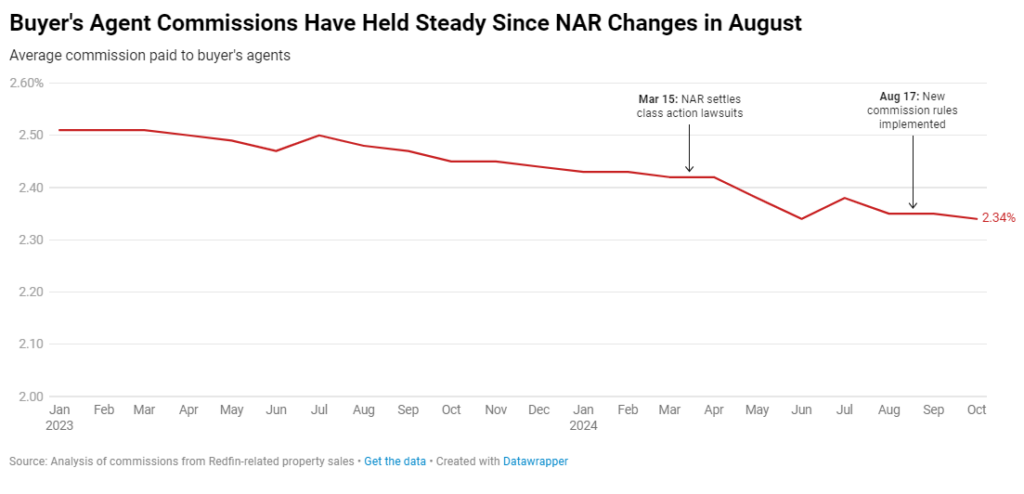

Commissions paid to real estate agents representing buyers have remained essentially unchanged since new rules on commissions went into effect on August 17, according to a new analysis from Redfin. The average buyer’s agent commission for homes sold in October was 2.34%, ticking down just one basis point from 2.35% for homes sold in August, when the new changes took effect. That’s down from an average of 2.45% a year ago.

Redfin’s analysis is based on internal data on buyer’s agent commissions for October home sales that have already closed or are scheduled to close by the end of the month. The commissions data was sourced from sales of Redfin agents’ listings, deals closed by Redfin partner agents, or where a buyer utilized Redfin-owned Bay Equity Home Loans. It excludes deals where Redfin agents represented the buyers, because Redfin sets a competitive fee for its buyer services, which is as low as 1.75% in some markets. Data would be skewed to reflect Redfin’s fees, while the goal of this analysis is to track change across the industry.

Buyer’s agent commissions have fallen 17 basis points since January 2023, when they averaged 2.51%. Commissions trended slightly lower following the National Association of Realtors (NAR) settlement, dropping from an average of 2.42% in March to 2.35% in August, when the new changes went into effect. Commissions remained at an average of 2.35% in September, before dropping by a single basis point to 2.34% in October. It’s too soon to say whether the trend since August is a continuation of, or departure from, the long term trend of declining commissions.

“Redfin agents say the biggest difference since August 17 is the need to educate customers about rule changes and have conversations about agent fees with buyers at the start,” said Redfin Chief Economist Daryl Fairweather. “Our agents see that as a positive, as it encourages more communication upfront and increases transparency around fees.”

A History of Policy Change

In mid-March of this year, NAR announced an agreement to resolve litigation over broker commission claims asserted on behalf of home sellers. The agreement would settle claims against NAR, over one million NAR members, all state/territorial and municipal Realtor associations, all association-owned MLSs, and all brokerages having a NAR member as principal in 2022 with a residential transaction volume of $2 billion or less. The settlement was the culmination of a series of lawsuits against NAR.

The NAR settlement accomplished two essential goals: it released most NAR members and many industry stakeholders from liability in these instances, and it ensured that cooperative compensation remains an option for customers when purchasing or selling a house. NAR also obtained in the deal a mechanism enabling practically all brokerage organizations with a residential transaction volume of more than $2 billion in 2022, as well as MLSs that are not completely controlled by Realtor’s associations, to acquire releases efficiently if they so desire.

Traditionally, sellers paid the buyer’s agent commission as well as their own agent’s commission. Fairweather said Redfin agents report that sellers are covering the buyer’s agent commission in most transactions, though more sellers are deciding not to proactively offer a commission and instead waiting to see what buyers request in their offer.

In relatively competitive housing markets, agents are seeing more negotiation over who pays the buyer’s agent, and how much they are paid.

