According to a recent analysis by the Realtor.com economic research team, homebuilders are increasingly utilizing discounts, with almost 20% of new homes having a price reduction in late 2025. In Q4, 19.3% of new build listings featured price reductions, while the figure for existing homes was only 18%. According to the Realtor.com Quarterly New-Construction Insights report, this indicates that, for the first time in recent history, new homes were more likely than pre-owned homes to have a price reduction.

This shift indicates that homebuilders are reacting more quickly than homeowners as the market moves towards a more buyer-friendly environment, with many individual sellers possibly preferring to remove their property from listings rather than provide a discount.

“New construction has been one of the steadiest parts of the housing market over the past few years, but builders are clearly responding to today’s affordability pressures and higher levels of existing-home inventory,” said Danielle Hale, Chief Economist at Realtor.com.

Which States Are Seeing the Largest Share of Price Cuts?

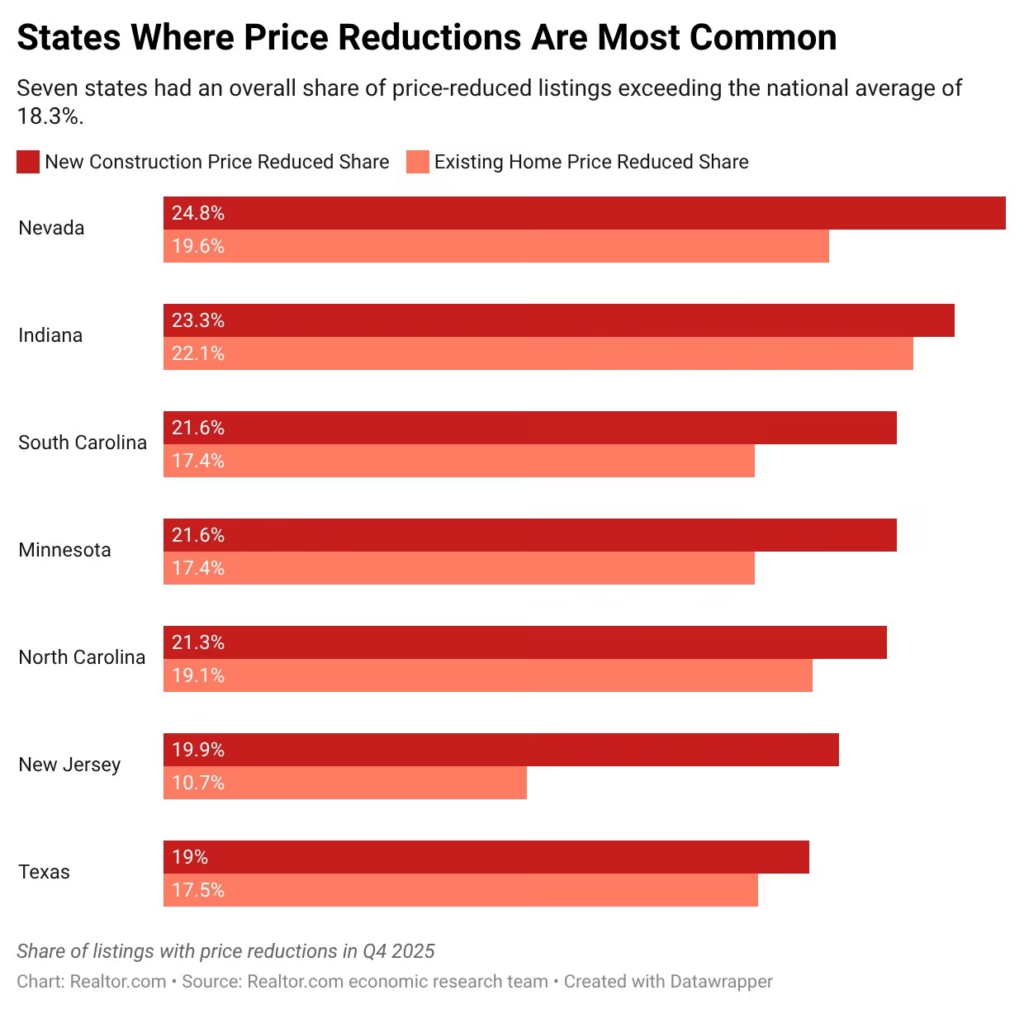

Even though price reductions are usually focused in the South and West, there are a few exceptions. As an illustration, listings with reduced prices in Indiana, Minnesota, and New Jersey surpass the national average. States that also have a percentage of listings with price reductions surpassing the national average include Nevada, South Carolina, North Carolina, and Texas.

The top seven states where price reductions are most common are:

- Nevada

- Indiana

- South Carolina

- Minnesota

- North Carolina

- New Jersey

- Texas

“This is not just a reflection of regional divergence and where new homes are built. We are seeing builders compete more directly on price to keep sales moving, even as overall new-home prices remain relatively stable,” Hale said.

In Q4 2025, the median listing price of newly constructed homes was $451,128, reflecting a modest increase of 0.3% compared to the previous year, whereas listing prices for existing homes remained virtually unchanged. Homebuilders have recognized that they are reacting to low demand in a market weighed down by issues of affordability and economic uncertainty.

Lennar, a homebuilder, disclosed in its December quarterly earnings report that the average sales price for homes delivered in the three months ending in November was $386,000, reflecting an estimated 10% decrease from the previous year.

“The current housing market is entrenched in an affordability crisis, leaving many average American families feeling excluded from the traditional promise of upward mobility and homeownership,” said Stuart Miller, CEO of Lennar, on a call with investors.

New Condos & Single-Family Homes See Price Shifts

In Q4, the median listing price for newly constructed attached properties (such as condos and townhomes) surpassed that of new single-family homes. This was not true for existing homes, where attached homes were considerably cheaper than free-standing homes, as their smaller typical size would suggest.

“What we’re seeing is a market where single-family new construction is filling an affordability gap that resale homes increasingly can’t,” said Joel Berner, Senior Economist. “Condos are still playing an important role in certain markets, but they’re skewing more luxury, while detached homes are doing more of the work when it comes to expanding supply.”

Nonetheless, builders of residential properties are focusing condominium construction efforts on costlier markets and on densely populated regions where demand is high within those markets. This has led to the phenomenon of price inversion.

The report found that almost 10% of all newly listed condominiums in the U.S. are located in the metropolitan areas of New York City or Miami, where the median price for listings exceeds one million dollars. Meanwhile, in markets like Houston, Dallas, San Antonio, Atlanta, and Phoenix—where prices are nearer to the national median—new single-family construction is predominant.

The post New Construction Home Discounts Skew Market More Buyer-Friendly first appeared on The MortgagePoint.