According to the latest Realtor.com Rental Report, all 50 major U.S. metro areas prefer renting to buying a starting home as rents continue to decline in July. Rising mortgage rates, rising housing prices, and declining rents all contribute to the over $1,000 savings when renting as opposed to buying, which is a pattern that was observed in February. Just 47 metro areas preferred renting at the same time last year.

“For every major U.S. metro, renting a starter home continues to be more affordable than buying a starter home, continuing a trend we saw this February as rents declined and home prices continued to grow,” said Ralph McLaughlin, Senior Economist at Realtor.com. “However, we are starting to see the advantage of renting over buying decrease across several metros, especially as more affordable inventory hits the market. It has been a challenging time for potential first- time homebuyers, especially as rents have been so favorable, but with mortgage relief finally on the way, we might continue to see the advantage of renting shrink, giving homebuyers a path into their first home.”

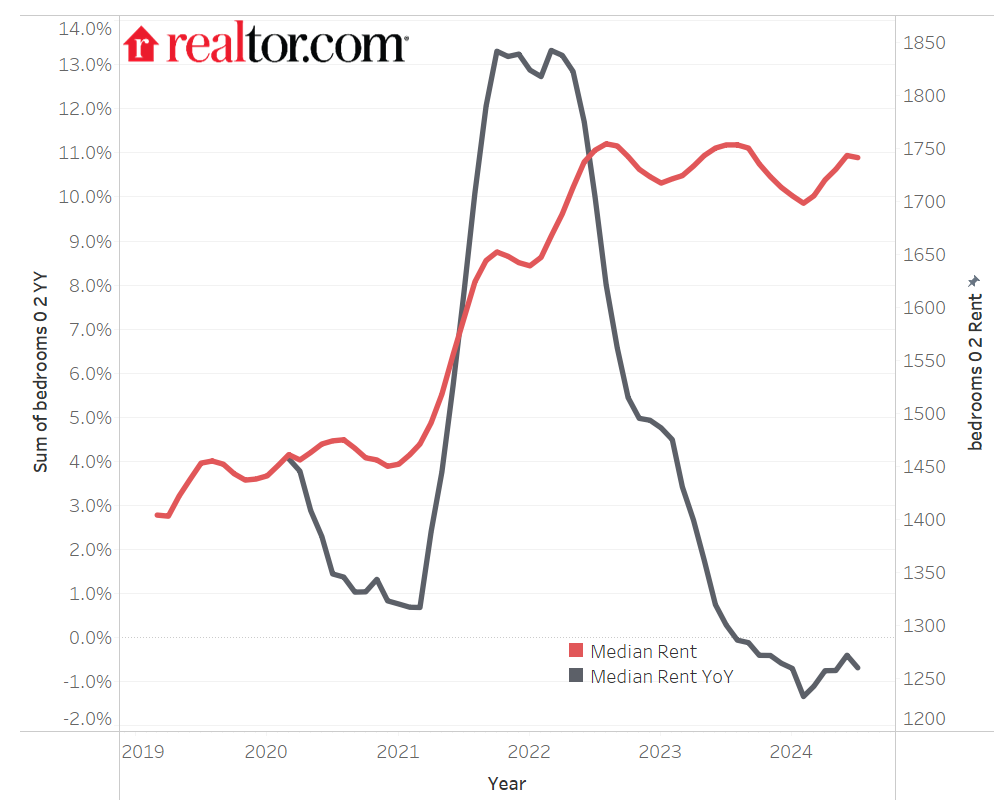

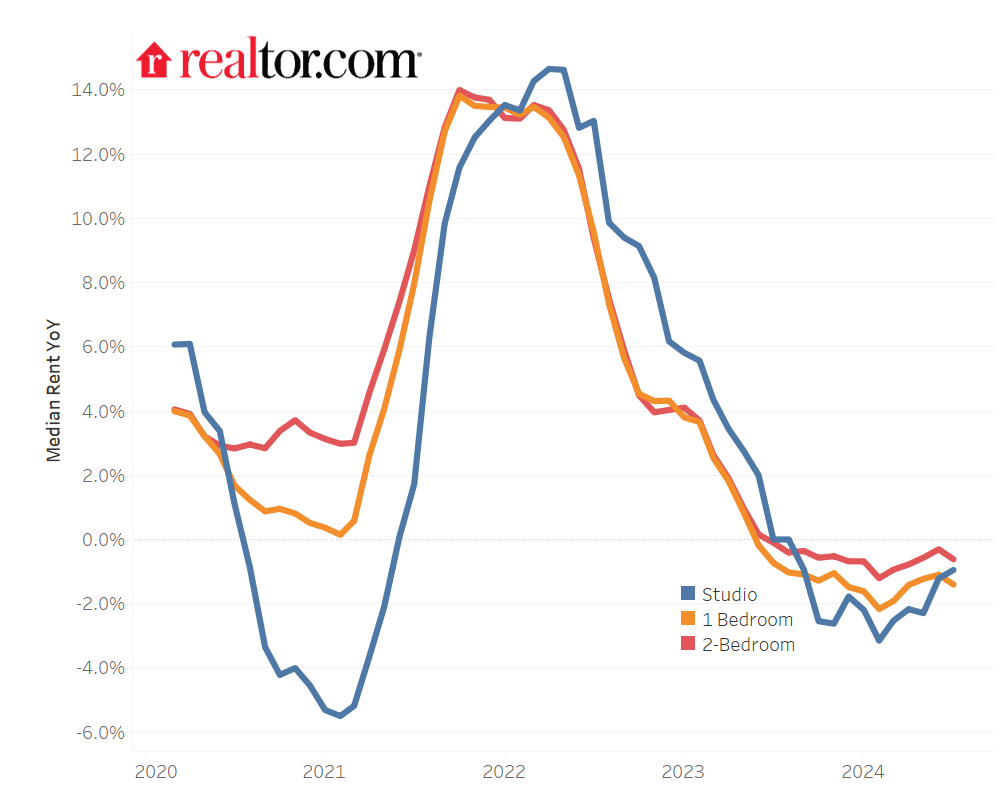

In addition, the rent decrease for properties with 0–2 bedrooms in July this year is the twelfth consecutive year-over-year.

Top 10 metros with the largest rent versus buy savings:

- Austin-Round Rock-Georgetown, Texas — buying cost 144.4% more than renting ($2,120 monthly rent savings)

- Seattle-Tacoma-Bellevue, WA — 107.7% ($2,222)

- Los Angeles-Long Beach-Anaheim — 99.5% ($2,784)

- Nashville-Davidson-Murfreesboro-Franklin, TN — 93.3% ($1,399)

- Phoenix-Mesa-Chandler, AZ — 91.6% ($1,396)

- Columbus, Ohio — 91.3% ($1,090)

- Dallas- Fort Worth-Arlington, Texas — 88.3% ($1,307)

- San Francisco-Oakland-Berkeley, CA — 88.2% ($2,442)

- New York-New Jersey-Jersey City, NY, NJ, PA — 81.1% ($2,342)

- Boston-Cambridge-Newton, MS — 78.6% ($2,336)

Renting a Starter Home Continues to be More Affordable In All 50 U.S. Metros

One of the most common questions posed to prospective first-time homeowners is whether it makes sense to buy a property now or to keep renting, and one of the main factors to take into account is the cost and benefit comparison of renting vs. buying. In the top 50 metro areas, purchasing a starter home in July 2024 will cost $1,067, or 61.3% more per month than renting one.

In all 50 major metro areas this year, renting is more economical than buying; this is an increase from July of last year, when just 47 metro areas considered rent to be more economical. In particular, during the previous 12 months, three metro areas—Pittsburgh, Birmingham, AL, Memphis, TN, and Birmingham, AL—went from buy-favoring to rent-favoring markets.

