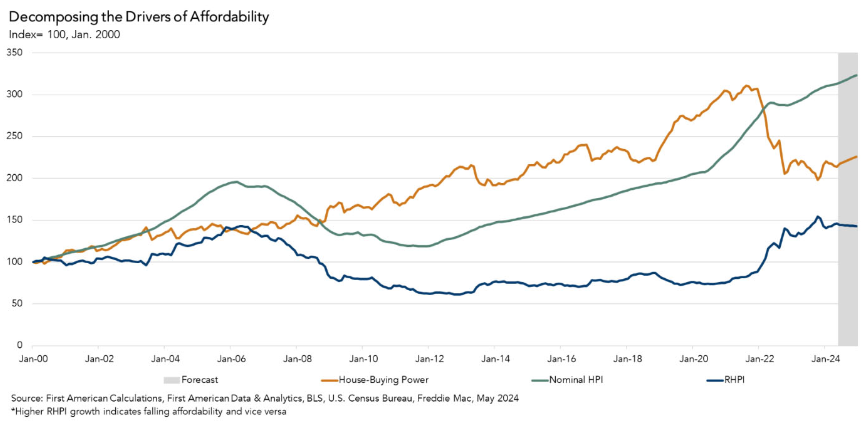

As we approach the latter half of the year, the affordability crunch in the housing market shows no signs of easing. According to a recent report from First American, a combination of rising interest rates and escalating home prices is expected to maintain pressure on housing affordability through the end of 2024.

Interest Rates on the Rise

According to First American’s data analysis from Mark Fleming, Chief Economist for First American Financial Corporation, one of the primary drivers behind the ongoing affordability crisis is the upward trajectory of interest rates. The Federal Reserve has been steadily increasing rates in an effort to combat inflation, and this has directly impacted mortgage rates. Higher borrowing costs have made it more challenging for potential homebuyers to secure affordable financing, effectively pricing many out of the market.

Fleming highlights that “while the Fed’s actions are necessary to curb inflation, they are also making it more difficult for homebuyers to enter the market.” This sentiment is echoed by many in the industry who are concerned about the long-term implications of sustained high rates.

Escalating Home Prices

Simultaneously, home prices continue to climb, driven by a persistent supply-demand imbalance. The limited inventory of homes for sale, coupled with strong demand from buyers, has led to increased competition and higher prices. This scenario has created a challenging environment for first-time homebuyers and those with limited budgets. Zillow reports that the average United States home value is currently at $363,438, up 3.8% over the past year.

The report from First American points out that “the combination of higher interest rates and rising home prices has reduced affordability to levels not seen in over a decade.” This trend is particularly concerning for middle-income earners who are finding it increasingly difficult to purchase homes in desirable locations.

Looking Ahead

While some experts had hoped for a cooling off in the housing market, the data suggests that affordability issues will remain a significant challenge. Fleming notes that “unless we see a substantial increase in housing supply or a decrease in demand, affordability is likely to stay constrained.”

Policy interventions at the federal and state levels could play a role in addressing these issues, but any meaningful impact is expected to take time. In the meantime, prospective homebuyers will need to navigate a complex and competitive market.

For those looking to buy, it is more important than ever to stay informed about market trends and seek professional advice to make well-informed decisions. As we move forward, the housing market will continue to be a key area of focus for both policymakers and industry stakeholders.

The post Affordability Crunch Expected to Persist Through Year-End first appeared on The MortgagePoint.