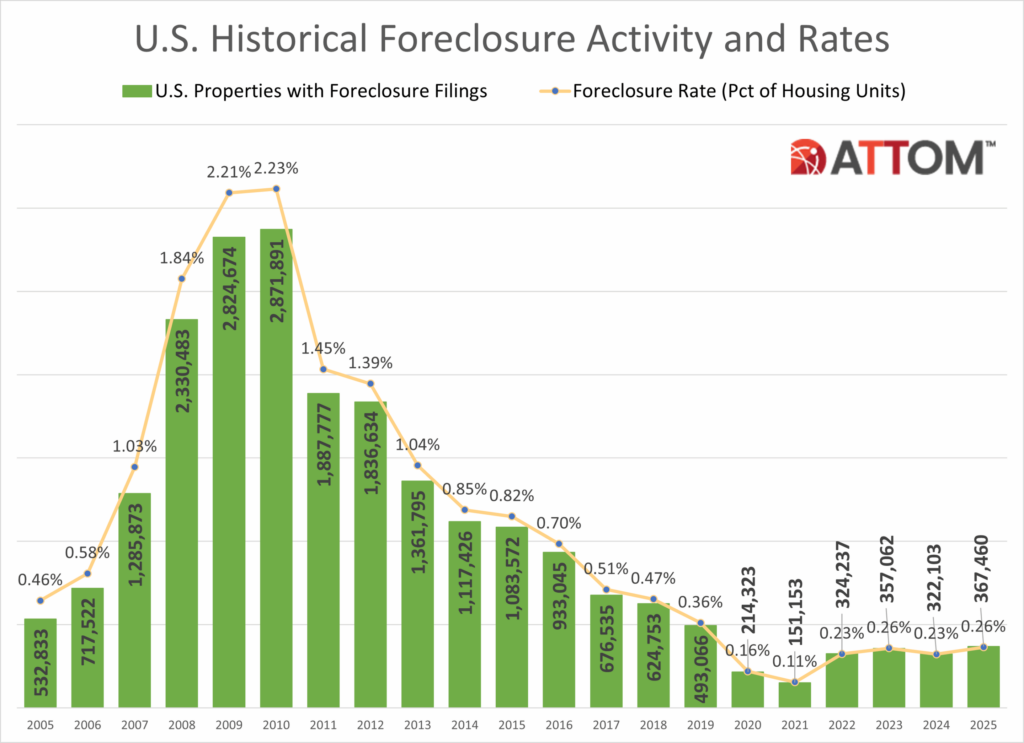

According to ATTOM’s Year-End 2025 U.S. Foreclosure Market Report, an estimated 367,460 U.S. properties had foreclosure filings (default notices, scheduled auctions, and bank repossessions) in 2025, up 14% from 2024 and up 3% from 2023, but down 25% from 2019, before pandemic-related disruptions changed the dynamics of the housing market. Additionally, foreclosure filings decreased by roughly 87% in 2025 from a peak of about 2.9 million in 2010.

The 367,460 homes with foreclosure filings in 2025 made up 0.26% of all housing units in the U.S., a little increase from 0.23% in 2024, a decrease from 0.36% in 2019, and a decline from a peak of 2.23% in 2010.

“Foreclosure activity increased in 2025, reflecting a continued normalization of the housing market following several years of historically low levels,” said Rob Barber, CEO at ATTOM. “While filings, starts, and repossessions all rose compared to 2024, foreclosure activity remains well below pre-pandemic norms and a fraction of what we saw during the last housing crisis. The data suggests that today’s uptick is being driven more by market recalibration than widespread homeowner distress, with strong equity positions and more disciplined lending continuing to limit risk.”

Key Findings — Q4 2025:

- There was a total of 111,692 U.S. properties with foreclosure filings in Q4 2025, up 10 percent from the previous quarter and up 32% from a year ago.

- Nationwide in Q4 2025, one in every 1,274 properties had a foreclosure filing.

- States with the worst foreclosure rates in Q4 2025 were South Carolina (one in every 689 housing units with a foreclosure filing); Florida (one in every 730 housing units); Delaware (one in every 778 housing units); Illinois (one in every 875 housing units); and Nevada (one in every 881 housing units).

Foreclosures Tick Up Across U.S.

In 2025, lenders began foreclosing on 289,441 U.S. properties, up 14% from 2024 and up 213% from the pandemic-era low in 2021, but down 14% from 2019 and 86% from a peak of 2,139,005 in 2009.

