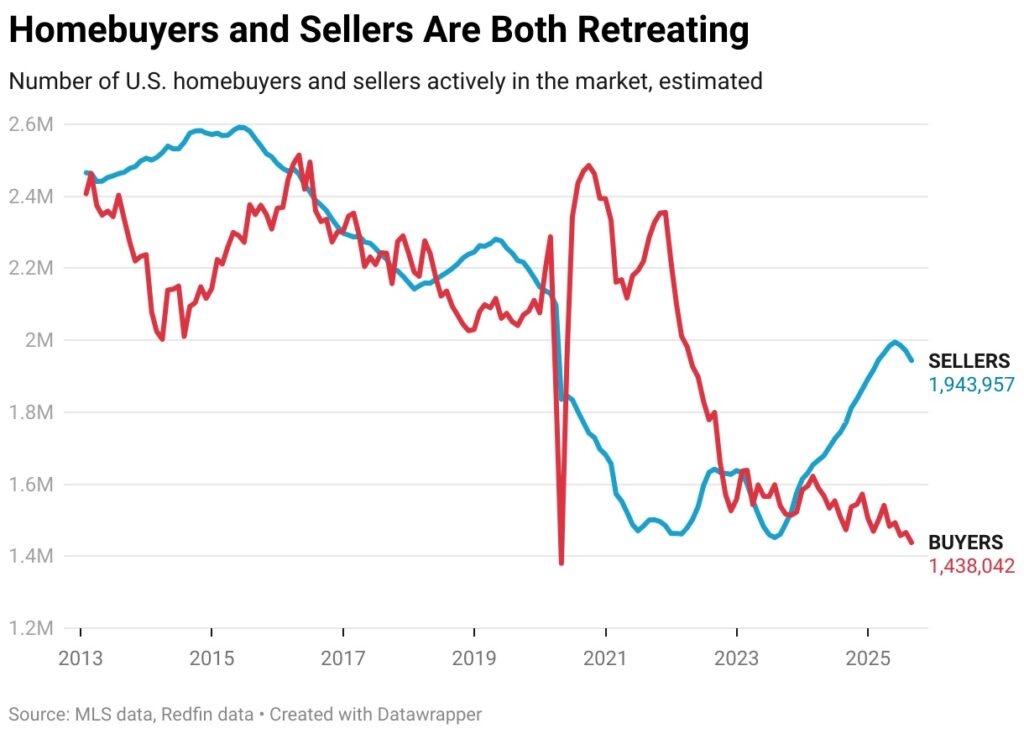

In August, the U.S. housing market had an estimated 35.2% more home sellers than purchasers (or, in numbers, 505,915 more)—according to a recent report from Redfin. The only month since 2013 where sellers outnumbered purchasers by a larger percentage (36.3%) was June 2025. To put it another way, this summer’s buyer’s market was the best recorded.

Since home prices are still rising, albeit much more slowly than in previous years, and mortgage rates are declining but still more than double their historical low, many Americans have been priced out of the housing market.

The U.S. housing market saw an estimated 1.44 million homebuyers in August, the lowest number since 2013, with the exception of the start of the pandemic, when the market came to a complete halt. Due to rising home prices and high mortgage rates, the housing industry has been losing purchasers. However, in recent weeks, mortgage rates have decreased, reducing monthly payments for homebuyers by hundreds of dollars and encouraging more homeowners to refinance.

“We haven’t yet seen a big jump in homebuyer demand due to declining mortgage rates,” said Chen Zhao, Redfin’s Head of Economics Research. “Buyers may show up in greater numbers if mortgage rates keep falling, which could happen if the economy continues to weaken. If the economy slows further, the Fed may cut rates more than expected, but the catch is that a slowing economy could push the U.S. into a recession.”

Note: Redfin uses MLS data on active listings and pending sales, as well as proprietary data on the average time between a buyer’s first tour and the closing of the deal, to estimate the number of purchasers. Simply put, the number of active listings in the MLS indicates the projected number of sellers in the market. According to Redfin, a market is considered a buyer’s market if there are more than 10% more sellers than buyers, and a seller’s market if there are more than 10% less sellers than buyers.

