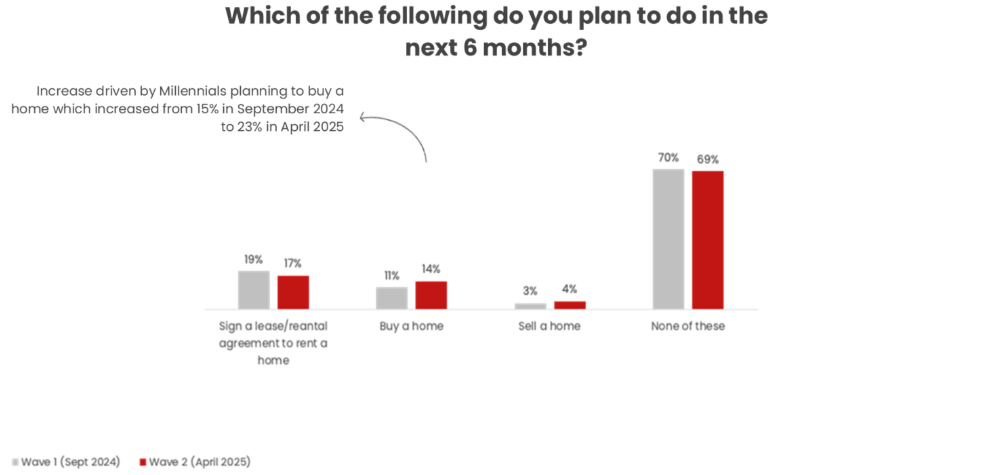

Millennials are the only generation with a growing interest in buying a home this spring, despite high borrowing costs and affordability pressures, according to a new Realtor.com survey. The share of Millennials planning to buy a home in the next six months rose to 23%, up from 15% in September 2024.

“Despite current market challenges and persistently high mortgage rates, Millennials are showing a notable increase in home buying interest this spring compared to last fall,” said Laura Eddy, VP of Research and Insights at Realtor.com. “The influence of mortgage rates cannot be overstated, with the vast majority of Americans, including Millennials, prioritizing lower rates before committing to a purchase. The lock-in effect is still very much in effect.”

Overall, roughly 69% of Americans say they are not planning to engage in a real estate transaction in the next six months, reflecting ongoing reluctance amid elevated interest rates. Most buyers are still holding out for lower borrowing costs. According to the survey, 63% of respondents want mortgage rates to drop below 5% before considering a purchase, and only 2% would buy with rates above 6%.

Among current homeowners, the lock-in effect remains a powerful deterrent. A recent Realtor.com survey of potential sellers found that half of those with a mortgage feel “locked in” by their current rate, particularly those who have delayed selling for more than a year.

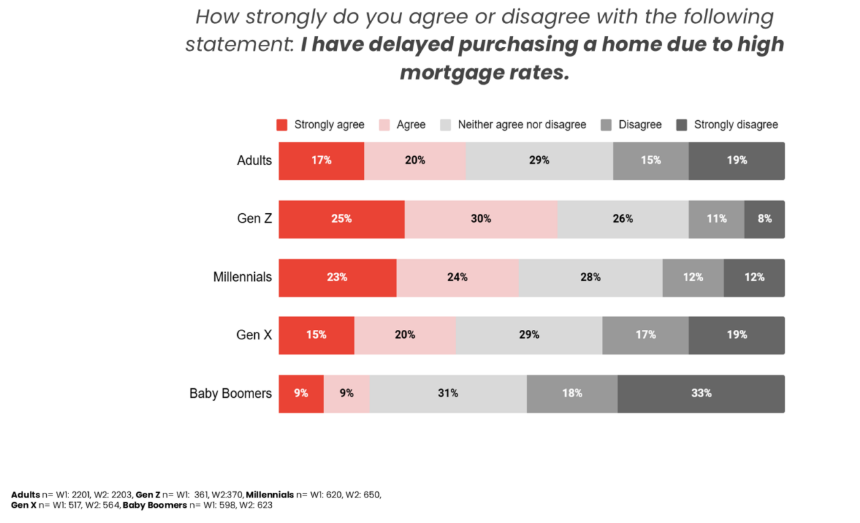

One-third of survey respondents said they have delayed purchasing a home due to high mortgage rates—a figure consistent with findings from September. Among younger generations, the impact is even more pronounced: more than half of Gen Z and Millennials reported postponing their plans to buy. Gen Z also showed an increased likelihood of signing leases and delaying home purchases compared to last fall.

While 41% of Baby Boomers said mortgage rates don’t impact their purchase decisions, younger generations remain highly sensitive to fluctuations. In fact, over two-thirds of respondents overall acknowledged that mortgage rates influence their homebuying decisions.

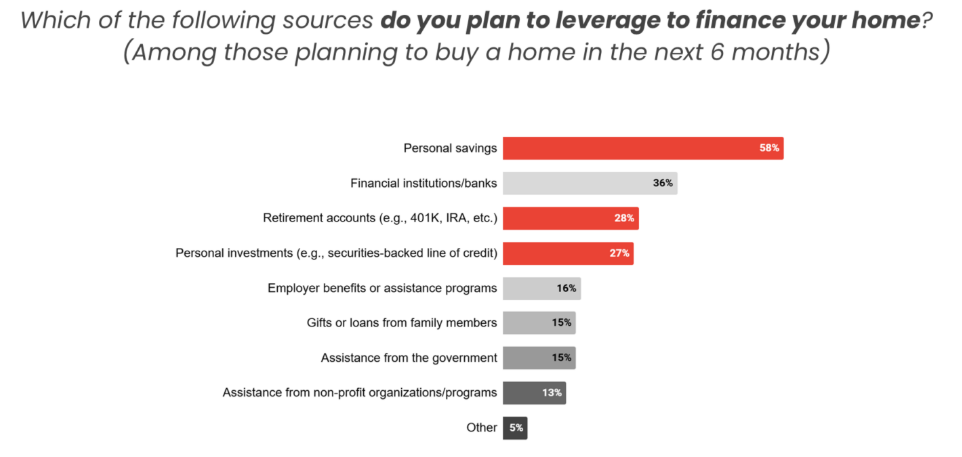

The survey also highlighted how homebuyers are financing purchases: 57% across all generations used personal savings, 15% tapped retirement accounts or investments, and 12% received gifts or loans from family members. Among prospective buyers, one in four intend to use retirement or investment funds for financing.

“Mortgage rates on top of an insufficient supply of budget-friendly homes complicates the affordability picture, especially for first-time homebuyers,” said Hannah Jones, Senior Research Analyst at Realtor.com. “However, we expect that this lock-in effect will ease as more homeowners grow tired of waiting for significant rate changes and as life factors such as jobs, kids and retirements drive more to make a home purchase.”

The post Millennials Buck Rate Trends, Show Rising Interest in Homebuying first appeared on The MortgagePoint.