Seung Hyeong Lee, a Ph.D. Candidate in Economics at Northwestern University, and Younggeun Yoo, a Ph.D. Student in Economics at the University of Chicago, detailed in a new research paper titled, “‘Giving Up’: The Impact of Decreasing Housing Affordability on Consumption, Work Effort, and Investment,” how many younger generations have given up on becoming homeowners.

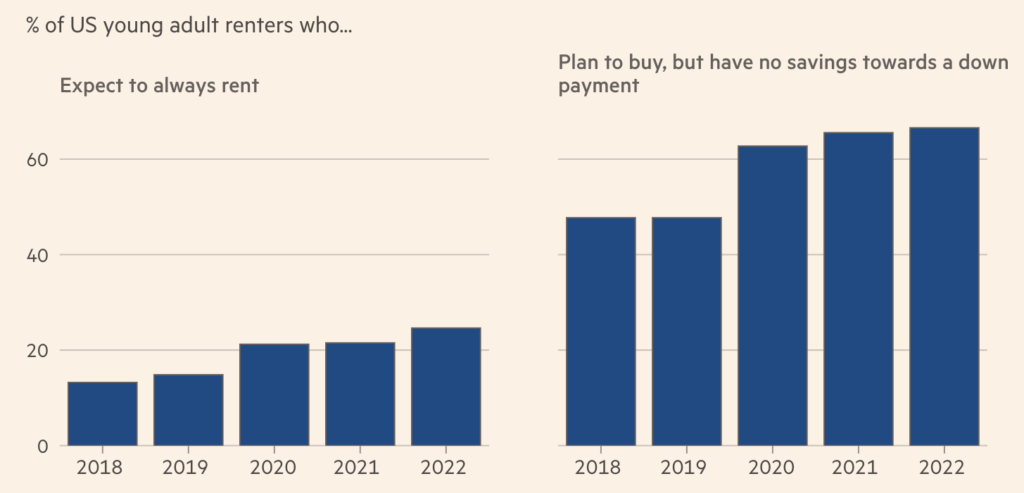

This is a result of the steep decline in housing affordability in recent decades nationwide. According to their predictions, the homeownership rate of cohorts born in the 1990s will be approximately 9.6 percentage points lower than that of their parents’ generation when they retire.

The pair revealed that renters with relatively modest wealth display the same behaviors. Over the course of a person’s life, these reactions compound, resulting in a significantly larger wealth disparity between those who give up and those who continue to pursue homeownership.

Additional commentary from John Burn-Murdoch, Chief Data Reporter at the Financial Times, further detailed the research findings and further offered his insight on the subject.

“It has become a rite of passage for every new generation of young adults to be labelled lazy and irresponsible by its elders, but Gen Z has probably had it worse than most,” Burn-Murdoch said, attributing Gen Z attitudes toward risky investments like cryptocurrencies and NFTs.

There are two major contrasts between Gen Z and those preceding generations facing similar disdain:

- Rather than fighting back on these characterisations, today’s 20-somethings have tended to embrace them, leaning into neologisms such as “quiet quitting,” the act of employees doing the minimum required for their job, which means meeting their basic responsibilities and working only their scheduled hours, without going “above and beyond.”

- According to new research, these actions are logical reactions to deteriorating economic conditions, particularly the growing difficulty of becoming a homeowner.

Homeowner Sentiment Weakening Among Many Young Adults

Reduced work effort, increased leisure spending and investment in risky financial assets are all factors that are significantly more prevalent among young adults who have little to no realistic probability of being able to afford a home in today’s housing market and economy.

Research indicates that those for whom homeownership is a more achievable goal in the medium term, or who have already accomplished it, take fewer risks and strive harder at their jobs. Lee and Yoo further outline how the connection between unaffordable housing and economic attitudes among generations seem to be linked.

What U.S. economic expert Demetri Kofinas calls “financial nihilism” has played a significant role in homebuyer sentiment in younger adults. As home affordability shrinks, individuals who come to believe they won’t reach the likelihood of attaining homeownership turn to a mixture of high-risk behaviors.

Gen Z is sometimes regarded as “lacking resilience in the workplace”; many young professionals have flocked to social media to decry the pointlessness of the typical 9-5 trend. The data implies these evolving ideas and behaviors are anchored in economic reality as it progresses.

“It’s not that previous generations were more engaged in their work because jobs back then were thrilling, it’s that applying oneself at work used to be a means to an end,” Burn-Murdoch said. “With the reward of owning your own home yanked out of reach, the whole thing feels futile.”

The outcomes of these examinations have substantial consequences:

- They emphasize how urgent it is to address the issue of homeownership affordability. As many consumers can now see, the effects are upsetting society and the economy as a whole, putting many young individuals on a precarious financial path where mistakes could be irreversible.

- They underline the significance of teaching young people with the financial literacy they need to navigate a new environment where for many the only hope of success is to take enormous monetary risks. Compared to their parents, today’s 20-somethings are far more likely to become lifelong tenants. This implies that they will want more advice than previous generations on alternative ways to build wealth, as well as the knowledge and assistance to understand that the game is not yet finished.

“It’s all very well bemoaning the growing economic nihilism of younger generations—and the evidence bears it out—but they’re just playing the cards they have been dealt,” Burn-Murdoch concluded.

To read more, click here.

The post Generational Pessimism: Young Adults Giving Up on Homeownership first appeared on The MortgagePoint.