U.S. Housing Market Lost Roughly 50K Sellers Since May

As of last week, the average 30-year-fixed mortgage rate was 6.26%, the lowest level in almost a year. A critical mass of homebuyers may return to the market if mortgage rates fall below 6%, according to Redfin agents. Mortgage rates had factored in the Federal Reserve’s decrease to its benchmark interest rate last Wednesday. As of right now, markets expect two more 25 basis point cuts this year. As market players await further economic data, especially the next jobs report on October 3, Redfin experts predict that mortgage rates will stay stable in the near future.

Although there are still more selling than buyers, sellers have begun to back off in response to the homebuyers’ retreat. August saw the lowest number of house sellers since January, with an estimated 1.94 million. That is a decrease from the May peak of 1.99 million. To put it another way, within the last three months, the property market has lost almost 50,000 sellers. Since these data are seasonally corrected, this does not represent a seasonal movement.

Some sellers are choosing not to list at all after witnessing their neighbor’s property sell for less than the asking price, while others are delisting after seeing their properties linger on the market for months with no nibbles from bidders.

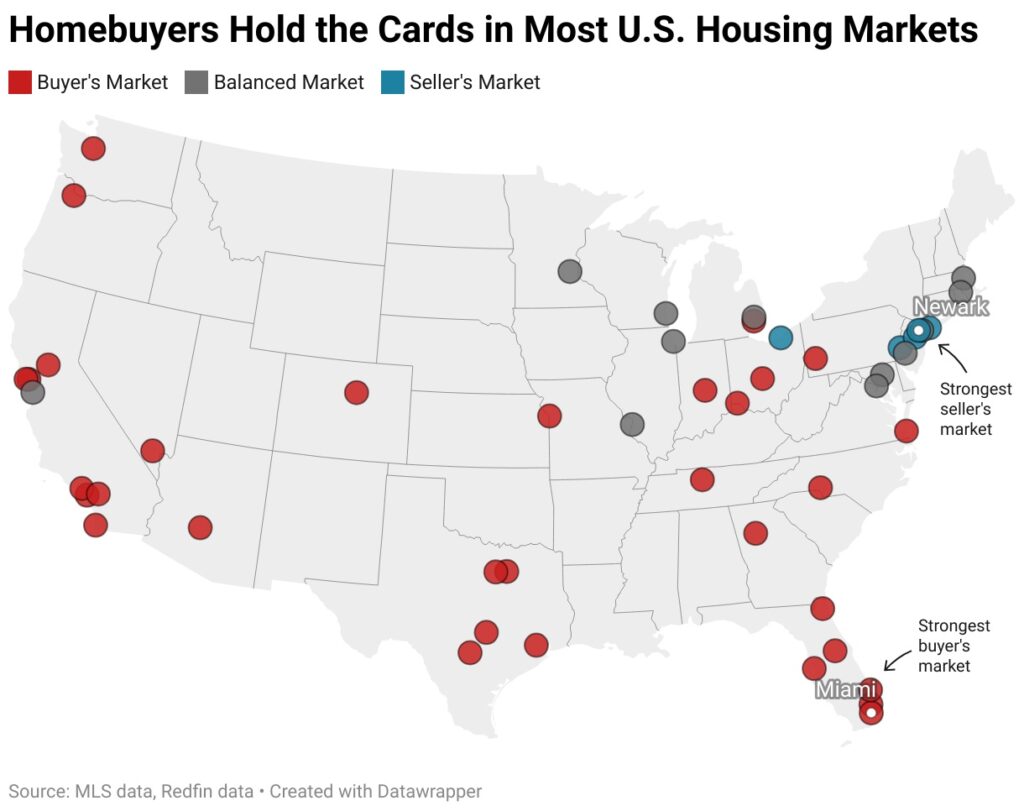

In terms of regional trends, in August, there were an estimated 8,746 homebuyers and 21,230 home sellers in Miami. This indicates that there were 143% more sellers than purchasers, which is the biggest disparity among the 50 most populated cities in the U.S. Fort Lauderdale, FL (128%), West Palm Beach, FL (116%), Austin, Texas (131% more sellers than buyers), and San Antonio (111%) followed.