States that saw the greatest number of foreclosure starts in 2025 included:

- Texas (37,215 foreclosure starts)

- Florida (34,336 foreclosure starts)

- California (29,777 foreclosure starts)

- Illinois (15,010 foreclosure starts)

- New York (13,664 foreclosure starts)

Those metropolitan statistical areas with a population greater than 1 million that saw the greatest number of foreclosure starts in 2025 included:

- New York, NY (14,189 foreclosure starts)

- Chicago (13,312 foreclosure starts)

- Houston (13,009 foreclosure starts)

- Miami (8,936 foreclosure starts)

- Los Angeles (8,503 foreclosure starts)

Examining Bank Repossessions YoY

Some 46,439 houses were seized by lenders through foreclosures (REO) in 2025, up 27% from 2024 but down 68% from 143,955 in 2019, the final year before pandemic-related decreases, and down 96% from a peak of 1,050,500 in 2010.

States that saw the greatest number of REOs in 2025 included:

- Texas (5,147 REOs)

- California (4,030 REOs)

- Pennsylvania (2,975 REOs)

- Florida (2,869 REOs)

- Illinois (2,768 REOs)

The states with the highest rates of foreclosure in 2025 were:

- South Carolina (1 in 242 housing units)

- Florida (1 in 230 housing units)

- Delaware (1 in 240 housing units)

- Illinois (1 in 248 housing units)

- Nevada (1 in 248 housing units)

Rounding out the top 10 states with the worst foreclosure rates in 2025, were:

- New Jersey (1 in every 273 housing units)

- Indiana (1 in every 302 housing units)

- Ohio (1 in every 307 housing units)

- Texas (1 in every 319 housing units)

- Maryland (1 in every 326 housing units)

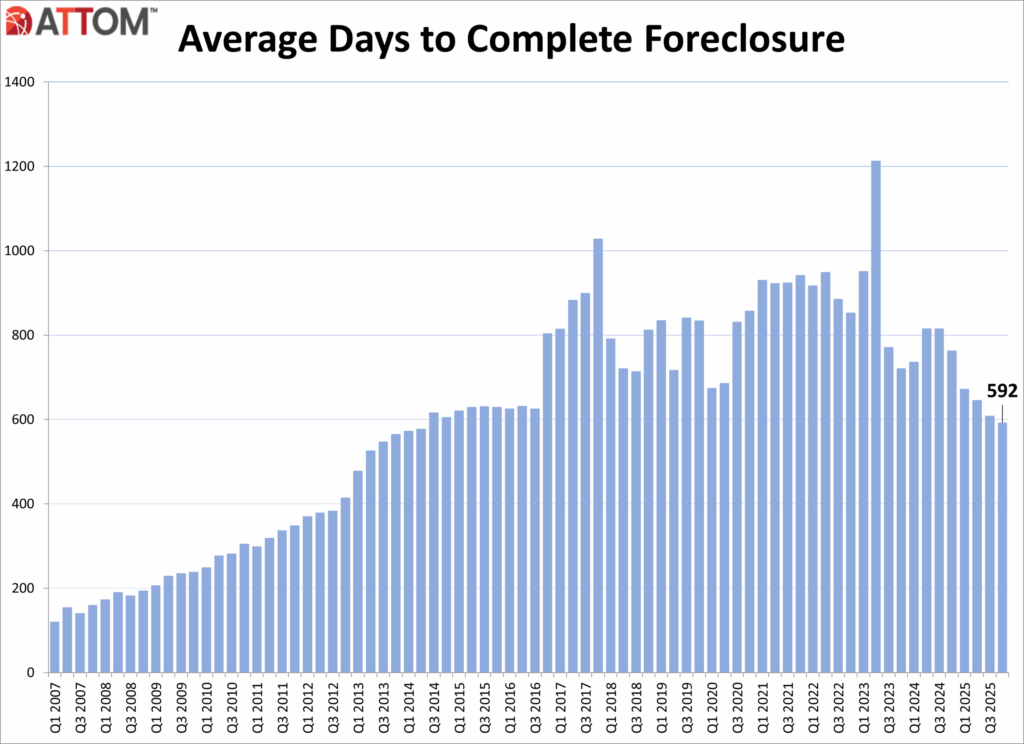

Average Foreclosure Times Vary Nationwide

In Q4 of 2025, U.S. properties that were foreclosed had been in the foreclosure process for an average of 592 days, which was 22% less than a year earlier and 3% less than the preceding quarter.

States with the longest average time to foreclose in Q4 2025 were:

- Louisiana (3,461 days)

- New York (1,998 days)

- Hawaii (1,760 days)

- Connecticut (1,600 days)

- Kansas (1,594 days)

According to ATTOM’s Year-End 2025 Foreclosure Market Report, the number of foreclosure filings, starts, and bank repossessions in the United States increased in 2025 compared to 2024, indicating a continuous trend toward more normalized market circumstances. Foreclosure activity is still much below peaks from the previous housing crisis and well below pre-pandemic levels, even with the yearly rises.

Note: Data from December 2025 and Q4 2025 also revealed higher monthly and annual foreclosure activity.

The post Foreclosures Tick Higher: Signs of Distress or Recalibration? first appeared on The MortgagePoint.