In just the past few years, there has been a significant increase in the proportion of U.S. homeowners with high mortgage rates, according to a new CNBC report. This is significantly affecting the refinancing market and, to a lesser degree, the housing market. Rates have taken a central role in discussions about how to enhance home affordability, and rightly so.

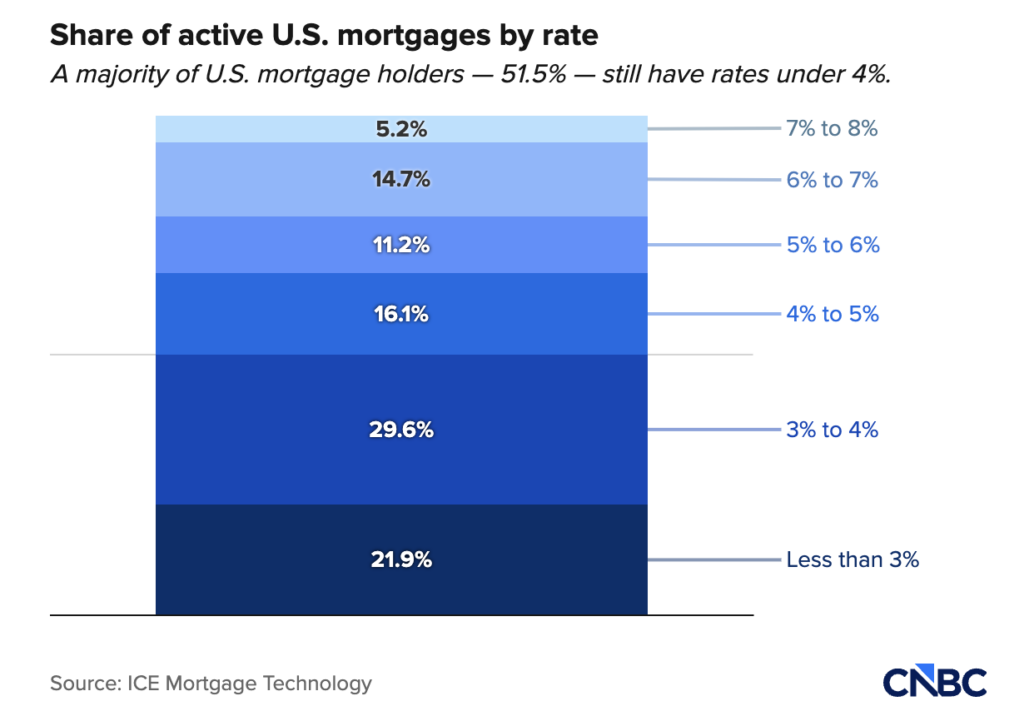

In 2022, following mortgage interest rates reaching over a dozen record lows and igniting a refinancing surge, only about 10% of homeowners had 30-year fixed-rate mortgages exceeding 5%. According to ICE Mortgage Technology, just four years later, that share has surged to over 30%. Approximately 20% of borrowers hold mortgages with interest rates exceeding 6%.

The National Association of Realtors (NAR) has reported that home sales have not been very strong in recent years, with a historical low of 4.06 million sales last year, which is virtually the same as in 2024. This follows 2022, which saw home sales reach 6.12 million—an unprecedented figure over the previous 15 years. The share of borrowers with higher interest rates increased due to more recent sales and some cash-out refinancing.

Enhancing Mortgage Affordability for Buyers, Owners & Renters

The Trump administration is concentrating significantly on reducing mortgage rates to enhance home affordability. Recently, the president revealed a strategy for Fannie Mae and Freddie Mac to acquire over $200 billion in mortgage-backed securities. The extent to which that would reduce mortgage rates post-purchase remains debatable, yet the mere announcement led to a slight decrease in rates.

According to industry experts, the actual purchases could reduce the current 30-year rate by approximately an eighth of a percentage point, bringing it down to around 6%. ICE Mortgage Technology reported that if the average for the 30-year fixed rate reached 6%, 5.5 million existing homeowners would be able to take advantage of refinancing.

“The most popular interest rate that’s been used to buy a home over the last 3.5 years is between 6.875% and 6.99%, right? Nobody wanted to tell their neighbors they used a 7% interest rate to buy a home, so everybody bought down into this high 6% range,” said Andy Walden, ICE Mortgage Technology’s Head of Mortgage and Housing Market Research.

According to the report, those homeowners could reduce their rate by at least 75 basis points, thereby making the associated fees financially justifiable. Experts and economists suggest that if interest rates fell to 5.88%, that figure would increase to 6.5 million homeowners.

“Coincidentally, those 15-basis-point-spread moves from this $200 billion in MBS purchase is moving rates from what would have been six and a quarter right now down to six and an eighth. And so it’s providing meaningfully more refinance incentive than would otherwise be out there, and it’s having an oversized impact on the market,” Walden said.

Refi Applications, Trends & Activity Soar from Last Year

The Mortgage Bankers Association (MBA) reports that applications for home loan refinancing have increased by approximately 120% compared to the previous year.

Regarding home sales, the last four years saw the emergence of the so-called rate “lock-in” effect, which meant that potential sellers were reluctant to forfeit their historically low rates. They thus delayed actions that they may have otherwise desired to take.

According to Walden, as 2025 began, there were about 39 million homeowners whose interest rates were below 5%, and about 12 million whose rates were below 3%.

“If you look at how those borrowers behaved last year, only about 6% of those folks gave up those low rates, either through a refinance to pull equity out of their home or through the sale of their home. Close to 95% of homeowners held on to those rates tight,” Walden said.

Regarding potential homebuyers, a reduction of 15 basis points in the 30-year fixed rate would result in a monthly mortgage payment savings of approximately $35 for the average home price. As an alternative, they could maintain the rate and purchase 1.5% more home.

“Certainly a move in the right direction, but not a massive movement for those homebuyers,” Walden said.

The post Many Homeowners with Elevated Mortgage Rates Would Benefit from Refinancing first appeared on The MortgagePoint.