As housing affordability continued to be a widespread issue, the number of households burdened by costs reached unprecedented levels in 2024, according to Harvard’s Joint Center for Housing Studies. Estimates from the Center, based on newly released American Community Survey data, indicate that in 2024, an estimated 43.5 million households were cost burdened, spending over 30% of their monthly income on housing costs.

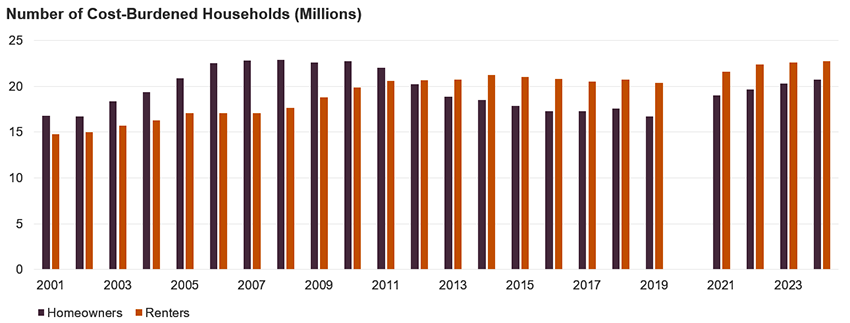

The number of cost-burdened households rose by 589,000 compared to the previous year, resulting in a total increase of an astonishing 6.4 million since 2019 and leaving one-third (33%) of households facing cost burdens. In 2024, another record was set as 21.6 million households (16% of the total) faced severe financial strain by allocating over half their income to housing.

With affordability getting worse, the count of homeowners burdened by costs reached a peak not seen since 2011. In 2024, a total of 20.7 million homeowner households (24% of all homeowners) experienced cost burdens, marking an annual increase of 419,000 households and a rise of 4.0 million since the pre-pandemic period. Part of this change can be attributed to demographic shifts linked to an aging population, with about half of the households newly facing this burden being led by older adults. When older adults retire or reduce their working hours, their income decreases.

Renter Household Costs, Median Incomes & Homeowner Expenses

For older adults who own their homes outright, the increase in non-mortgage expenses (such as insurance, utilities, or property taxes) is becoming a more significant worry. In fact, median housing costs for households that owned their homes outright increased by 35% since 2019, compared to a 25% increase for all homeowners. Meanwhile, homeowner incomes only rose by 23%.

The number of renter households burdened by costs also increased, reaching a new record high. In 2024, there were 22.7 million renter households that were cost-burdened (accounting for 49% of all renters), marking a record high for the fourth straight year. The number of burdened renters increased by 170,000 compared to the previous year and rose by 2.3 million compared to 2019. The rise in housing costs and income growth since the onset of the pandemic contributed to unaffordability. Specifically, from 2019 to 2024, the median housing costs for renters increased by 38%, while incomes grew by only 28%.

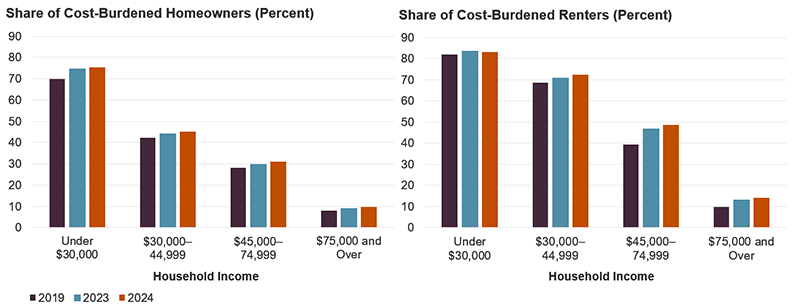

The share of homeowner households experiencing cost burdens increased across all income groups, with the most rapid growth occurring among those with moderate incomes, as rising costs affected individuals higher up the income scale. In 2024, almost a third (31%) of homeowners with incomes ranging from $45,000 to $74,999 experienced burdens, reflecting an annual increase of 1.1 percentage points.

Moreover, the share of homeowners earning between $30,000 and $44,999 who were burdened reached 45%, reflecting an annual increase of 0.9 percentage points. However, the most significant rise in burden prevalence since the pandemic began occurred among homeowners with lower incomes. Three-quarters of homeowners earning less than $30,000 in 2024 were cost burdened, marking an increase of 5.7 percentage points since 2019.

Share of Cost-Burdened Renters Sees Sharp Rise in Middle-Income Households

Middle-income households saw the fastest increase in the number of renters who are burdened by costs. Between 2023 and 2024, there was a significant increase of 2.1 percentage points in the share of burdened renters earning between $45,000 and $74,999, reaching 49 percent of households. Since 2019, the proportion of middle-income renters experiencing cost burdens has risen by an astonishing 9.5 percentage points, as post-pandemic rent increases have increasingly affected higher-income households.

Even renters with the highest incomes were affected by the increasing unaffordability; from 2019 to 2024, the proportion of burdened renters earning $75,000 or more per year rose by 4.1 percentage points, reaching 14% of households. In contrast, the proportion of burdened lower-income renters has not had much room for growth, increasing only 1.1 percentage points since 2019 to 83%, as those earning under $30,000 have consistently faced the greatest affordability challenges.

Households of color continued to experience higher cost burdens, particularly in comparison to white households, partly due to a legacy of discrimination in housing, employment, and education. Among homeowners, the proportion of households facing cost burdens was highest among Black and Hispanic owners, at 32% and 29%, respectively.

Moreover, the proportions of burdened homeowners were higher among Asians (27%), those identifying as multiracial (26%), and Native Americans (25%), while for white homeowners, this figure was just 22%. There were also comparable disparities among renters. Over half of Black (57%) and Hispanic (54%) renters experienced unaffordable living situations, in contrast to 50% of multiracial renters, some 45% of white renters, and 44% of Native American and Asian renters.

With the ongoing rise in housing costs, an unprecedented number of households are experiencing pressure regarding affordability. Housing assistance continues to be a vital support for lower-income renters who are experiencing the most severe impacts of the affordability crisis. It is also essential for older homeowners with low incomes to have access to means that can counteract the increase in non-mortgage expenses, such as energy assistance, property tax abatements, and home weatherization programs.

State and local governments can reform local zoning laws and promote more cost-effective building methods, such as modular and manufactured housing, to benefit households across the income spectrum. This could motivate the building of more residences and the creation of various kinds of housing, which would help alleviate the ongoing supply deficits that have led to unprecedented unaffordability.

The post Housing Unaffordability Climbs as Share of Cost-Burdened Households Hits Record High first appeared on The MortgagePoint.