Austin, Texas, topped the list of markets most in favor of renting, with the monthly cost of purchasing a starter house coming in at $3,558—144.4% higher than the monthly rent of $1,468, for a monthly savings of $2,120. New York, Los Angeles, San Francisco, and Seattle were among the other top markets where renting was preferred over buying. Despite having somewhat lower buy costs, Dallas, Texas, and Columbus, Ohio, are among the top ten rent-favoring metro areas due to their reasonable rental costs.

The Advantage of Renting Shrank in Many U.S. Metros

The benefit of renting decreased by 2 percentage points from the previous year due to an increase in the number of smaller, more reasonably priced homes for sale, which caused a tiny drop in the listing prices of starter homes. In the top 50 metro areas, the average monthly cost of purchasing a starter house was 63.3% more in July of last year than it was in July of this year. While the total benefit of renting decreased by 2 percentage points, or $42, in the top 50 metro areas from a year ago, it remained $758 higher than it was five years prior (prior to the pandemic).

The rent advantage decreased in 23 out of the top 50 markets in the last year; the markets with the biggest decreases were San Francisco, California; San Jose, California; Denver, Colorado; Washington, D.C.; and Miami, Florida. Given that residences in these cities saw significant annual drops in their listing prices, it is not unexpected that the rent advantage was most eroded in these metro areas.

Not all metros, though, saw that renting was becoming less advantageous. In fact, over the past 12 months, two metro areas—Memphis, TN, and Birmingham, AL—have become more rent-favorable, and this is seen in the high percentage of investor house purchases in these areas.

Top metros with diminishing advantage in renting (Dollar amount difference from July 2023 to July 2024):

- San Francisco-Oakland-Berkeley, CA (-$563)

- San Jose-Sunnyvale-Santa Clara, CA (-$468)

- Denver-Aurora-Lakewood, CO (-$314)

- Washington-Arlington-Alexandria, DC-VA-MD-WV (-$282)

- Miami-Fort Lauderdale-Pompano Beach, FL (-$273)

Top metros with increasing advantage in renting (Dollar amount difference from July 2023 to July 2024)

- Memphis, TN-MS-AR ($246)

- Birmingham-Hoover, AL ($209)

- New York-New Jersey-Jersey City, NY, NJ, PA ($173)

- Los Angeles-Long Beach-Anaheim, CA ($156)

- Richmond — VA ($130)

To read the full report, including more data, charts, and methodology, click here.

The post Renting Beats Out Buying in All Major U.S. Metros first appeared on The MortgagePoint.