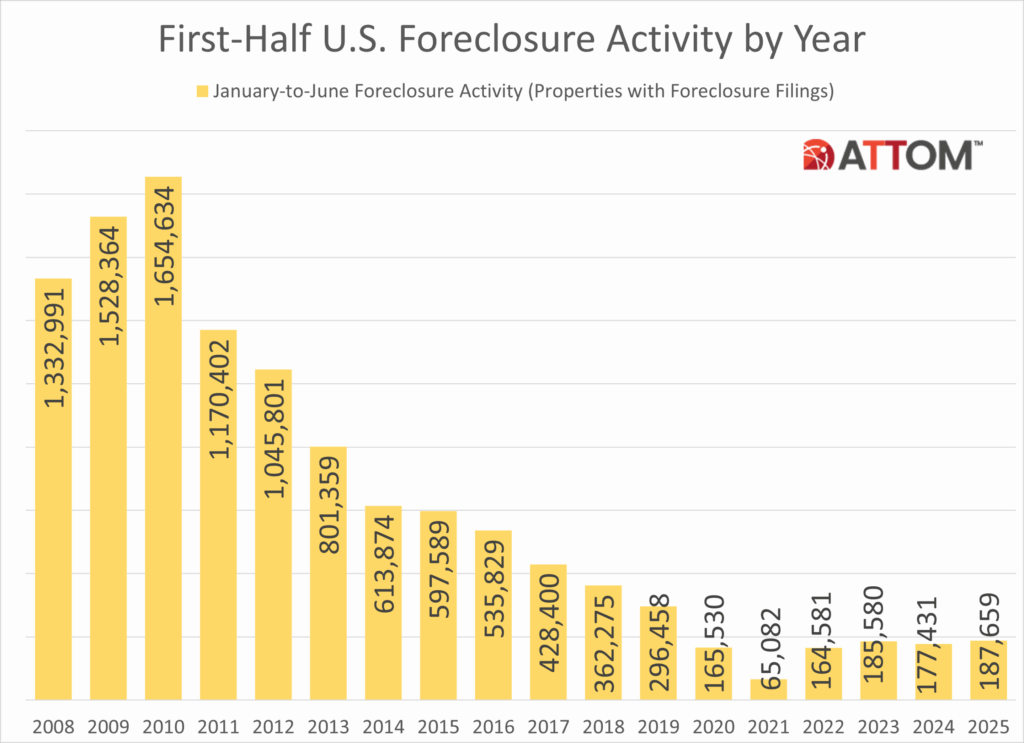

The Mid-Year 2025 U.S. Foreclosure Market Report, published by ATTOM revealed that in the first half of 2025, some 187,659 U.S. properties had foreclosure filings, such as default notices, scheduled auctions, or bank repossessions. That number represents a 5.8% increase from the same period last year and a 1.1% increase from the same period two years ago.

“Foreclosure activity continued its upward trend in the first half of 2025, with increases in both starts and completed foreclosures compared to last year,” said Rob Barber, CEO at ATTOM. “While the overall numbers remain below pre-pandemic levels, the persistent rise suggests that some homeowners are still facing financial challenges amid today’s housing and economic landscape.”

The U.S. states that saw the greatest increases in foreclosure activity compared to a year ago in the first half of 2025 included:

- Alaska (up 55%)

- Rhode Island (+51%)

- Wyoming (+46%)

- Utah (+46%)

- Colorado (+41%)

In the first half of 2025, one in every 758 housing units nationwide—or 0.13% of all housing units—had a foreclosure filing.

States with the worst foreclosure rates in the first half of 2025 were:

- Illinois (0.23% of housing units with a foreclosure filing)

- Delaware (0.23%)

- Nevada (0.21%)

- Florida (0.21%)

- South Carolina (0.20%)

The following states have first-half foreclosure rates among the top 10 in the country:

- Texas (0.15%)

- Connecticut (0.17%)

- Ohio (0.16%)

- Indiana (0.18%)

- New Jersey (0.18%)

Declining Foreclosure Activity Across the U.S.

The average duration of the foreclosure procedure for properties that went through foreclosure in Q2 2025 was 645 days. That number was down 21% from a year ago and down 4% from the prior quarter.

In Q2 of 2025, there were 100,687 homes in the U.S. with a foreclosure filing, reflecting a 7% increase from the previous quarter and a 13% increase from the same period last year.

Additional Highlights — National

- Nationwide in June 2025, one in every 4,361 properties had a foreclosure filing.

- States with the worst foreclosure rates in June 2025 were South Carolina (one in every 2,426 housing units with a foreclosure filing); Nevada (one in every 2,615 housing units); Florida (one in every 2,716 housing units); Illinois (one in every 2,766 housing units); and Delaware (one in every 3,074 housing units).

- 21,782 U.S. properties started the foreclosure process in June 2025, down 10 percent from the previous month but up 17% from June 2024.

- Lenders completed the foreclosure process on 3,892 U.S. properties in June 2025, up 1% from the previous month and up 35% from June 2024.

To read more, click here.

The post Foreclosure Filings Spike in First Half of 2025 first appeared on The MortgagePoint.