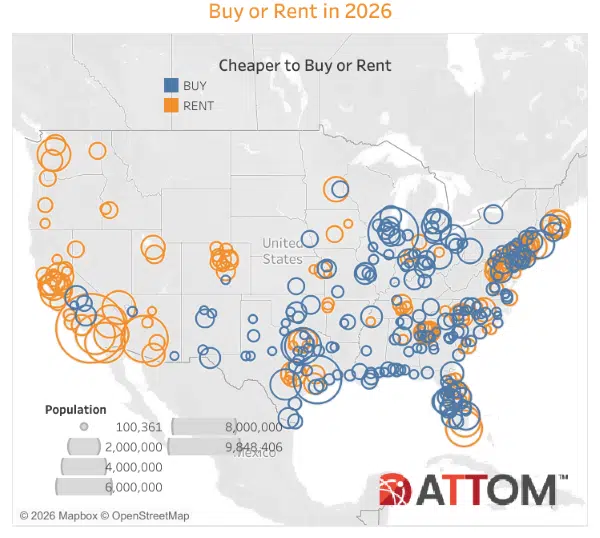

ATTOM has published its 2026 Rental Affordability Report, revealing that in over half of the examined counties, homeownership is more affordable than renting a three-bedroom property. In 57.7% (210) of the 364 counties with sufficient data for analysis, typical homeownership expenses accounted for a smaller portion of residents’ wages than those spent on renting.

Although owning a home would turn out to be more affordable over the long term for many Americans, it typically necessitates a substantial initial deposit. With home prices reaching unprecedented heights by the close of 2025, this could pose challenges for some prospective buyers looking to take that step. In 2025, median home prices increased at a faster rate than rents in over two-thirds of the counties examined.

“Renters looking to put down roots, young families who need more space, professionals relocating for work, and many others are facing a very tough choice,” said Rob Barber, CEO of ATTOM. “The data shows that buying is typically the most affordable long-term option, but as the housing market sets new record-high prices quarter after quarter, affording the initial investment becomes increasingly challenging.”

In 69% (251) of the 364 counties with sufficient data for analysis, the median prices of single-family homes increased at a greater rate (or decreased at a lesser rate) than the median rent for three-bedroom properties. The report included counties that met the following criteria: a population of at least 100,000, adequate data on single-family home sales for 2025, and sufficient three-bedroom rental data for both 2025 and 2024.

The most populous counties where median home prices rose faster (or declined slower) than typical three-bedroom rent were:

- Los Angeles County, CA

- Harris County, Texas

- Maricopa County, AZ

- San Diego County, CA

- Orange County, CA

The most populous counties where rent increases outpaced home prices were:

- Cook County, IL

- Alameda County, CA

- Palm Beach County, FL

- Hillsborough County, FL

- Orange County, FL

Counties located in Midwestern states demonstrated a robust inclination for home ownership to be more affordable than renting, whereas this was not the case in Western states. In 81.5% of the examined counties in the Midwest, buying was more affordable than renting. In the Southern region, this applied to 66.3% of the counties. However, in the Northeast, purchasing a home was more affordable than renting in 48.8% of the examined counties, while in the West this was true for only 16.9% of counties.

Homeownership Affordability Varies Across Nation

In 65.7% (239) of the 364 counties examined, expenses related to home ownership accounted for over one-third of a typical resident’s earnings. Owning accounted for over a third of the average residents’ earnings in 96.9% of counties located in Western states, 86% of counties in Northeastern states, 61% of counties in Southern states, and 29.7% of counties in Midwestern states.

The most affordable counties to own a home (assuming a 20% down payment on purchase) were:

- Peoria County, IL (owning consumed 14.5% of typical wages)

- Wayne County, MI (14.9%)

- Mobile County, AL (15.1%)

- Jefferson County, AL (16.3%)

- Montgomery County, AL (16.7%)

Meanwhile, in 76.9% (280) of the analyzed 364 counties, renting a three-bedroom property consumed over a third of a typical resident’s earnings. In the West, 95.4% of analyzed counties saw rent consuming over a third of wages; in the Northeast, this figure was 90.7%, in the South it was 77.7%, and in the Midwest it was 40.7%.

To read more, click here.

The post Homeownership Beats Renting in Most Counties, But Rising Prices Complicate the Math first appeared on The MortgagePoint.