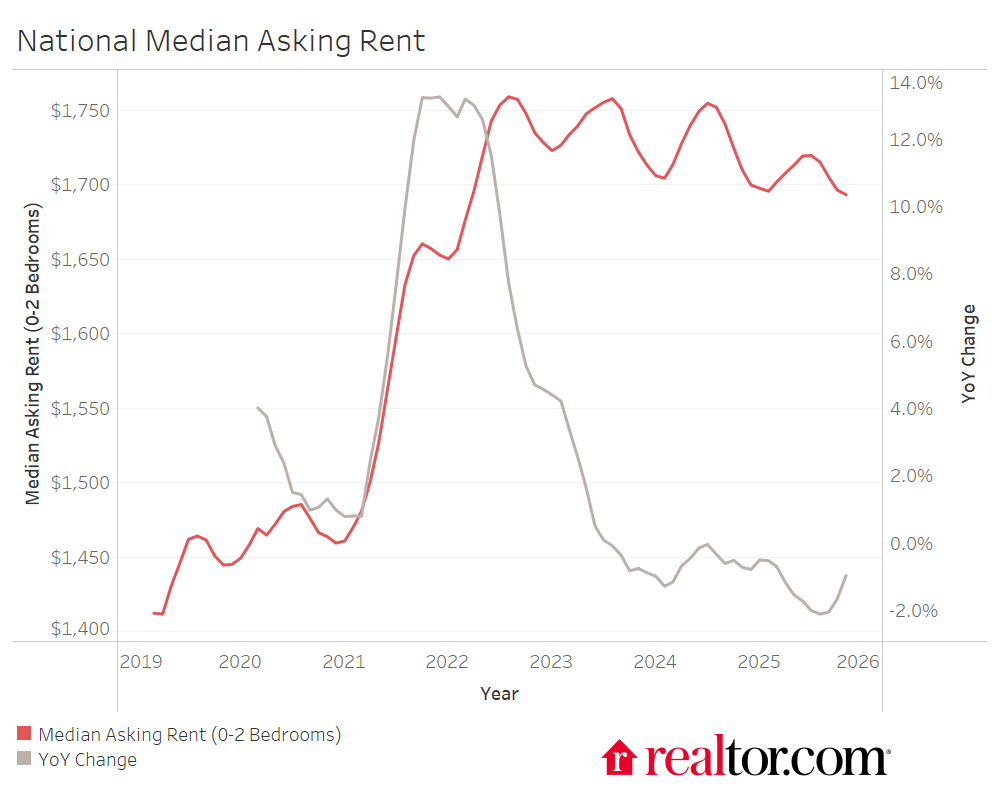

For the 28th consecutive month, the median asking rent for units with 0–2 bedrooms decreased year-over-year (YoY) across the 50 major metropolitan areas in the U.S. At $1,693, the national rent level is down $6 from the previous month and $17 (or 1%) from the previous year, according to new Realtor.com data. In addition to marking the third consecutive November in which prices have decreased from the prior year, asking rent is getting close to its seasonal low, which typically occurs in the winter after peaking in early summer.

The November peak in 2022 was $1,735, which was 2.5% higher than the November readout this year. This indicates that there has been some respite from the post-pandemic rent increase. The general rent level is still high, nevertheless. Rent has increased by 17.2% since November 2019, when the national rent for flats with 0–2 bedrooms was $1,445. This has put a strain on renters’ budgets nationwide. The primary focus of the housing market in 2025 will be affordability, and this research will examine how rental affordability is getting better while still being a significant financial burden for people with lower incomes.

| Unit Size | Median Rent | Rent YoY | Consecutive Months of YoY Decline | Rent vs. Nov 2022 | Rent vs. Nov 2019 |

| Overall | $1,693 | -1.0% | 28 | -2.4% | 17.2% |

| Studio | $1,418 | -0.4% | 27 | -3.7% | 12.2% |

| 1-Bedroom | $1,572 | -1.0% | 30 | -3.3% | 15.1% |

| 2-Bedroom | $1,874 | -1.1% | 30 | -2.5% | 19.3% |

Rents for rental properties with 0, 1, and 2 bedrooms are all down, as they have been for the most of the previous few years, but the breakdown for studio units this month suggests a slight improvement.

For studios, the annual rent change is only -0.4%, while the increase rates for units with one or two bedrooms are -1% and -1.1%, respectively. Because their tenants typically have more flexible living arrangements, smaller unit rates tend to react more quickly to fluctuations in demand, making studio rents somewhat more volatile than larger unit rents. The demand for rentals may be marginally improving as those living in roommate or family home arrangements want to live alone, while studio rates are approaching flat increase year over year. Larger unit rents are similarly moving in the direction of a no-growth situation, but more slowly at this time.

