The July 2024 CreditGauge, a monthly analysis by VantageScore that shows the general state of consumer credit in the U.S., was issued. Lenders and consumers had a more conservative credit stance through the end of July. Although the average customer’s credit score, which is determined by VantageScore 4.0, is still quite high at 702, overall consumer credit usage dropped to 51.6%, a four-year low, as a result of increased credit caution.

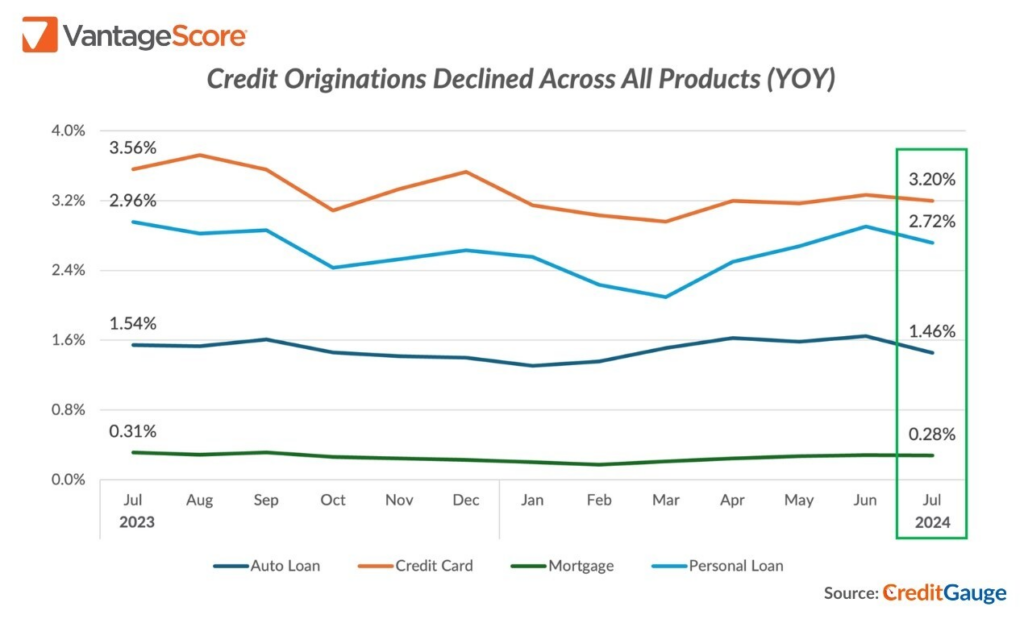

For every category of credit product, lenders also decreased the rise in new credit loans when compared to July 2023. Due to the poorer employment climate, which has affected consumer payments on recent loans, early-stage consumer credit delinquencies (30-59 Days Past Due) increased at their highest rate in over four years.

“Some new warning signs emerged in July, including higher delinquencies and lower originations,” said Susan Fahy, Executive VP and Chief Digital Officer at VantageScore. “Both lenders and consumers are becoming more credit cautious as many consumers de-leveraged and reduced credit utilization. We are seeing the impact of sustained high interest rates, which are clearly cooling lending activity.”

Key Insights for July 2024 CreditGauge:

- Credit originations declined across all products. In July 2024 compared to July 2023, the percentage of newly opened credit accounts decreased for all lending products. Mortgage originations were unchanged from the previous month, while other originations decreased as well. Out of all the products, new auto loans saw the biggest month-over-month reduction, down 0.19%. The greatest one-month decline among generation groups was seen in Gen Z consumers, as new auto loan originations decreased by 0.3% in July 2024 compared to June 2024. Lenders’ higher perception of risk and consumers’ significantly more cautious borrowing practices were the main causes of the decline in originations.

- Overall credit utilization decreased. July 2024 loan balances compared to June 2024 loan balances decreased overall as well as the quantity of available credit used. The average balance decreased by $147, while the credit utilization rate decreased by 0.2% from month to month to 51.6%. A four-year low was recorded on overall credit utilization.

- Late payments rose broadly. In comparison to June 2024 and July 2023, there was an increase in overall delinquencies in July 2024 across all DPD categories. Within the 30-59 DPD group, the biggest year-over-year rise was seen in auto loan delinquencies, which jumped by 0.20% from July 2023 to July 2023. Mortgage delinquencies increased by 0.17% during the same time frame. With the exception of Superprime, delinquency rates increased annually across all VantageScore credit levels. The declining job market for consumers was reflected in the widespread rise in delinquencies, as many found it more difficult to make credit payments on time.

To read the full report, including more data, charts, and methodology, click here.

The post U.S. Consumers Exhibit ‘Credit Caution’ Amid Rising Delinquencies first appeared on The MortgagePoint.