According to a recent nationwide poll by Discover Personal Loans, some 84% of Americans want to improve their financial status, yet 41% are not sure how to handle their personal finances appropriately. In the upcoming year, 20% of Americans anticipate their financial status to worsen, while 41% of them think it will remain the same or improve (38%).

Americans anticipate inflation will increase their costs in many key categories in 2025:

* “In which categories do you think you’ll spend the most money on in 2025? Please select up to 5.” Survey respondents chose up to five top spending categories from among 14 categories presented as answer options.

‡Subset: “Compared to the last 12 months, how much more or less do you anticipate your top spending categories will cost over the next 12 months?” Data shown in table represents the percentage of Americans who believe their costs will increase over the next 12 months, from among those who chose the respective spending category as among their top 5 for spending the most money in 2025.

| Spending category | % of Americans that expect the category to be among their top 5, for spending the most money in 2025* | % of Americans that believe their costs will increase ‡ | % of Americans that believe their costs will increase dramatically or significantly (6% to more than 10%) ‡ |

| Groceries | 70% | 67% | 45% |

| Housing | 49% | 54% | 30% |

| Healthcare/ Medical Expenses | 30% | 67% | 39% |

| Debt repayment | 29% | 50% | 27% |

| Transportation | 26% | 53% | 29% |

“I’m inspired that Americans are motivated to seek a brighter financial future, and that many are making or searching for a game plan to achieve their financial goals,” said Dan Nickele, VP of Discover Personal Loans. “American consumers also told us they anticipate costs to rise in categories like groceries and healthcare. Weathering the storm requires a strong financial foundation which can include taking actions like creating a budget, contributing to an emergency fund, and exploring opportunities to refinance high-interest debt.”

American Consumers Prepare for Inflation & Financial Debt

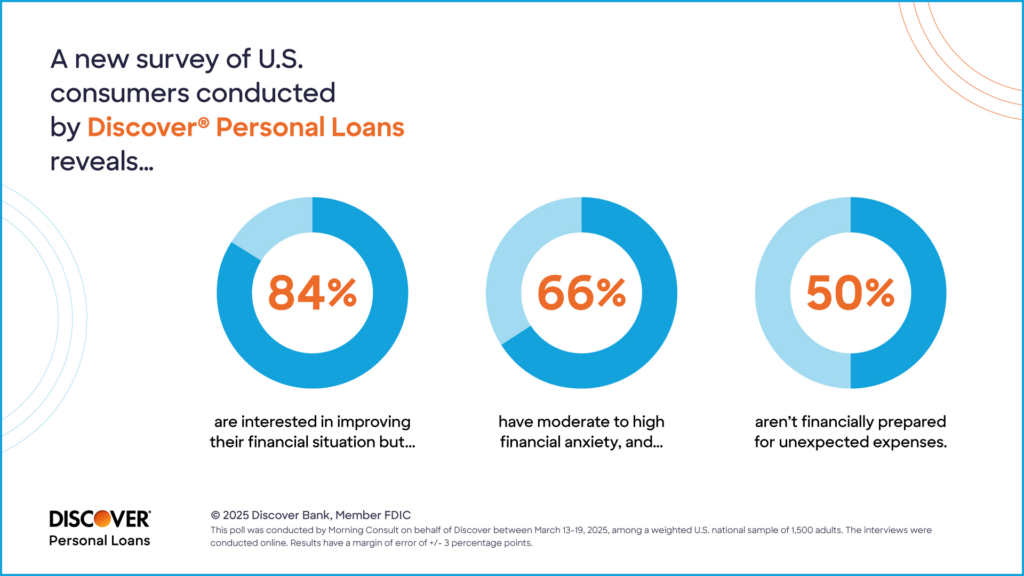

There was disagreement among poll participants over the general direction they thought the U.S. economy was heading in when asked to consider the current state of the economy: 15% say neither, 31% think we’re going in the right way, and 48% say we’re going in the wrong direction. Given that 86% of Americans are concerned about their own financial status to some extent and that two-thirds (66%) feel high or moderate worry, it is possible that economic uncertainty is influencing financial stress.

Over the previous five years, financial stress has stayed high.

In addition—and unfortunately—approximately 44% of Americans claim to be in debt at the moment. Of those debtors:

- 84% say inflation makes managing personal debt challenging.

- 83% say a budget is a helpful tool for managing personal debt, but only 44% say they created a budget for 2025.

- 77% say paying off personal debt is expensive.

- 70% are not financially prepared for unexpected expenses over $2,500.

- 58% feel they will never get out of debt.

- 52% lose sleep over personal debt.

- 48% aren’t confident they’ll get their debt paid off within the next year.

- 48% say their personal debt is unmanageable—including credit card debt (70%), medical debt (38%), and money owed to family/friendly (25%).

- 33% report a significant amount of debt.

- 37% avoid looking at the amount of money in their bank account.

How Are Americans Handling Economic Conditions?

The survey also found some unfortunate news: half of all Americans lack the financial stability to handle unforeseen expenses.

Nearly half of Americans in 2025 claim that daily expenses (45%) and inflation (49%) are factors in their financial hardship. Due to the current status of the economy (38%), personal debt (29%), unforeseen expenses (28%), housing costs (27%), and household income (25%), at least 25% of Americans suffer from financial worry.

According to the survey, 27% of Americans believe they could be contributing more to their current emergency fund, while half of Americans do not have one. Additionally, half of Americans claim that they are generally unprepared financially for unforeseen costs.

Many Americans feel unprepared financially for a number of situations, such as:

| Circumstance | Do not feel financially prepared to handle |

| An economic downturn or recession | 55% |

| A family crisis (e.g., illness, death, legal issues) | 54% |

| An unexpected expense over $2,500 | 53% |

| Retirement | 50% |

| Job loss or reduction in income | 49% |

| Taking on caregiver expenses | 49% |

| A major home improvement project or purchase | 49% |

| At least one of the circumstances above | 77% |

“At Discover, our goal is to help customers find smart solutions to achieve their financial goals. For some people, especially those with high-interest debt, a personal loan may be a helpful tool to reduce the cost of their interest and accelerate the elimination of debt,” Nickele said. “Research is important when making big financial decisions, especially with some of the negative perceptions out there around personal loans. I encourage consumers who could benefit from a personal loan to look for lenders that offer competitive interest rates, no fees, flexible repayment terms and fast funding. If you already have a relationship with a credit card company or bank that you trust, that’s a good place to start personal loan research.”

In 2025, some 45% of Americans make financial resolutions or goals. Of these, 81% claim to have made at least some improvement, with 38% being satisfied with it and 43% believing they could have done better. Creating and adhering to a budget (36%), cutting back on discretionary spending (31%), investing (35%), adding to an emergency fund (26%), diversifying sources of income (25%), and paying off or consolidating high-interest debt (24%), are among the top actions taken by the 38% of Americans who are satisfied with their progress.

To read more, click here.

The post Consumers Reveal Financial Stressors Amid Rising Costs & Debts first appeared on The MortgagePoint.