Where Has Rental Affordability Improved for Minimum-Wage Earners?

Even while rents have been declining over the past few years, they are still much higher than they were prior to the COVID-19 outbreak and provide a considerable financial challenge to households nationwide. This is particularly true for people with the lowest incomes. Since 2009, the federal minimum wage ($7.25/hour), which is not replaced by state or local minimum wages for a large portion of the nation, has remained unchanged, making it more challenging for minimum-wage individuals to pay their rent.

In order to demonstrate this difficulty, analysts calculated the number of hours each renter would need to work each week in order to afford the median 0–2 bedroom rental in their metro area, assuming a two-earner family in which both renters make the minimum wage for the principal city of their metro area. They also estimated that rent accounts for thirty percent of their earnings. Remarkably, based on November 2025 rentals and 2025 minimum earnings, there are only five of the top 50 metro areas where two minimum-wage earners could afford the median rental without working overtime. All five have minimum salaries above the federal minimum of $7.25 and rent below the national average.

| Metro | Median Asking Rent (0-2 Bedrooms – Nov 2025) | Minimum Wage (2025) | Minimum Wage (2026) | Req’d MW Hours per Week per Renter (2026) | Difference from 2025 to 2026 |

| Detroit-Warren-Dearborn, MI | $1,327 | $10.56 | $13.73 | 39 | -12 |

| Miami-Fort Lauderdale-West Palm Beach, FL | $2,287 | $13.00 | $15.00 | 61 | -9 |

| Tampa-St. Petersburg-Clearwater, FL | $1,672 | $13.00 | $15.00 | 45 | -7 |

| Orlando-Kissimmee-Sanford, FL | $1,650 | $13.00 | $15.00 | 44 | -7 |

| Jacksonville, FL | $1,457 | $13.00 | $15.00 | 39 | -6 |

Due to increases in the minimum wage in Michigan and Florida, Detroit, and Jacksonville, FL, will be added to this list in 2026. The U.S. will see numerous increases in state and local minimum wages in the coming year. For example, Missouri and Rhode Island will both implement minimum wage increases of at least $1. In terms of minimum-wage hours, this is mostly an improvement over the number of hours that both household members in these metro areas work.

Even still, two minimum-wage earners cannot afford the typical rental unit in 43 of the nation’s 50 largest metropolitan regions. The 10 metro areas listed below are those where minimum-wage workers have to put in the most hours in order to pay the median rent. Nine states default to the federal minimum wage, with only one (San Jose, CA) having a minimum wage hike planned for 2026. The only cities with median rent higher than the national average are Philadelphia and San Jose.

| Metro | Median Asking Rent (0-2 Bedrooms – Nov 2025) | 2026 Minimum Wage | Req’d MW Hours per Week per Renter 2026 | Minimum-Wage Increase Scheduled in 2026 |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | $1,739 | $7.25 | 96 | No |

| Milwaukee-Waukesha, WI | $1,685 | $7.25 | 93 | No |

| Atlanta-Sandy Springs-Roswell, GA | $1,543 | $7.25 | 85 | No |

| Nashville-Davidson–Murfreesboro–Franklin, TN | $1,511 | $7.25 | 83 | No |

| Charlotte-Concord-Gastonia, NC-SC | $1,498 | $7.25 | 83 | No |

| Raleigh-Cary, NC | $1,478 | $7.25 | 82 | No |

| Pittsburgh | $1,471 | $7.25 | 81 | No |

| San Jose-Sunnyvale-Santa Clara, CA | $3,363 | $16.90 | 80 | Yes |

| Dallas-Fort Worth-Arlington, Texas | $1,441 | $7.25 | 80 | No |

| Austin-Round Rock-San Marcos, Texas | $1,388 | $7.25 | 77 | No |

For example, the minimum wage is almost legally enforceable in San Jose proper: Workers at fast food restaurants are paid at least $20 per hour and often much more. To split the typical rental unit, two minimum-wage workers would need to put in 80 hours a week at the basic California minimum wage of $16.90. The median rental unit for the entire metropolitan region, which includes all of Santa Clara and San Benito counties, requires two fast-food workers in San Jose to put in 67 hours a week, even at the higher sector-specific minimum pay of $20.

Note: Not all of these minimum wages are legally obligatory. Relatively few workers are actually paid the statutory minimum wage since the market’s minimum is frequently higher than the statutory minimum, which means that the going rate for entry-level labor is higher than the law would predict.

The post U.S. Asking Rents Fall as Affordability Improves for Minimum-Wage Earners first appeared on The MortgagePoint.