A new Redfin report reveals that approximately one-third (33.1%) of renter-occupied housing units in the U.S. are situated in large multifamily buildings, marking the highest percentage recorded since 2011.

In comparison, single-family homes account for 31% of rentals, which is the lowest proportion ever recorded. Units located in small multifamily buildings constitute 27.3% of the country’s rental inventory, while townhomes account for 8.5%. In 2022, large multifamily buildings became the most common type of rental housing, surpassing single-family homes, as multifamily construction increased during the pandemic’s moving frenzy.

Note: This report is based on a Redfin analysis of U.S. Census Bureau data through 2024—the most recent year for which data are available.

Share of Rental Stock by Property Type (2024):

| Metro area | Single-family rentals, as % of all rentals | Large multifamily rentals, as % of all rentals | Small multifamily rentals, as % of all rentals | Townhome rentals, as % of all rentals |

|---|---|---|---|---|

| Riverside, CA | 49.5% | 24.6% | 18.7% | 7.2% |

| Nassau County, NY | 45.7% | 27.8% | 20.0% | 6.5% |

| Detroit | 45.1% | 24.4% | 21.1% | 9.4% |

| Sacramento, CA | 41.0% | 26.8% | 22.9% | 9.3% |

| Las Vegas | 38.9% | 27.3% | 27.6% | 6.3% |

| St. Louis, MO | 37.3% | 26.1% | 27.9% | 8.8% |

| Phoenix | 36.1% | 35.0% | 23.6% | 5.3% |

| Jacksonville, FL | 34.7% | 30.9% | 28.0% | 6.4% |

| Charlotte, NC | 33.7% | 29.2% | 30.1% | 7.0% |

| Indianapolis | 33.2% | 25.2% | 34.5% | 7.0% |

Home Construction Growth Fueling Rental Trends & Activity

Since the Great Recession’s aftermath, construction of both multifamily and single-family homes has generally increased, but the growth of multifamily construction has outpaced that of single-family homes—particularly during the pandemic. During the pandemic-induced moving frenzy, rental demand surged, and builders found it easier to create additional rental properties to meet that demand due to the prevalence of ultra-low interest rates. Investors often find rental housing appealing due to its potential for higher cash flows, diversified income sources, scalability, and tax advantages. In recent years, some cities have simplified the process of constructing multifamily housing.

“Big apartment buildings make up a growing piece of the rental-market pie because America has been building a lot of them, which has made them more affordable for renters,” said Asad Khan, Senior Economist at Redfin. “Increased supply gives renters more options and more room to negotiate prices. While multifamily construction has slowed recently, there are still more apartments for rent than people who want to rent them, which has kept rent growth at bay.”

In 2024, the construction of large multifamily buildings reached an all-time high. Meanwhile, the construction of single-family homes is still below the levels observed during the housing bubble of the early 2000s, and most of these homes are purchased by homebuyers rather than rented out.

“Record-low mortgage rates during the pandemic drove Americans to buy up a large chunk of the single-family homes on the market, meaning the pool available for renters shrunk,” Khan said. “The people who own these homes are now hesitant to move because housing costs have soared, and they’re typically locked into low mortgage rates. That makes the single-family-home market locked up for both renters and buyers, and keeps prices high.”

