According to a recent study from Redfin, the technology-powered real estate brokerage, mortgage rates fell to a daily average of 6.34% on August 5, the lowest level since April 2023. After a worse-than-expected jobs report heightened worries of a recession, rates plunged; although they have since somewhat increased, they are still close to the lowest point in more than a year.

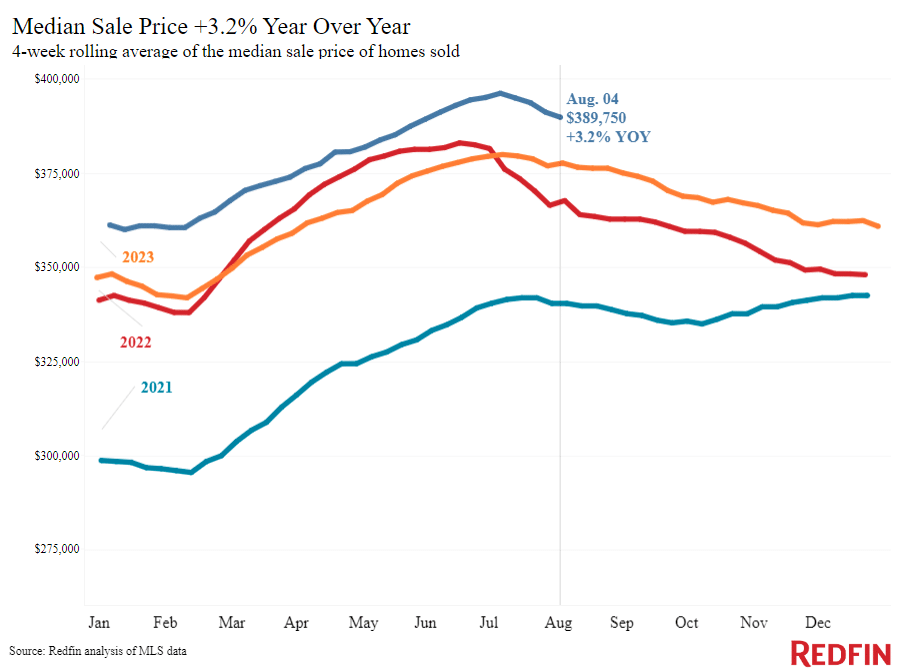

The value of homes is likewise declining from its peak: During the four weeks ended August 4, the median sale price was $389,750, which was more than $6,000 less than the all-time high set in early July. Even though it is a usual seasonal fall, the 3.2% year-over-year gain is the lowest in nine months, suggesting a slight slowdown in price growth.

Despite the alleviation of the affordability pinch, home sales have not improved. The largest drop in nine months in pending sales was 6.7% year-over-year, and despite Friday’s rate drop, fewer offers were written with Redfin agents this past weekend. However, there are indications that early in the house-buying process, prospective buyers are starting to show signs of life and that pending sales may shortly rebound.

Seasonally adjusted, the number of applications for mortgage purchases increased somewhat over the past week. The Homebuyer Demand Index is down 13% year-over-year, but it’s the lowest drop in three months. Redfin representatives also note an increase in interest in home tours.

“Many of the buyers I’m working with are excited because they’ve been casually house hunting for a year, waiting for rates to come down before they make an offer. Now a lot of those buyers want to get in now, before rates get too low and cause more competition,” said Redfin Premier agent Shoshana Godwin. “One of my listings, which went on the market last week, had over 100 parties come through and received nine offers. Buyers are securing lower rates than they were a few months ago, but costs are still high enough that buyers are picky. If they’re going to have a high monthly payment, they want a move-in ready home so they don’t have to pay for upgrades.”

New listings are regaining some of the drive they lost in the previous few weeks on the supply side. The annual growth in new real estate listings is 5.9%, the highest level in the last five weeks. Redfin experts argue that since rates have started to decline and there is a ton of stale inventory, now is an excellent moment to enter the market.

To read the full price, including more data, charts, and methodology, click here.

The post Buyers Touring More Homes as Rates Drop to 12-Month Low first appeared on The MortgagePoint.