Due to mortgage repayment and property appreciation, the majority of Americans’ wealth originates from their homes. Therefore, the most important financial decisions that families make throughout their lifetimes are purchasing and selling a property. The buying side of the exercise has been the subject of a lot of research, mainly examining the differences in mortgage availability and affordability by age and race.

To find out if returns differ by income and demography, a new study conducted by the Center for Retirement Research at Boston College looked at the selling side of the transaction. The degree to which home-seller returns fluctuate throughout the course of a homeowner’s life, and specifically whether elderly homeowners receive the same returns as their younger counterparts, is one important question.

This brief, which is based on a recent paper, provides an in-depth examination of age-related differences in home-sale returns in order to address that question. In order to determine seller age, the methodology makes use of a recently developed dataset that connects voter records and housing transactions. According to recent data, a drop in home returns begins at age 70 and gets worse with every year that the seller gets older. The study aims to detail potential explanations, such as the property’s condition and marketing and sales strategies, after establishing a connection between age and the penalty in property returns.

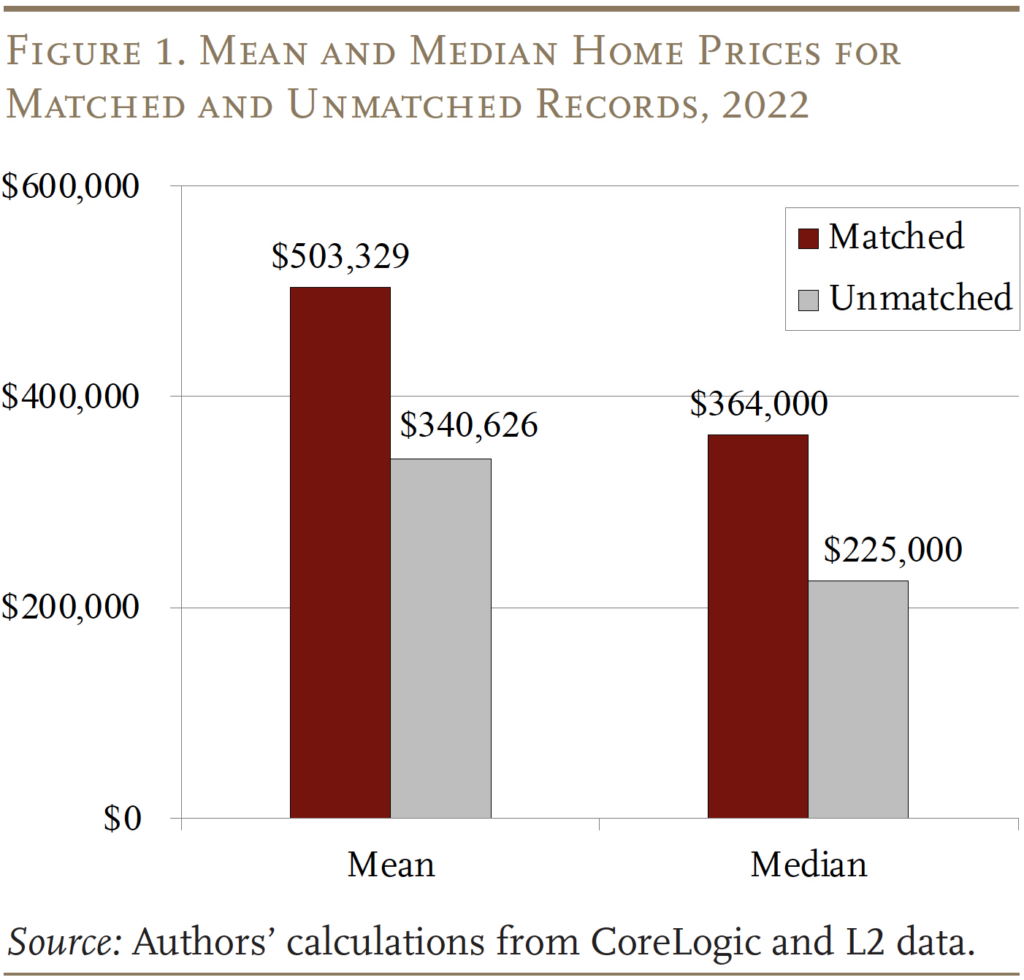

The home prices were somewhat higher for the matched than the unmatched sales (see Figure 1). These lower values may reflect that the unmatched sales include second- and investment-home properties, homes purchased by non-citizens, and homes owned by non-voters – all of which are likely to have lower prices. While home prices may differ somewhat, the age distribution of sellers in the newly-constructed dataset aligns nicely with estimates from the Zillow Seller Survey data.

