The $200 billion mortgage bond purchase by President Donald Trump signifies a novel strategy aimed at reducing the costs associated with homeownership, according to the latest Scripps News report.

However, expert economists caution that President Trump’s $200B mortgage initiative might have the opposite of its intended effect by driving up home prices. The plan to reduce mortgage rates has ignited a significant debate, with experts cautioning that the advantages may be fleeting and that it could lead to increased home prices.

The president has unveiled a number of proposals aimed at reducing mortgage rates, independent of any interest rate reductions from the Federal Reserve.

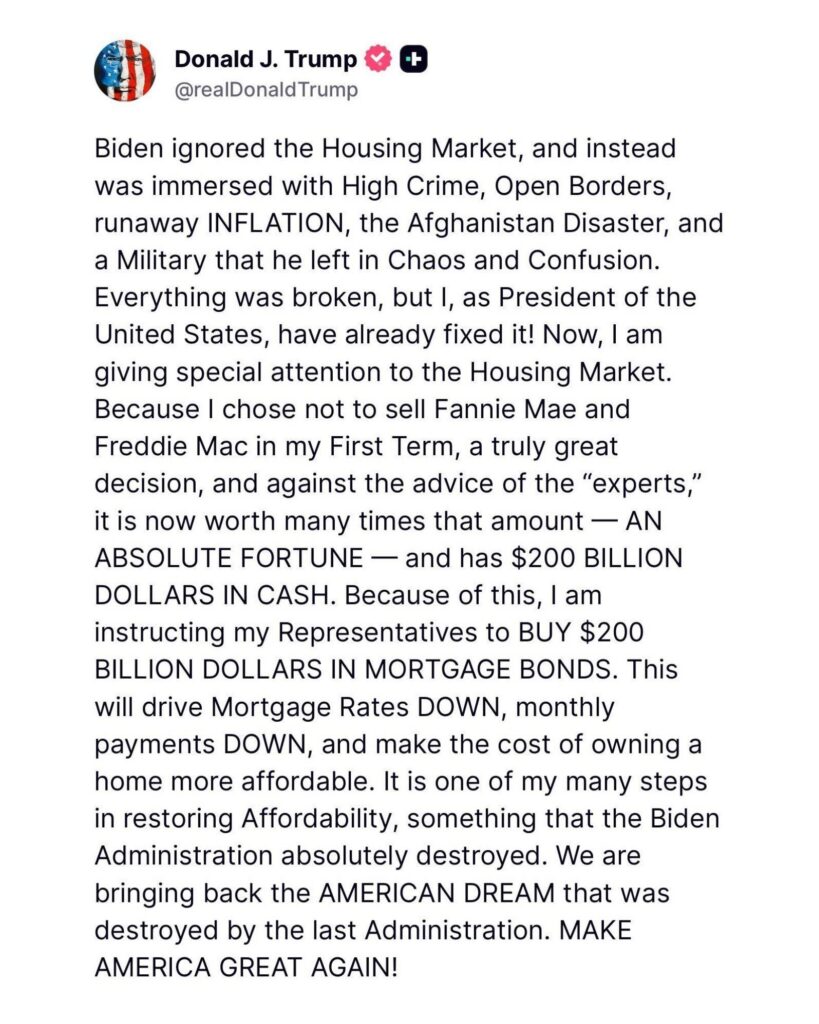

See Trump’s social media post below:

Economists Examine Trump’s Projected Mortgage Motions

Among the proposals is the instruction for Fannie Mae and Freddie Mac to acquire mortgage bonds worth $200 billion. Following his announcement on Truth Social on January 8, mortgage rates have decreased slightly; however, economists are skeptical about whether this decrease will be sufficient to substantially enhance affordability.

“Homeownership has always been a symbol of health and vigor,” Trump said.

Trump further elaborated on his proposed policies during his recent speech at the World Economic Forum in Davos, Switzerland.

Studies show that since 2022, the housing market has been sluggish due to the convergence of high mortgage rates and years of rapidly increasing home prices, according to Scripps News and industry experts.

Joel Berner, Senior Economist at Realtor.com, stated that directly manipulating mortgage rates is a novel strategy, one that hasn’t been utilized.

“Directly manipulating mortgage rates is not really something they’ve done much of before. This is sort of new,” Berner said.

According to Berner, the aim of the acquisition is to lower interest rates by boosting demand for mortgage-backed securities. The plan intends to lower the so-called mortgage “spread,” which is the difference between the interest rate on a 30-year mortgage and the yield of 10-year Treasury bonds. Further, during periods of economic uncertainty, spreads widen, whereas a narrow spread fosters greater market confidence.

“What they are doing is increasing demand to squish that margin down and allow for mortgage rates to fall,” Berner said.

Currently, mortgage rates are down and are hovering slightly above 6%. Nevertheless, according to Berner, it is difficult to determine with certainty whether the action will have lasting effects.

“It really depends on how the market perceives the move,” Berner said. “If they perceive it as Fannie and Freddie are going to become long-term holders of mortgage bonds, then it’s entirely the case that mortgage rates might sustain lower. If they think it’s a one-time pop, then it might just be a short-term dip in rates.”

Trump’s Action to Prohibit Certain Housing Transactions

Trump is also taking steps to ban large institutional investors from buying more single-family homes.

“Homes are built for people, not for corporations and America will not become a nation of renters, we’re not gonna do that,” Trump said at the forum in Davos, Switzerland.

However, there has also been some skepticism regarding that proposal. Daryl Fairweather, Chief Economist at Redfin, raises doubts about its effectiveness.

“Even if you were to ban these really large investors, they would probably be replaced by smaller investors. It’s not necessarily going to open up inventory for first-time homebuyers,” Fairweather said.

As said, economists caution that the purchase of mortgage bonds may have unintended negative consequences. According to Berner, a slight easing of mortgage rates will lead more individuals to enter the market, and with an increase in simultaneous purchases, home prices will rise.

“The whole goal here is affordability and lower mortgage rates do mean better affordability,” Berner said, “but not if it comes at the same time as an increase to home prices. They’re walking a very fine line here, and we’ll be interested to follow how it works out.”

Edward Pinto, who is a resident fellow at the conservative American Enterprise Institute, compared Trump’s first announcement of $200 billion to a “sugar high.”

“It might have an effect, but it will be fleeting,” said Pinto, a former Fannie Mae Executive. He stated that although Trump’s announcement momentarily caused a decline in mortgage rates, they rose again after Trump made threats regarding a Greenland takeover.

“It’s easy for the federal government to make a mistake here. They’ve done it in the past,” Pinto said.

The post Impact of Trump’s Proposed Mortgage Plan Might be Opposite of His Intent, Economists Say first appeared on The MortgagePoint.