U.S. home prices are up 0.1% year over year from December 2024 to December, marking a deceleration from the 2.6% growth rate a year earlier and although national price growth recently has stabilized, it ticked slightly higher from a low of -0.01% in August 2025.

That’s based on an analysis of the Zillow Home Value Index by ResiClub.

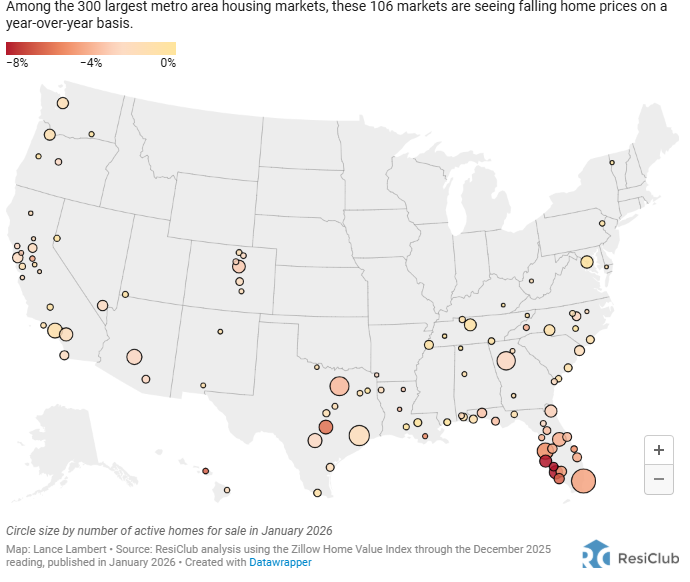

The analysis noted that 106 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year reading in the December 2024 to December 2025 window. None were in the Midwest, the analysis showed.

In the first half of 2025, the number of major metro-area housing markets seeing year-over-year declines climbed, and according to the report, that count has since pretty much stopped ticking up.

Here’s what the ResiClub analysis noted:

- 31 of the nation’s 300 largest housing markets (10% of markets) had a falling year-over-year reading in the January 2024 to January 2025 window.

- 42 of the nation’s 300 largest housing markets (14% of markets) had a falling year-over-year reading in the February 2024 to February 2025 window.

- 60 of the nation’s 300 largest housing markets (20% of markets) had a falling year-over-year reading in the March 2024 to March 2025 window.

- 80 of the nation’s 300 largest housing markets (27% of markets) had a falling year-over-year reading in the April 2024 to April 2025 window.

- 96 of the nation’s 300 largest housing markets (32% of markets) had a falling year-over-year reading in the May 2024 to May 2025 window.

- 110 of the nation’s 300 largest housing markets (36% of markets) had a falling year-over-year reading in the June 2024 to June 2025 window.

- 105 of the nation’s 300 largest housing markets (36% of markets) had a falling year-over-year reading in the July 2024 to July 2025 window.

- 109 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year reading in the August 2024 to August 2025 window.

- 105 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year reading in the September 2024 to September 2025 window.

- 105 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year reading in the October 2024 to October 2025 window.

- 98 of the nation’s 300 largest housing markets (33% of markets) had a falling year-over-year reading in the November 2024 to November 2025 window.

- 106 of the nation’s 300 largest housing markets (35% of markets) had a falling year-over-year reading in the December 2024 to December 2025 window.

In the first half of 2025, there was a notable increase in the number of housing markets recording year-over-year price declines as the supply-demand equilibrium (as measured by inventory) shifted more quickly toward homebuyers. However, the report noted that over the past seven months, the list of declining markets has begun to stabilize as inventory growth has decelerated.

Home prices are still climbing a little year over year in many regions where active inventory remains well below pre-pandemic 2019 levels, such as pockets of the Northeast and Midwest.

Some Areas Experience Modest Price Pullbacks

However, some pockets in states such as Texas, Florida, and Colorado, where active inventory exceeds pre-pandemic 2019 levels, are seeing modest home price pullbacks or flat pricing.

ResiClub said that many of the housing markets seeing the most softness, where homebuyers have gained the most leverage, are mostly in Sunbelt regions, particularly the Gulf Coast and Mountain West.

It said that many of those areas saw even greater price surges during the Pandemic housing boom, with home price growth outpacing local income levels.

However, as pandemic-driven domestic migration slowed and mortgage rates rose in 2022, markets such as Tampa, Florida, and Austin, Texas, faced challenges, relying on local income levels to support high home prices.

Fast Company reported that Sunbelt softening was further compounded by an abundance of new home supply in the region and that builders often are willing to lower prices or offer affordability incentives to maintain sales, which also has a cooling effect on the resale market.

As a result, Fast Company reported that some buyers who might previously have chosen existing homes are instead choosing new construction with more attractive deals.

That added further upward pressure to resale inventory growth over the past few years, according to the analysis.

While 106 of the nation’s 300 largest metro-area housing markets are seeing year-over-year home price declines, another 194 are seeing year-over-year home price increases, the analysis noted.

The post Home Prices Slip in 106 Major Markets While National Values Inch Higher first appeared on The MortgagePoint.