Due to a decline in 10-year Treasury yields and heightened economic uncertainty brought on by the prolonged federal government shutdown, mortgage rates dropped Thursday, October 23, to their lowest point in more than a year.

According to Freddie Mac, the average rate on 30-year fixed home loans fell from 6.27% the previous week to 6.19% for the week ending October 23. In 2024, rates averaged 6.54% for the same time frame.

“Mortgage rates continued to trend down this week, hitting their lowest level in over a year,” said Sam Khater, Chief Economist at Freddie Mac. “At the start of 2025, the 30-year fixed-rate mortgage surpassed 7%, while today it hovers nearly a full percentage point lower. This dynamic has kept refinancings high, accounting for more than half of all mortgage activity for the sixth consecutive week.”

Government Trends & How Homebuyers Are Affected

After the Treasury yields, which affect the cost of long-term borrowing, fell to year-to-date lows around 4%, mortgage rates eased by about 50 basis points from three months ago. The action was taken in the midst of a data vacuum brought on by the shutdown, which is now over three weeks old and has denied Federal Reserve policymakers important information on the job market’s current situation, which they need to inform their choices.

The Fed is mandated by Congress to maintain inflation as near to its 2% target as practicable while simultaneously promoting maximum employment. The most recent Consumer Price Index (CPI) report, which was delayed by more than a week because of the Washington, DC, deadlock, will be available to central bank officials on Friday.

The September CPI data, a crucial indicator of inflation, however, is more likely to affect markets than Fed policy, according to Senior Economist Jake Krimmel of Realtor.com. At the upcoming FOMC meeting on October 28–29, the central bank’s Board of Governors is almost certain to lower its federal funds rate by a quarter of a percentage point; however, Krimmel claims that the drop is already factored into mortgage rates and Treasury yields. In the meanwhile, there is no guarantee that rates will be lowered again in December.

A sustained recovery in the housing market will require lower mortgage rates, a large increase in inventory to ease prices, and job growth robust enough to overcome economic uncertainty.

According to Krimmel, who also notes that economists from the Mortgage Bankers Association have cautioned that rising inflation expectations and expanding government budget deficits will continue to push long-term rates higher. In the short term, homebuyers and refinancers may experience a slight improvement in negotiating conditions and gradual relief in payments.

Determining Mortgage Rates & Additional Factors

Key Findings:

- Borrowers have more control over their mortgage rate than they might think, even in a high-rate environment.

- Improving your credit score from “good” (660–720) to “very good” (720–760) can lower mortgage rates by about 0.11 percentage points on average–saving almost $10,000 over the life of a typical loan.

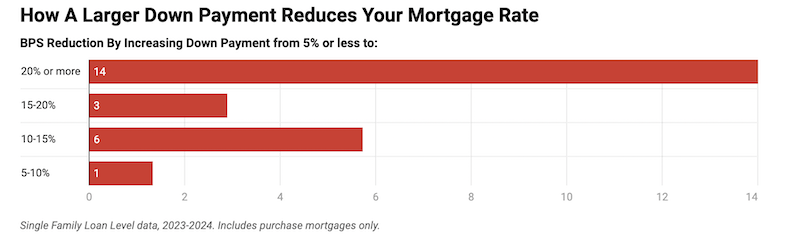

- Putting 20% down is a key milestone, as it can more than double the rate discount of smaller down payment jumps while eliminating private mortgage insurance.

- Shopping around is the single biggest rate-reducer: Choosing the right lender can save up to 0.55 percentage points, or more than $40,000 over the life of a 30-year loan.

- Property and structure type matter, too: Second homes, investment properties, condos, and manufactured homes tend to carry higher rates.

- What doesn’t matter as much? Once you qualify, a higher credit score above 800, a lower debt-to-income ratio, or a 5%–19% down payment make only marginal mortgage rate differences.

Will Declining Rates Help Homebuyer Optimism?

Many home purchasers, particularly those who had been waiting for rates to drop sufficiently to make a move or refinance, are starting to see this as an opportunity since rates are declining and another rate cut by the Federal Reserve is imminent.

Rates have dropped to their lowest levels in a year just as the greatest time of year to buy is approaching. However, a crucial question is also brought up by this window of opportunity: What do borrowers really have control over in terms of their mortgage rate?

Additionally, buyers have little control over the market dynamics that drive interest rates. However, not everyone pays the same financing expenses, notwithstanding the vagaries of financial markets and macroeconomics. Mortgage rates differ significantly amongst borrowers, even at the same moment. For example, the average mortgage rate in the third quarter of 2024 was 6.6%, but the difference between average borrowers was about 0.75 percentage points (75 basis points). The 25th percentile borrower paid 6.25%, and the 75th percentile borrower paid 6.99%.

The annual payments for that disparity amount to thousands of dollars. (A 75 basis-point swing is equivalent to more than $2,000 in savings annually and more than $60,000 over the course of a 30-year loan for a median-priced home of $425,000 with a 20% down payment.) Furthermore, borrower-level choices and traits, rather than macroeconomic patterns, are frequently the cause of this difference in origination rates.

To read more, click here.

The post Mortgage Rates Hit 2025 Low, Offering Hope for a Sluggish Housing Market first appeared on The MortgagePoint.