Market Activity Shows Record-Low Share of Single-Family Rentals

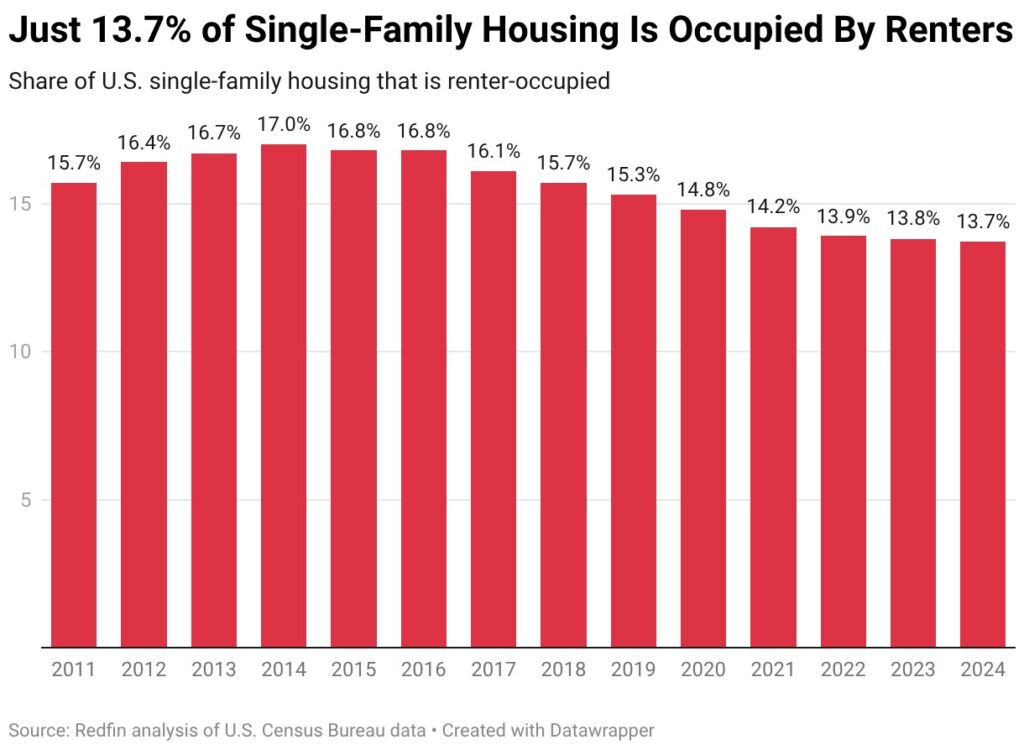

Only 13.7% of single-family homes are occupied by renters, marking the lowest percentage in records since 2011. The total number of single-family-home rentals in the U.S. amounts to 11.3 million, which is the third lowest level recorded. In contrast, the number of rental units in large multifamily buildings has reached a record high of 12.1 million. Small multifamily buildings contain 10 million rental units, while there are 3.1 million townhome rentals.

In New York, 69.1% of rentals are located in large multifamily buildings, which represents the highest proportion among the 50 most populous metropolitan areas in the U.S. and is more than double the national average. Minneapolis (61.5%), Seattle (52.5%), Miami (51.3%), and Boston (49.9%) follow it.

At the opposite end is Virginia Beach, VA, where only 22.6% of rentals are located in large multifamily buildings, representing the lowest proportion among the top 50 metropolitan areas. Following are Cincinnati (23.9%), Detroit (24.4%), Riverside, CA (24.6%), and Warren, MI (24.7%).

Overall, areas characterized by greater density and higher costs tend to have the largest proportions of multifamily rental stock, which accounts for the prevalence of such rentals.

In New York, only 4.3% of rentals consist of single-family homes, which is the lowest proportion among the top 50 metropolitan areas. Next comes Philadelphia (6.5%), Washington, D.C. (9.4%), Boston (10.4%), and Baltimore (11.1%).

The metros with the highest share of single-family-home rentals are:

- Riverside (49.5%)

- Nassau County, NY (45.7%)

- Detroit (45.1%)

- Sacramento, CA (41%)

- Las Vegas (38.9%)

Which Metros Are Seeing the Largest Growth in Multifamily Rentals?

The share of rentals in large multifamily buildings in Dallas has risen to an estimated 46.3% from 29.2% in 2014. The increase of 17 percentage points is the largest among the top 50 metropolitan areas. Following are Phoenix (15,9 ppts), Seattle (14,6 ppts), Atlanta (13,7 ppts), and Jacksonville, FL (13,7 ppts).

Zero metros experienced a significant decrease.

The smallest increases were in:

- New York (0.9 ppts)

- Nassau County (1.5 ppts)

- Detroit (2.2 ppts)

- West Palm Beach, FL (2.9 ppts)

- San Francisco (3.5 ppts)

In terms of the single-family rental share, only two metropolitan areas have experienced growth in the last 10 years. In Philadelphia, single-family homes account for 6.5% of rentals, an increase of 0.2 percentage points from 6.3% in 2014. Anaheim was the other metro area that experienced a rise (0.01 ppt).

Over the past 10 years, the metros that experienced the most significant drops in single-family rental share are:

- Phoenix (-11.7 ppts)

- Charlotte, NC (-9.3 ppts)

- Tampa, FL (-8.9 ppts)

- Orlando, FL (-8.7 ppts)

- Seattle (-8.7 ppts)

To read the full report, click here.

The post Single-Family Rental Trends Shift as Renters Seek Affordability first appeared on The MortgagePoint.