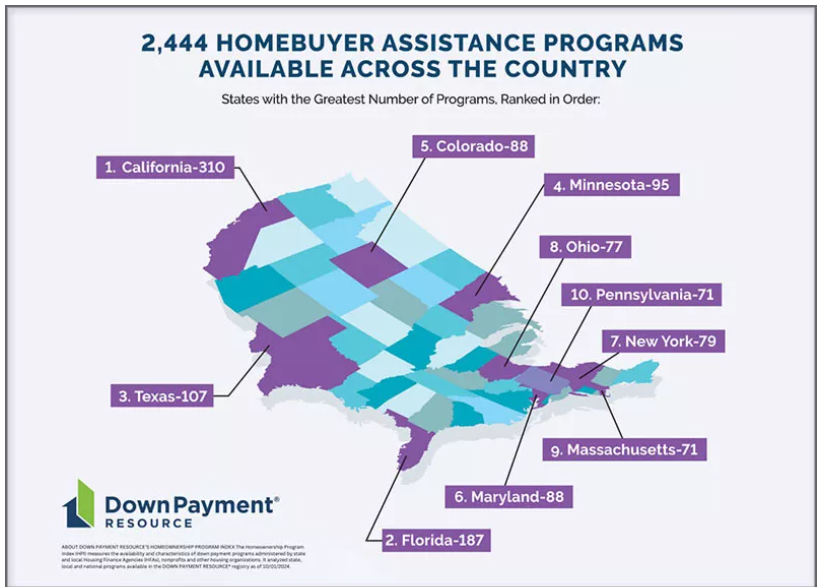

Down Payment Resource (DPR) has released its Q3 2024 Homeownership Program Index (HPI) report which found the number of national homebuyer assistance programs increase by 29 to 2,444 during the third quarter of the year.

The report showed a 5% increase in programs for first-generation buyers. First-generation homebuyers have been singled out by the Harris Presidential campaign, which along with building three million affordable housing units for rent and ownership, proposes to provide $25,000 down-payment assistance to first-time homebuyers who have paid rent on time for two years, with more generous support for qualifying first-generation homeowners.

“We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford,” said Rob Chrane, Founder and CEO of DPR. “Our data show the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Key findings of the Q3 2024 Homeownership Program Index (HPI) report include:

- The number of U.S. homebuyer assistance programs increased by 29 over the past quarter. This represents a 1.2% increase over the previous quarter.

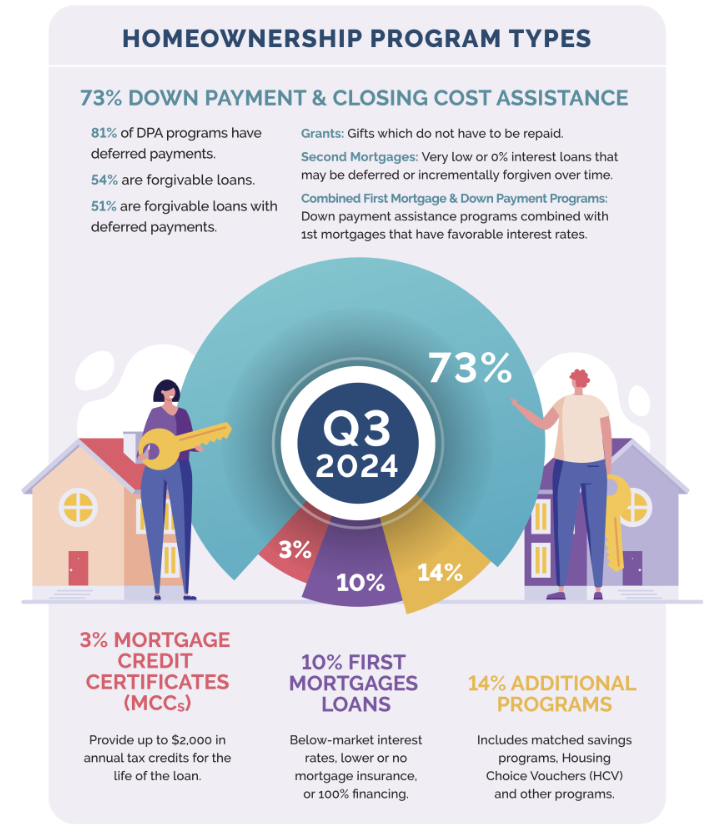

- There was an 8% increase in below market rate/resale programs and 7% increase in grant-funded programs, and 6% increase in other homebuyer assistance from Q2 2024. Below market rate or BMR homes are affordable homes sold at a lower price than the market average and are intended for low- to moderate-income buyers. When a BMR homeowner wants to sell, they must sell the home to an income-eligible buyer.

- 949 municipalities offered DPA programs. Municipalities represented the majority of funding sources in Q3 2024 at 39%, which is virtually unchanged from last quarter. Nonprofits were the second highest funding source, 21% in Q3 2024, followed by state HFAs at 19%. A few of these programs have seen increases from federal program resources, including the American Rescue Plan Act (ARPA) and the U.S. Department of Health & Human Services (HHS).

- 777 programs supported multifamily purchases, up 7% from the previous quarter. Of those, 526 allowed for three-unit properties, up 7% from Q2 2024, while 501 allowed for four-unit properties, up 8% from Q2 2024.

- 195 programs offer incentives for special groups. 35% offer special funding for educators, 29% for protectors, 26% for firefighters, 24% for healthcare workers, and 24% for Native Americans, and 22% for military homebuyers.

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs.

DPR features a database that tracks more than 2,400 programs and toolsets for mortgage lenders, multiple listing services (MLSs) and API users, DPR helps housing professionals connect homebuyers with the assistance they need. DPR frequently lends its expertise to nonprofits, housing finance agencies, policymakers, government-sponsored enterprises and trade organizations seeking to improve housing affordability. Its technology is used by seven of the top 25 mortgage lenders, the three largest real estate listing websites and 600,000 real estate agents.

Click here to view a state-by-state list of down payment providers, and click here to view the full “The Down Payment Resource Q3 2024 Homeownership Program Index Report.”

The post Available Down Payment Programs Rise in Q3 first appeared on The MortgagePoint.