According to Auction.com’s 2025 Disposition Strategy Report (DSR), average REO inventory increased to 897 days for traditional sales compared to just 320 days for REO auctions, while auction-first, earlier dispositions produced a record 43 percentage-point net-proceeds advantage over traditional REO through Q3 2025.

“The time value of money principle—that a dollar today is worth more than a dollar in the future—is key to understanding why earlier dispositions perform better, coming into even sharper focus in a slowing market,” said Jason Allnutt, CEO of Auction.com.

What’s inside the report:

- How days-in-inventory and carrying costs impact net proceeds in a slowing market

- Comparisons across foreclosure, Day 1 REO auction, and traditional REO to inform portfolio strategy

- Examples connecting disposition choices to community outcomes and resale pathways

- Metrics and visuals to inform 2026 planning (net proceeds, timelines, and outcomes)

Examining Disposition Types, REO Activity & More

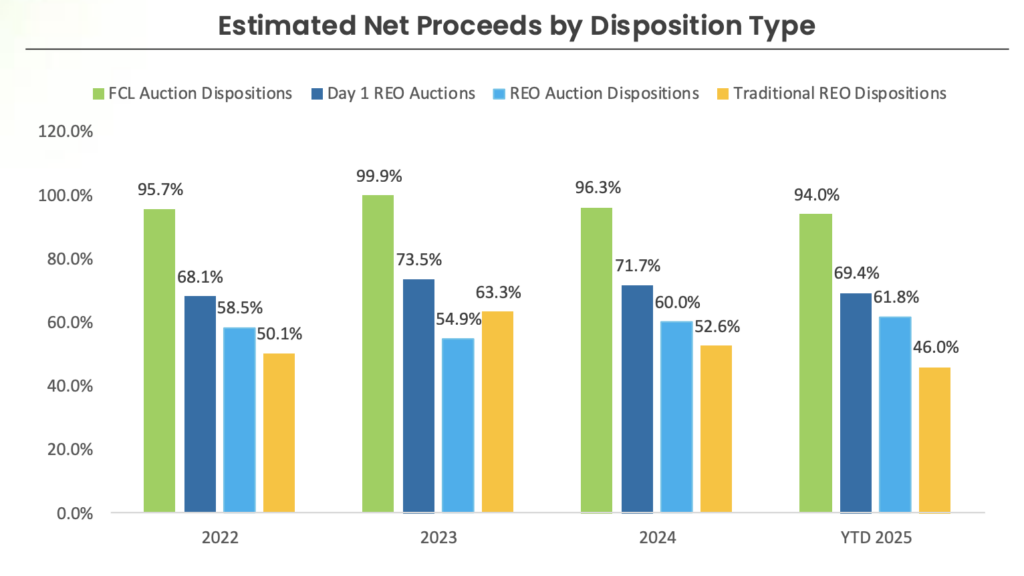

Since 2018, the estimated net proceeds from auction dispositions—bank-owned (REO) and foreclosure auctions combined—have surpassed net proceeds from typical sale REO dispositions by an average of 31 percentage points.

Due in major part to rising mortgage rates in late 2022 and 2023, which peaked in November 2023, the net profits advantage for auction dispositions grew over the past two years as retail market inventories increased and home price appreciation slowed.

The net profits advantage for auction dispositions was on course to hit a record high of 43 points through Q3 of 2025, barely surpassing 2022. By deducting the expected costs of renovation, holding, sales, and closing from the sale price of the property and dividing the result by the entire amount owed to the foreclosing party, net proceeds were determined.

Estimated renovation and holding expenses were computed at a rate of 10% per year, prorated for the amount of days in REO inventory, for both regular sales and REO auction sales. Foreclosure auction sales are, by definition, free of holding or renovation expenses. Sales and closing fees are projected to be 5.0% for foreclosure auctions, 1.5% for REO auctions, and a steady 7.5% for regular sales.

Foreclosure auction sales consistently lead the way in earlier dispositions, which often yield better net proceeds and less severe losses than later dispositions. For the past four years, including the third quarter of 2025, estimated net proceeds from foreclosure auctions have continuously registered 20 to 25 percentage points above any REO disposal type. While net proceeds for REO auction dispositions have been trending upward since 2023, traditional REO sales produced higher net proceeds than REO auction dispositions in 2023.

Day 1 REO auction dispositions, which are sales of properties immediately put up for auction after reverting to REO at foreclosure auction, typically produce the second-highest net proceeds on average of any disposition type. This is a subset of all REO auction sales.

