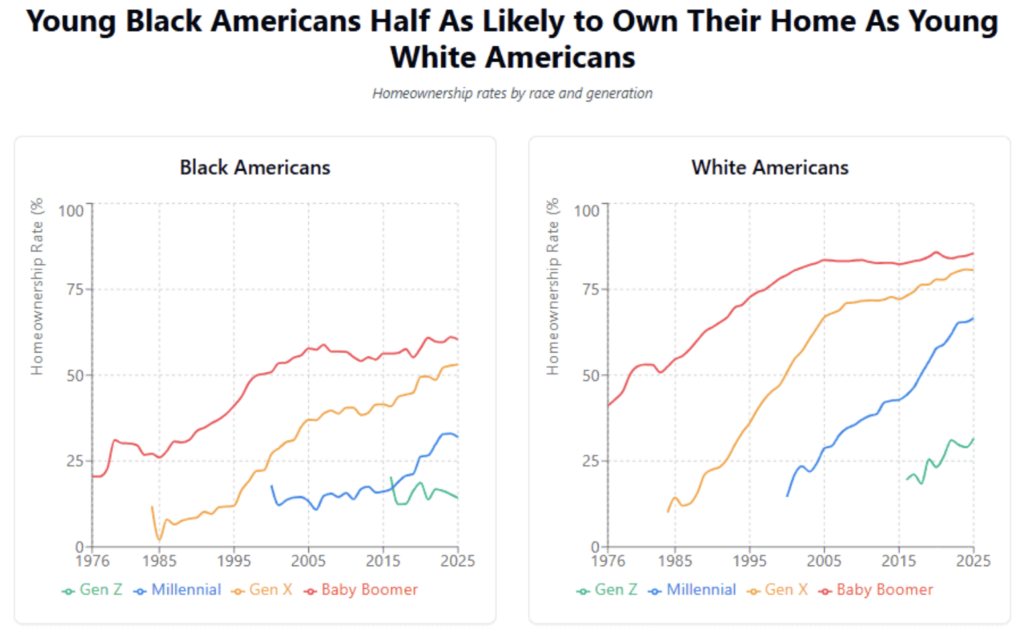

Almost one in three (31.6%) white Gen Zers and one in seven (14.2%) Black Gen Zers nationwide are home owners, according to new Redfin data. Similar disparities exist for millennials, with an estimated 66.6% of white millennials and 32% of Black millennials owning their home nationwide.

Over the past few years, the homeownership rate for young Black Americans has decreased, while that share has ticked up for their white counterparts.

In 2023, some 16.3% of Black Gen Zers were homeowners, compared to 14.2% currently. In 2023, the percentage of Black millennials was approximately 33%; today, it is 32%. Black Gen Zers and millennials had a lower homeownership percentage since many of them chose to rent rather than own when they started a new household, such as by leaving their parents’ home.

The homeownership percentage for white Gen Zers increased from 29.7% in 2023 to 31.6% now, while the rate for white millennials increased from 65.3% to 66.6%.

“Black millennials and Gen Zers are bearing the brunt of the racial homeownership gap because since they have reached homebuying age, the country has faced significant financial challenges and a major housing supply shortage,” said Daryl Fairweather, Chief Economist at Redfin. “Young Black Americans started out behind their white counterparts because they’re less likely to have property and money passed down from their families because of historical discrimination in housing and employment. Now they are coming of age during turbulent economic times that have impacted Black workers more than white workers. The Black unemployment rate rose to nearly 17% during both the Great Recession and the pandemic, compared to 9% and 14%, respectively, for white Americans.”

Note: Homeownership rate refers to the share of households headed by Gen Zers, millennials, Gen Xers or baby boomers that are owner-occupied, broken down by race; people who are living with their parents or other family members are not included in the calculation for their generation. Gen Zers were 13-28 years old in 2025; only adult Gen Zers (19-28 years old) were included in this analysis. Millennials were 29-44 in 2025, Gen Xers were 45-60, and baby boomers were 61-79.

Home Affordability for Young Black Americans Remains a Challenge

High home prices, high mortgage rates, and general economic instability have made the homebuying environment challenging in recent years. Young Americans, who usually have less money than their elder counterparts, are most affected by this.

Additionally, Black individuals usually have a harder time affording a home among those young Americans than white people do. This is due to a number of factors, including the racial wage and wealth gap. In the U.S., the average Black worker makes 79 cents for every dollar made by a white worker. Black households have $15 in wealth for every $100 held by white households. This makes it more difficult to finance monthly mortgage payments and to accumulate money for a down payment.

Another relevant variable is the unemployment gap. Black men have an unemployment rate of 7.1%, which is about twice as high as that of white men (3.7%). For women, the situation is similar; Black women have a 6.7% unemployment rate, whereas white women have a 3.2% rate.

Unfair housing practices also play a large role. Previous policies such as discriminatory housing restrictions and redlining have prevented generations of Black families from accumulating wealth through the ownership of valuable real estate. Black families still face structural obstacles to becoming homeowners today; for instance, Black homebuyers are twice as likely as white homebuyers to have their mortgage applications denied.

Compared to white families, Black families are also much less likely to inherit money over generations. Buying a home becomes more difficult as a result. According to a recent Ipsos Redfin survey, 15% of recent white homeowners and 9% of recent Black homebuyers, respectively, used a cash gift from relatives as their down payment.

Lastly, credit scores often hinder Black Americans from making home purchases. Getting a mortgage is more difficult for Black Americans since their median credit score is significantly lower than that of white Americans.

Age Also Plays a Factor in Homeownership Gaps

Additionally, data revealed a significant racial disparity in older generations’ homeownership.

White Gen Xers own their homes at a rate of 80.6%, compared to little over half (53.1%) of Black Gen Xers. Additionally, compared to 85.5% of white baby boomers, three out of five (60.4%) Black baby boomers are home owners.

For older Americans, the racial homeownership difference is smaller in percentage terms. In general, when baby boomers and Gen Xers were younger, homes were more cheap; even discriminated-against buyers were in a far less competitive and costly market than it is now. However, there is still a significant disparity, which is mostly caused by the previously mentioned causes, such as the racial wealth gap and historically discriminatory laws.

In addition to improving the availability of reasonably priced starter homes nationwide, which would help all young Americans, closing the racial homeownership gap would necessitate policy reforms that would significantly impact Black homebuyers. Helping Gen Z and young Black buyers get their foot in the door could involve initiatives like affordable homeownership, first-time buyer aid, down payment support, and improved access to fair, affordable credit.

On the up side, the good news for homebuyers is that analysts predict that affordability will begin to improve this year as mortgage rates continue to decline and salaries grow more quickly than property prices. Additionally, buyers have more bargaining power.

The post Homeownership Divides Across Generations first appeared on The MortgagePoint.