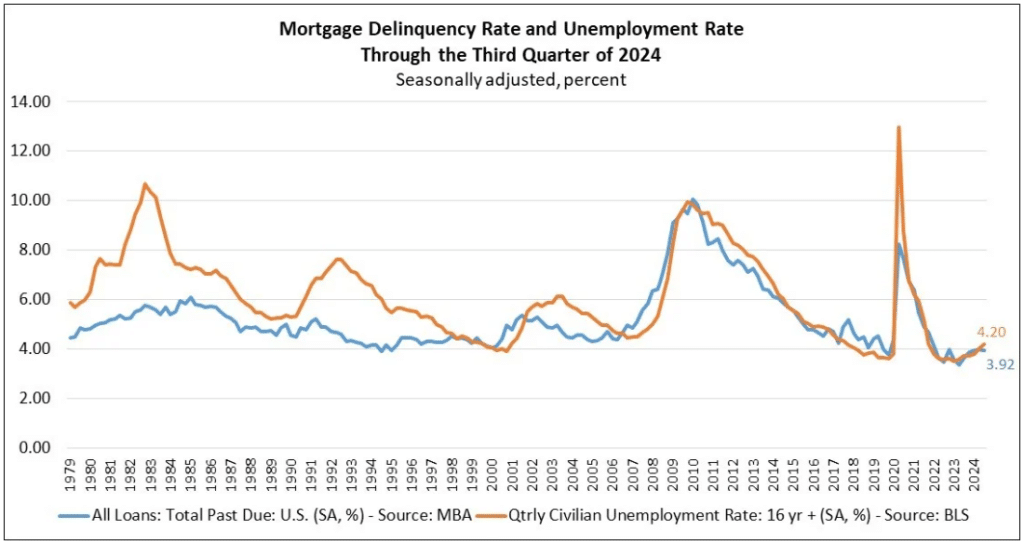

The latest Mortgage Bankers Association’s (MBA) National Delinquency Survey has found that the delinquency rate for mortgage loans on one- to four-unit residential properties decreased slightly to a seasonally adjusted rate of 3.92% of all loans outstanding at the end of Q3 2024, compared to one year ago.

The MBA reports the nationwide delinquency rate was down five basis points from Q2 of 2024, but up 30 basis points from one year ago. The percentage of loans on which foreclosure actions were started in Q3 rose by one basis point to 0.14%.

“Mortgage delinquencies have inched up over the past year,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Even though there was a small, third-quarter decline in the overall delinquency rate compared to the previous quarter, this was driven by a decrease in 30-day delinquencies. Later-stage delinquencies rose last quarter, and overall delinquencies were up 30 basis points from one year ago.”

Key Findings of the Q3 National Delinquency Survey

- Quarter-over-quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 14 basis points to 2.12%, the 60-day delinquency rate increased three basis points to 0.73%, and the 90-day delinquency bucket increased seven basis points to 1.08%.

- By loan type over the previous quarter, the total delinquency rate for conventional loans decreased one basis point to 2.63%. The FHA delinquency rate decreased 14 basis points to 10.46%, and the VA delinquency rate decreased five basis points to 4.58%.

- On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate increased 13 basis points for conventional loans, increased 96 basis points for FHA loans and, increased 82 basis points for VA loans from the previous year.

- The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of Q3 was 0.45%, up two basis points from Q2 of 2024 and four basis points lower than one year ago.

- The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.55%. It increased 12 basis points from last quarter and increased three basis points from last year. The seriously delinquent rate increased five basis points for conventional loans, increased 46 basis points for FHA loans, and increased 19 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased three basis points for conventional loans, increased 29 basis points for FHA loans and, increased 27 basis points for VA loans.

The five states with the largest quarterly increases in their overall delinquency rate were:

- Texas (24 basis points)

- Arkansas (14 basis points)

- Florida (13 basis points)

- Arizona (12 basis points)

- Wyoming (9 basis points)

“While delinquencies remain low by historical standards, the composition of loans in delinquency is changing, with more 60-day delinquencies and 90-day-plus delinquencies across all major loan types, compared to last quarter and one year ago,” said Walsh.

What Does the Delinquency Landscape Look Like for 2024?

Walsh noted that the effects of Hurricanes Helene and Milton will likely appear in the next reporting period of the MBA’s National Delinquency Survey, given the timing of the storms at the end of September and beginning of October.

According to the National Hurricane Center (NHC), Hurricane Helene, the eighth named storm of the season, made landfall as a Category 4 hurricane in Florida’s Big Bend region at approximately 11:10 p.m. EDT Friday evening, September 27, with estimated sustained winds at 140 miles per hour. Helene hit the shore in Florida, just east of the mouth of the Aucilla River, approximately 10 miles southwest of Perry, Florida. CoreLogic’s Hazard HQ Command Central estimates Hurricane Helene’s insured wind and storm surge losses to be between $3 billion and $5 billion, with significant uncertainty due to the wind field. Losses include damage to buildings, contents, and business interruption for residential, commercial, industrial, and agricultural property. The flood losses do not include precipitation-induced inland flooding and exclude losses to the National Flood Insurance Program (NFIP). CoreLogic’s estimate does not include damage to offshore property.

CoreLogic’s initial residential and commercial wind and flood loss estimates for Hurricane Milton found that industry-wide, insured wind and flood losses from Hurricane Milton are expected to be between $17 billion and $28 billion, and that total amount of damage, including losses to uninsured property, will be between $21 billion and $34 billion.

The post Q3 Mortgage Delinquencies Dip first appeared on The MortgagePoint.