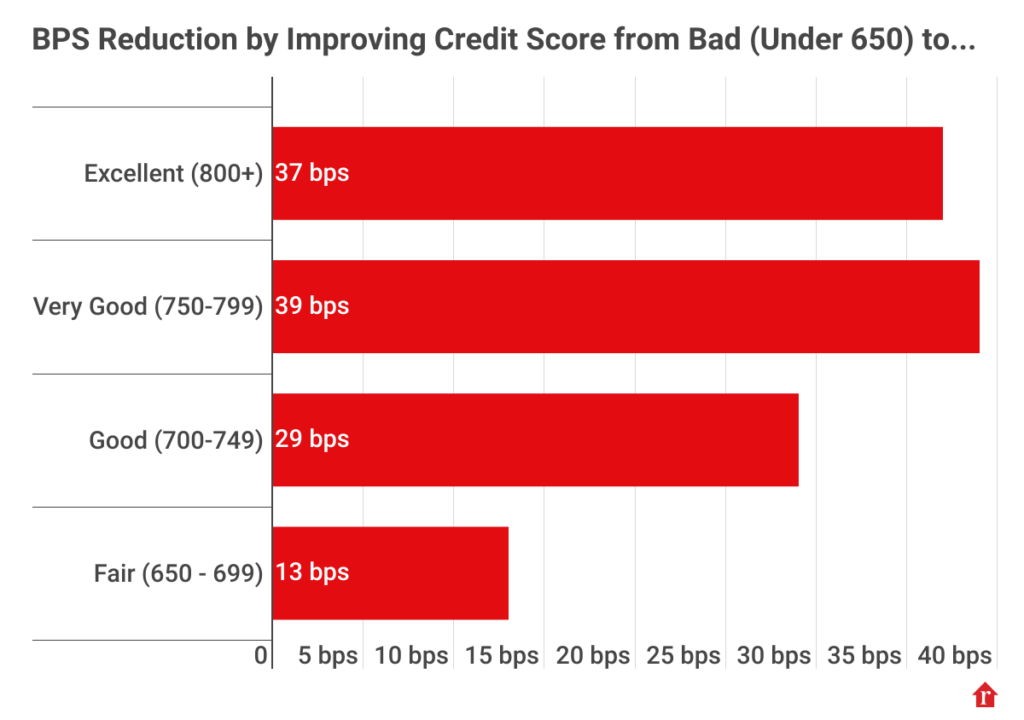

For a total impact of slightly less than 62 basis points, getting your financial house in order can be achieved by raising your credit score, lowering loan-to-value ratios, and cutting debt. These actions can result in reductions of 38 basis points, 18 basis points, and 4.5 basis points, respectively.

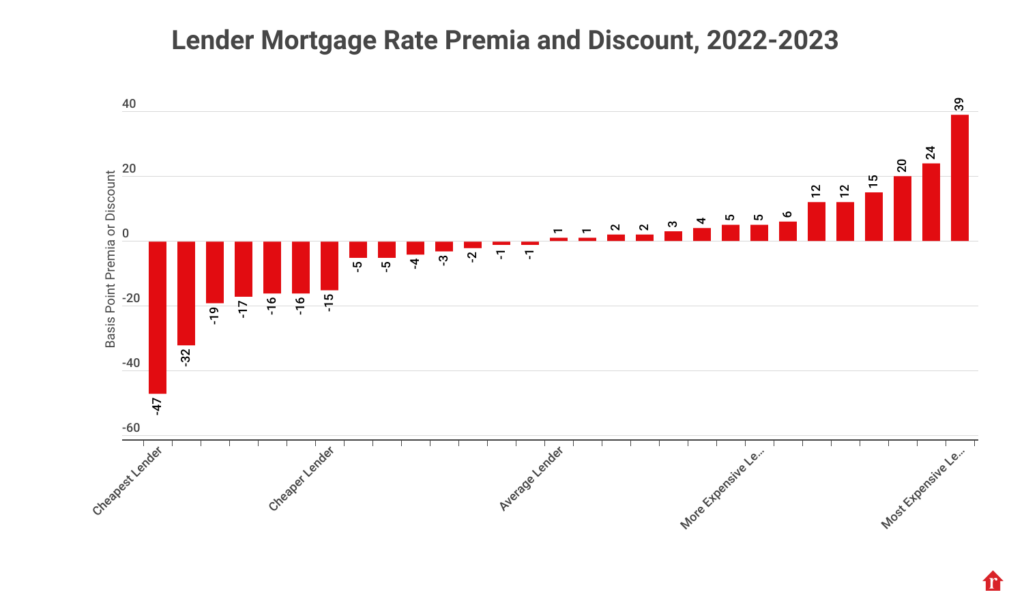

Can Rate Shopping Lead to Rate Chopping?

Shopping around for mortgage rates may be the most cost-effective strategy for obtaining the best rate. There is a spread of more than 75 basis points among the biggest lenders in the nation. Recall that our research accounts for the borrower’s attributes, including their credit score, amount of current debt, and down payment. This implies that the borrower would receive a 7% rate from the most costly lender and a 6.25% rate from the least expensive lender, all other things being equal.

The True Cost of Investment, Vacation, and Manufactured Homes

Although the aforementioned factors concentrate on steps that borrowers can take to assist reduce their mortgage rates, there are a number of “fixed” mortgage determinants that borrowers are powerless to change. Three stand out among them: whether the house being bought is meant to be a prefabricated home, whether it will be rented out, and whether it will be used as a second or holiday home.

Realtor.com categorized these as fixed-rate determinants conditioned on the premise that the decision to purchase an investment, vacation, or manufactured home has already been made, despite the fact that some may contend that borrowers have the ability to make such decisions.

In conclusion, Realtor.com research indicates that mortgage applicants who intend to use the house as an investment often pay 55 basis points more for their mortgage than do those who will be owner-occupiers. Additionally, our research indicates that mortgage rates are typically 32 basis points higher for applicants who intend to use the home as a second residence or vacation property than for owner-occupiers. Finally, we discovered that the average mortgage rate for buyers of manufactured homes is 20 basis points higher than the rate for buyers of single-family homes.

To read the full report, including more data, charts, and methodology, click here.

The post Rate Skimming Could Lead to Rate Trimming first appeared on The MortgagePoint.