Age Factors Playing a Role in Home Return Trends

The age of a home seller and annual returns have a significant negative correlation. For a home with the typical holding duration (11 years), an 80-year-old seller realizes roughly 0.5% less annually than a 45-year-old, which translates to a 5% lower sales price. This decrease results in a $20,000 loss on the average property price of $400,000. This result is the result of two causes. First, older people’s residences are less likely to be kept up. Second, elder homeowners are more likely to sell to investors and sell their houses off-MLS. Policy measures could be helpful in this case. In Illinois, legislation aimed at increasing the transparency of private listings led to a considerable decrease in the number of private listings and the size of the age difference.

Older adults typically realize smaller returns when they sell their homes, according to previous research. However, these studies frequently use self-reported home prices, which are subject to measurement error. The methodology discussed begins by building a new dataset that connects ages in voter registration records to actual housing transactions in the CoreLogic Deeds database in order to obtain a more precise and thorough analysis of age-related discrepancies.

In the US, CoreLogic compiles public deed records from more than 3,000 county clerk and recorder offices. The data can be as old as 50 in some counties. Property attributes including address, land use, and lot size; transaction details like sale date, selling price, deed type, arm’s length flag, and cash sale flag; and owner details like buyer name, seller name, or corporate buyer/seller comprise the data. A fraction of CoreLogic’s transactions are additionally promoted through the Multi-Listing Services (MLS), which provides more information about the property, including the asking price, the date of the initial listing, and other facts.

Using the property owner’s name, residential address, ZIP code, and birthdate—all of which L2 standardizes into a consistent format—the CoreLogic transaction data are connected to voter registration records, which are provided by a business known as L2. The match only covers 40% of all CoreLogic transactions because L2 data only includes principal residences and registered U.S. citizens, while only 65-75% of adult citizens are registered to vote. From less than 5% in the late 1990s to around 50% in the early 2020s, the matching frequency increases over time.

The matched sales had slightly higher home prices than the unmatched transactions. The fact that the mismatched sales include houses bought by non-citizens, residences held by non-voters, and second- and investment-home properties—all of which are probably less expensive—may be the reason for these lower values. The age distribution of sellers in the newly-constructed dataset is in good agreement with estimates from the Zillow Seller Survey data, even though property values may vary slightly.

Home Sales & Returns Vary by Transaction

It is necessary to refine the sample and define the focus before calculating any association between age and returns on home sales. Only observations in which the age of the first seller is known and in which the transaction is arm’s length are included in the sample. In order to exclude home flipping, the buyer and seller must also be older than eighteen; the purchase and sale prices must be over $10,000; the holding period must be three years or longer; and the transaction cannot include a fiduciary deed because the seller’s age does not correspond to the owner’s age.

In order to determine the buy and sell prices with accuracy, the study is secondly restricted to repeat sales. Approximately 10 million repeat sales make up the final sample for the baseline regression analysis after all modifications have been made.

The baseline regressions proceed in the following steps:

- Regressing the average annual return on seller’s age

- Introducing zip-code location, buy year, sell year, and their interactions

- Adding seller’s race, ethnicity, gender, and marital status

- Adding the age of the structure on the property, the holding period, and cash sale indicator

The estimate of annualized returns by seller age in relation to returns for people between the ages of 36 and 45 can be plotted. The decrease starts at age 70 and then picks up speed after that, as said in the beginning. The next step is to determine whether the state of the structure and the transaction mechanism have an impact on the result, as a significant difference still exists even after accounting for timing and personal information.

The findings suggest that two methods are involved in the outcomes. First, older people’s homes typically have worse maintenance. Second, elder homeowners are more likely to sell to investors and sell their houses off-MLS. Lower returns are linked to both of these characteristics, and older sellers are more affected by them. Furthermore, it is possible to consider the relationship between the selling technique and the age-related return penalty as causative since Illinois’s changes to increase the transparency of private listings greatly decreased the number of private listings and the size of the age disparity.

To read more, click here.

The post Older Sellers Face Growing Penalty on Home-Sale Profits first appeared on The MortgagePoint.