“Sellers are more and more wanting to pay 2% to a buyer’s agent,” said Jonathan Chvala, a Redfin Premier Agent in Chicago. “Now we’re negotiating commission more frequently.”

So far, increased negotiations haven’t resulted in a significant decline in commissions in Redfin’s data, but it’s worth noting that many homes that closed in September went under contract before the changes took effect. Agents and consumers, many of whom started working together before August, are still adjusting to the new rules.

“Commissions may face more downward pressure next year if we see a resurgence of bidding wars. Sellers are becoming increasingly aware that commissions are negotiable and that if they have a desirable home, they may be able to get the buyer to cover some, or even all, of the buyer’s agent commission,” Fairweather said. “Of course, as in all real estate deals, any negotiation is dependent on how much demand there is for a property. Sellers who are struggling to find a buyer may even offer more to help attract more interest.”

Andrew Vallejo, a Redfin Premier Agent in Austin, Texas, said he has not seen a difference in commission rates since the August 17 rule changes came into effect, as sales in the Austin market have been sluggish.

“If you’re a seller, reducing the commission isn’t something you can save on right now,” Vallejo said. “That’s because the buyer may not be able to afford your house if they have to pay their agent out of pocket as well.”

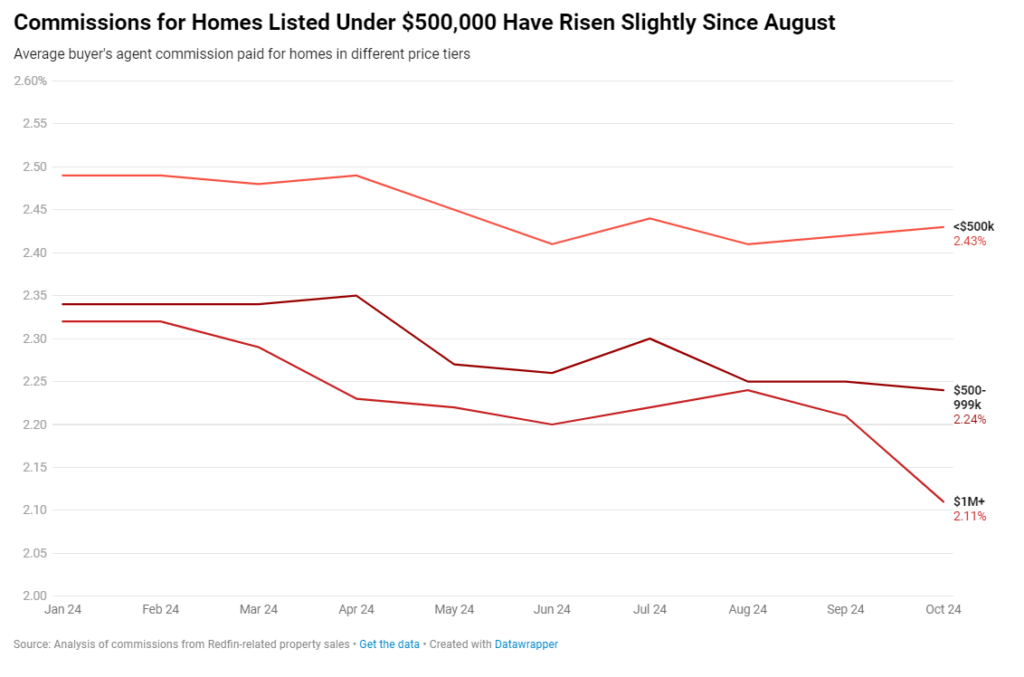

Commissions Have Risen Slightly for Some Homes Listed

While the average buyer’s agent commission has stayed the same since August, there have been slight changes within different price brackets. Buyer’s agent commissions for homes listed under $500,000—the most common type of transaction in our data—rose slightly from an average of 2.41% in August to 2.43% in October. Buyer’s agent commissions for homes listed between $500,000 and $1 million ticked down by one basis point, from an average of 2.25% to 2.24%.

Buyer’s agent commissions for homes listed above $1 million fell from an average of 2.24% in August to 2.11% in October. This aligns with anecdotes from Redfin agents, who are reporting downward pressure on commissions for high-end listings. It’s important to note, however, that our data for the $1 million-plus price bucket is limited.

Click here for more on Redfin’s analysis of real estate agents and commissions since NAR’s new rules took effect.

The post Real Estate Agents Weigh in on Impact of NAR Settlement first appeared on The MortgagePoint.