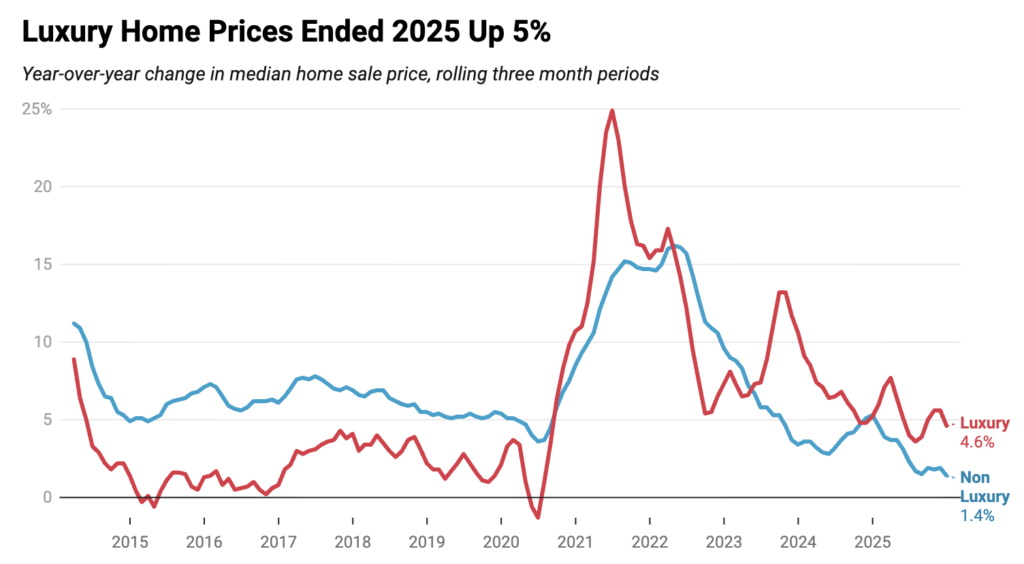

According to a recent report from Redfin (redfin.com), the real estate brokerage powered by Rocket, the median sale price of luxury homes in America increased by 4.6% year-over-year (YoY), reaching $1.31 million in December. In contrast, prices for non-luxury items increased by 1.4%, reaching $375,000—this marks the slowest growth since records began in 2013. Overall, luxury home prices dropped in only two metropolitan areas: Fort Worth, Texas, and Portland, OR.

Metro-Level Luxury Highlights: December 2025

- Prices: Luxury prices rose most in Milwaukee (20.6%), Orlando, FL (16.8%) and Nashville (13.6%). They fell in just two metros: Fort Worth, TX (-1.9%) and Portland, OR (-0.7%).

- Pending Sales: Luxury pending sales rose most in West Palm Beach, FL (28.6%), San Francisco (16.1%) and Tampa, FL (12%). They fell most in San Jose, CA (-35%), Philadelphia (-20.5%) and New Brunswick, NJ (-19.1%).

- Active Listings: Luxury active listings rose most in Tampa (40.6%), Detroit (19.2%) and Nashville (17.7%). They fell most in San Jose (-27.4%), Philadelphia (-16.1%) and Milwaukee (-14.9%).

- New Listings: Luxury new listings rose most in Detroit (29.4%), Kansas City, MO (22.4%) and Tampa (22.1%). They fell most in Milwaukee (-25.7%), New York (-19%) and Warren, MI (-13.9%).

- Speed of Sales: Luxury homes sold fastest in San Jose (13 days), Oakland (16 days) and St. Louis (23 days). They sold slowest in Miami (142 days), Fort Lauderdale, FL (133 days) and West Palm Beach (112 days).

According to Alin Glogovicean, a Redfin Premier real estate agent in Los Angeles, luxury home prices are increasing not due to high demand, but because wealthy buyers are competing for the limited number of desirable homes available.

“Homebuyers are very selective because prices and mortgage rates are high—they want a house that has everything. Even super wealthy buyers are hesitant to pull the trigger because there’s not a lot of great inventory and they don’t want to settle,” Glogovicean said. “We’re seeing bidding wars on the few homes that are desirable, which is driving up prices. If you list your house for $2.9 million and it’s in really good shape and in a desirable location, you might sell it for $3.3 million and get a buyer who pays cash and waives contingencies.”

In December, the YoY drop in luxury home pending sales reached 1.1%, marking the largest decline in six months. In comparison, pending sales of non-luxury homes dropped by 0.6%, marking the biggest decline in eight months. Further, closed transactions of luxury U.S. homes, which is a more retrospective measure, increased by 0.4% compared to the previous year. In comparison, non-luxury homes saw a reduction of 0.7%.

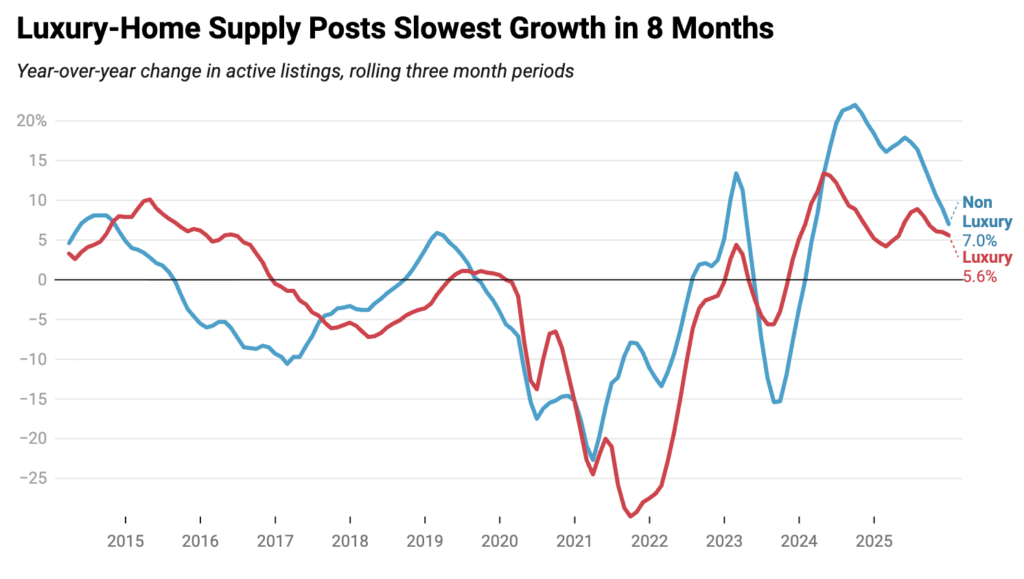

In December, active listings of luxury homes for sale rose 5.6% compared to the previous year, marking the slowest growth rate since April. While non-luxury listings increased at a rate of 7%, this was the slowest growth observed since February 2024. It is probable that the growth of supply is decelerating due to the sluggish demand from homebuyers. New luxury home listings increased by 2.9%, while non-luxury new listings saw a decline of 2.4%.

Note: These findings are based on a Redfin analysis of MLS home sales from October through December 2025, which Redfin refers to as “December” throughout this report. All figures cover rolling three-month periods, the most recent of which lines up with the fourth quarter. Redfin defines luxury homes as those estimated to be in the top 5% of their metro area’s price range, while non-luxury homes fall into the 35th–65th percentile. These data are subject to revision.

The post Luxury Home Prices Tick Up, But Demand Remains Stagnant first appeared on The MortgagePoint.