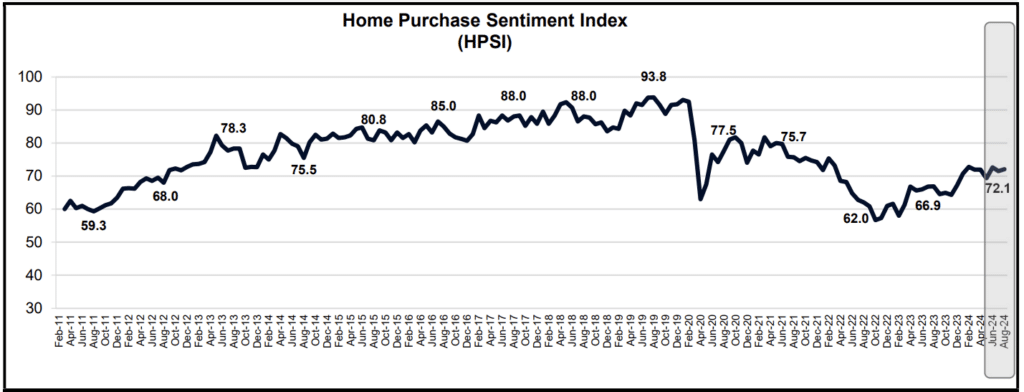

Although there was little change in the general sentiment of homebuyers, the Fannie Mae Home Purchase Sentiment Index (HPSI) rose 0.6 points to 72.1 in August as consumers expressed far higher optimism about the future direction of mortgage rates. A study conducted in August revealed that 39% of consumers, up from 29% the month before, anticipated a decrease in mortgage rates over the next 12 months. In contrast, 26% of respondents anticipate an increase in mortgage rates, while 35% anticipate no change in rates. While the majority of consumers still anticipate price increases, a larger portion of respondents said they expect home prices to fall over the course of the next year.

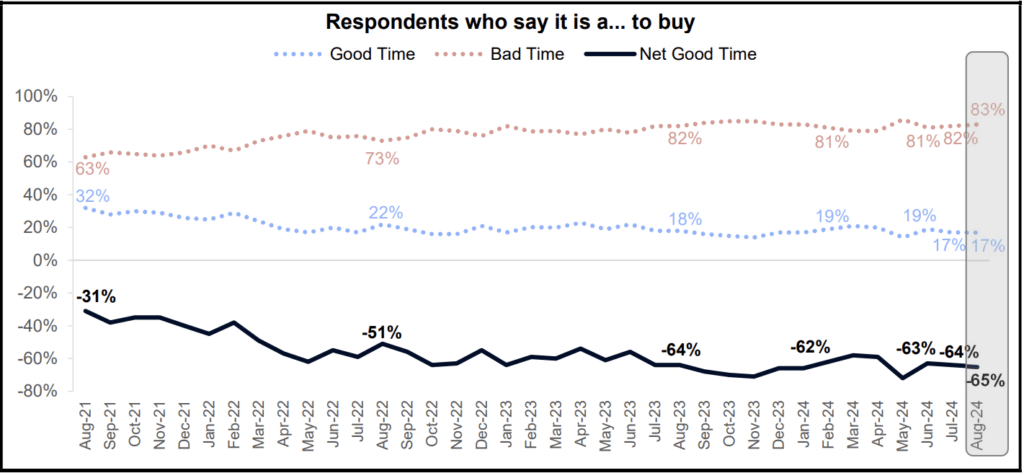

Even with the improved outlook for affordability, only 17% of consumers thought it was a good time to buy a home, reflecting the stability of their perceptions. Even while 65% of respondents think it’s a good time to sell a house overall, there are notable geographical discrepancies, such as a sizable difference between respondents in the Northeast and South, which probably indicate continued supply dynamics and changes in the inventories of homes for sale from market to market. Year-over-year, the entire index is up 5.2 points.keeps anticipating price increases.

“Despite significantly greater optimism that mortgage rates and home prices will move in a more favorable direction for potential homebuyers, most consumers remain apprehensive about the housing market and continue to point to the lack of affordability and supply as the chief reasons for their pessimism,” said Mark Palim, Fannie Mae VP and Deputy Chief Economist.

He added: “On a national level, housing sentiment was largely unchanged in August despite some positive developments for affordability, including a meaningful decline in actual mortgage rates and an uptick in home listings in certain markets, particularly in the Sunbelt. However, our survey did capture some interesting regional variation likely related to supply: In August, 56% of survey respondents from the South indicated that it’s a ‘good time to sell,’ a decrease of 5 percentage points month over month. This represented a strong divergence from the Northeast (80%), Midwest (70%), and West (66%) regions’ sense of home-selling conditions, each of which moved higher this month.”

HPSI Overview: Key Findings

The Home Purchase Sentiment Index (HPSI) for Fannie Mae climbed by 0.6 points to 72.1 in August. When compared to the same period last year, the HPSI is up 5.2 points.

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home remained unchanged from last month (17%) while the percentage who say it is a bad time to buy increased from 82% to 83%. As a result, the net share of those who say it is a good time to buy decreased 1 percentage point month over month to -65%.

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home (65%) and the percentage who say it’s a bad time to sell (34%) remained unchanged from last month. As a result, the net share of those who say it is a good time to sell stayed at 31% month over month.

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months decreased from 41% to 37%, while the percentage who say home prices will go down increased from 21% to 25%. The share who think home prices will stay the same remained at 37%. As a result, the net share of those who say home prices will go up in the next 12 months decreased 8 percentage points month over month to 13%.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 29% to 39%, while the percentage who expect mortgage rates to go up decreased from 31% to 26%. The share who think mortgage rates will stay the same decreased from 38% to 35%. As a result, the net share of those who say mortgage rates will go down over the next 12 months increased 16 percentage points month over month to 13%, the highest in survey history.

- Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months increased from 77% to 78%, while the percentage who say they are concerned stayed the same as last month (21%). As a result, the net share of those who say they are not concerned about losing their job increased 1 percentage point month over month to 57%.

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 18% to 17%, while the percentage who say their household income is significantly lower increased from 11% to 14%. The percentage who say their household income is about the same decreased from 69% to 68%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago decreased 4 percentage points month over month to 3%.

“This likely reflects in part the wide geographic variation in new home construction activity,” Palim said. “In the regions that had a stronger construction response following the pandemic, our latest survey data suggest that sellers may be losing some of their negotiating power due to the increased supply. That said, we also know from previous research that some potential homebuyers may be feeling additional pressure to move for non-financial reasons. Our recent Mortgage Understanding Survey showed that one-in-four respondents is actively considering purchasing a home in the next three years, and declining mortgage rates are likely to improve listing availability by further diminishing the so-called ‘lock-in effect.’”

To read the full report, including more data and methodology, click here.

The post Report: Consumers Feeling More Optimistic About Housing Market’s Future first appeared on The MortgagePoint.