The declining retail housing market has a disproportionately negative effect on net proceeds for traditional REO dispositions when seen through the prism of gross price execution as a percentage of total debt.

The gross price execution for traditional REO sales has dropped by 7.5 percentage points since it peaked at 110.1% in 2023, while the gross price execution for foreclosure auction dispositions has reduced by 6.0% during the same time frame.

Price execution for both disposition methods has been adversely affected by a weakening retail market, although traditional sales have been more severely affected. This is probably due to the fact that traditional REO transactions are less protected from the fluctuations of the retail housing market. In contrast, within the past two years, gross price execution as a percentage of total debt has actually increased for REO auction dispositions.

Foreclosure Auction Data & Analysis

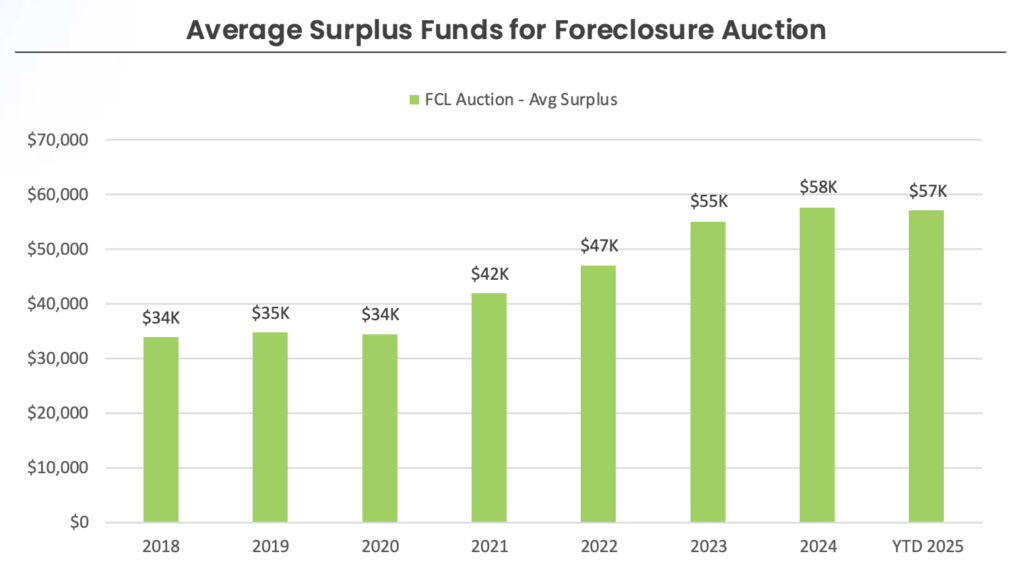

Junior lien holders and distressed homeowners have access to the almost $57,000 average surplus earned by foreclosure auction sales thus far in 2025, following the payment of any junior liens.

Since 2018, the Auction.com platform alone has produced $2.8 billion in surplus funds from foreclosure auction sales.

Due to the previously indicated limitations on surplus monies after the foreclosure auction, junior lien holders and distressed homeowners were unable to enjoy the average surplus of roughly $99,000 generated by traditional REO sales over the total debt owed to the foreclosing corporation.

Additionally, the holding and remodeling expenses paid by the investor and mortgage servicer while the property is in REO inventory are not taken into account by the conventional REO sale excess. These expenses reduce any profit from a conventional REO sale.

Additional Highlights from the DSR:

- The reason why gross price execution and net revenues for traditional REO dispositions have decreased over the past two years while those same metrics have increased for REO auction dispositions can be explained by average days in REO inventory by disposition method.

- Through Q3of 2025, the average number of days in REO inventory for traditional REO transactions increased to 897, up 77 days from 2024 and about six months (179 days) from 2023.

- In contrast, the average number of days in inventory for REO auction sales dropped to 320 in 2025, a decrease of 16 days from 2024 and 3 days from 2023. Inventory days for Day 1 REO auctions decreased much further.

In addition to lowering holding costs that affect net proceeds, fewer days in inventory frequently leads to a higher gross price execution because of buyer psychology regarding days on market, especially in local areas where property price rise is slowing or declining.

To read more, please see the link to Auction.com’s DSR at the beginning of the article.

The post Auction Dispositions Outperform Traditional REO by Record Margin, Report Finds first appeared on The MortgagePoint.