Five of the 50 most populated metro areas were seller’s markets, twelve were balanced markets, and 33 were buyer’s markets overall. While balanced and seller’s markets lean more toward the Midwest and East Coast, buyer’s markets are concentrated in the Sun Belt and on the West Coast.

“Housing inventory has surged in Florida, and as a result, buyers have become more selective,” said John Tomlinson, a Redfin Premier real estate agent in Fort Lauderdale. “With so many options, it doesn’t take much for buyers to back out of deals. Last year, if issues like faulty AC or an outdated roof came up during an inspection, buyers would say, ‘OK, we’ll work with it.’ Now they’ll just walk away.”

During the epidemic, the Sun Belt had a sharp increase in population as a large number of homebuyers from more affluent regions of the nation relocated there, pushing up house prices and forcing many residents out of the market. One reason why there are currently far more homes for sale than there are buyers is because homebuilders increased their operations to match the soaring demand.

More homes are still being built in Florida and Texas than in any other state. Some homeowners have left Florida as a result of the state’s worsening natural disasters, skyrocketing insurance costs, and growing condo HOA dues. Also in August, the average annual increase in home prices in the 33 buyer’s markets was 1.8%, while the five seller’s markets saw a 6% increase.

NY, FL, Metros See Strongest Seller’s Markets, With About Half as Many Sellers as Buyers

With an estimated 5,771 sellers and 10,120 buyers in August—a 43% seller-to-buyer ratio—Newark, NJ, had the best seller’s market. Nassau County, NY (41.7% fewer sellers than buyers), Montgomery County, PA (35.6% fewer), New Brunswick, NJ (25.5% fewer), and Cleveland (12% fewer) are the other four seller’s markets.

Because new building affects supply and demand, it can have a big impact on whether buyers or sellers have more negotiation power. Building permits are most frequently issued in the South, then in the West, Midwest, and Northeast. As previously stated, the majority of the country’s buyer markets are located in the South, whilst the Northeast and Midwest are home to the majority of the seller’s markets.

“Homebuyer demand isn’t super strong, but sellers on Long Island are still fetching more than their asking price and receiving multiple offers because there aren’t enough houses for sale,” said Panagiota “Peggy” Papazaharias, a Redfin Premier real estate agent in Nassau County, NY. “Many homeowners on Long Island are hesitant to sell and are holding onto their low mortgage rates particularly tightly because New York is so expensive; if they sell their home and move somewhere else in the area, they’d be dealing with not only a higher mortgage rate but also some of the highest home prices in the country.”

Conversely, in recent months, buyer’s markets have shifted most in Denver and Las Vegas.

In August, Denver’s seller-to-buyer ratio increased from 7.9% to an anticipated 57.1%. The highest gain among the 50 most populous metro areas is 49.2 percentage points. Next are Detroit (+35.5 ppts to 30.6%), Nashville (+38.7 ppts to 107.6%), Seattle (+39.5 ppts to 26.8%), and Las Vegas (+48.8 ppts 96.7%).

“We have more homes for sale in Denver than we’ve had in quite a while,” said local Redfin Premier agent Tamara Mattox-Kabat. “At the same time, there are many first-time buyers who aren’t sure if they can afford to buy and are hoping mortgage rates come down further, but home prices could rise if rates fall further. Previously, a first-time buyer would look at one-bedroom condos; now they’re purchasing two-bedroom units so they can get a roommate to help cover the mortgage.”

According to Mattox-Kabat, depending on the kind of property, she advises sellers to do the following to get top dollar: hire a housekeeper, schedule carpet cleaning, do touch-ups on the paint, declutter, stage the house to look as model-like as possible, and conduct pre-inspections to address health and safety issues. “Homes with little maintenance and inspection issues and a clean canvas appeal to buyers,” she said.

To read more, click here.

The post 2025 Experiences Strongest Buyer’s Market in More Than a Decade first appeared on The MortgagePoint.