The “last call” for homes before the holiday shopping season ends is being boosted by reduced mortgage rates, which is attracting increased interest from both buyers and sellers. According to Zillow‘s most recent market report, there was a surge in activity throughout September due to another break in mortgage rates. This trend may persist into October, depending on the trajectory of future rates.

Mortgage rates dropping to a two-year low of 6.08% in late September represented an increase in buying power of more than $40,000 for a buyer who could have afforded the payment on a typical property in May. More sellers entered the market as a result of that rate drop. Consequently, house sales (-22.2% relative to pre-pandemic norms) and new listings (-17%) approached their pre-pandemic averages more closely than they had in previous months.

“September proved the readiness of both buyers and sellers to return when conditions are right. Lower mortgage rates helped more buyers clear the affordability hurdle, and gave buyers already in the market more homes to choose from,” said Skylar Olsen, Chief Economist of Zillow. “The mortgage rate spike after a strong jobs report early this month gave back some of those affordability gains, at least for now. Buyers should be prepared for more ups and downs, which means it’s crucial to have their finances in order and their expert team in place to act quickly, but not rashly, when they find the right house.”

U.S. Home Value Overview:

- The typical U.S. home value is $360,999.

- The typical monthly mortgage payment, assuming 20% down, is $1,760.

- Home values climbed month-over-month in only two of the 50 largest metro areas in September: the New York City metro area (0.3%) and Providence, RI (0.1%).

- Home values fell, on a monthly basis, in 44 major metro areas. The largest monthly drops were in San Francisco (-1.1%), San Jose, CA (-0.9%), New Orleans (-0.8%), Austin, Texas (-0.8%), and Tampa, FL (-0.7%).

- Home values are up from year-ago levels in 43 of the 50 largest metro areas. Annual gains are highest in San Jose, CA (7.8%), Hartford, CT (7.6%), New York (7.1%), Providence, RI (7%), and Buffalo, NY (5.9%).

- Home values are down from year-ago levels in seven major metro areas. The largest drops were in New Orleans (-4%), Austin, Texas (-4%), San Antonio (-2.7%), Birmingham, AL (-0.7%), and Tampa, FL (-0.5%).

- The typical mortgage payment is down 7.5% from last year and has increased by 97.3% since pre-pandemic.

Inventory and New Listings:

- New listings decreased by 8.3% month-over-month in September.

- New listings decreased by 1.2% compared to last year.

- New listings are 17% lower than pre-pandemic levels.

- Total inventory (the number of listings active at any time during the month) in September decreased by 0.2% from the previous month.

- There were 21.6% more listings active in September compared to last year.

- Inventory levels are 29.1% lower than pre-pandemic levels for the month.

Price Drops and Share Sold Above List Price:

- Roughly 25.1% of listings in September had a price cut. That is down 0.8 percentage points (ppts) month-over-month.

- There are 1.2ppts more listings with a price cut compared to last year.

- Some 30.5% of homes sold above their list price last month. That is down 2.8 ppts month-over-month.

- An estimated 6.2 ppts fewer homes sold above their list price compared to last year.

Newly Pending Sales:

- Newly pending listings decreased by 7.3% in September from the prior month.

- Newly pending listings increased by 3.5% from last year.

- Median days to pending, the typical time since initial list date for homes that went under contract in a month, is at 21 days in September, up one day since last month.

- Median days to pending increased by six days from last year.

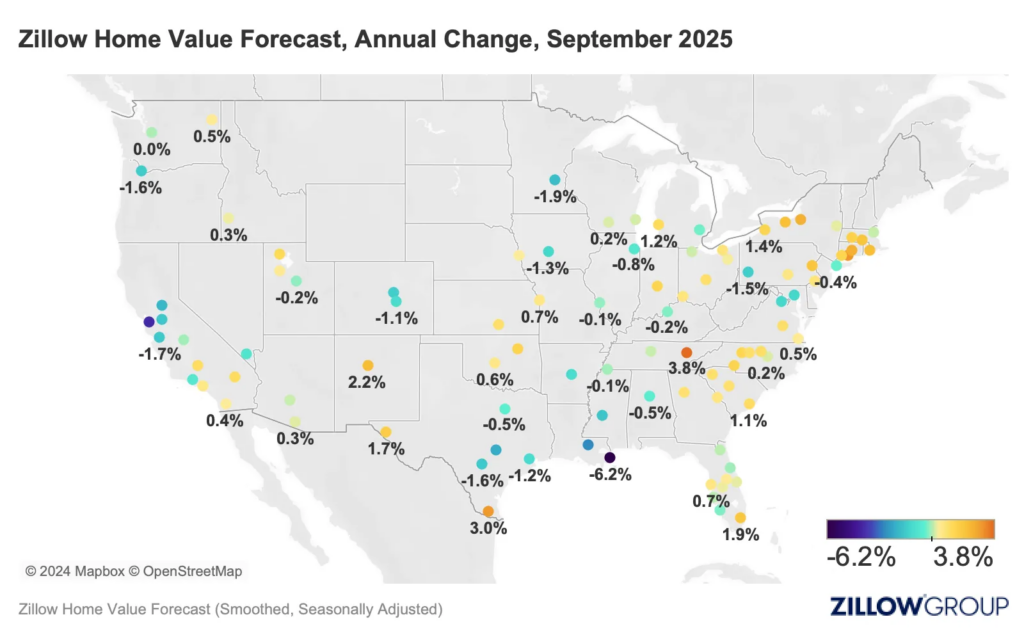

Increased activity from both buyers and sellers maintained around equilibrium property values. Relative to August, the average home value in the United States is currently slightly less than $361,000. Over the past year, home values have increased 2.4% nationwide, which is the weakest annual growth rate since last October.

The increase in competition that purchasers experienced in September is exemplified by trends in price reductions and time on market. After peaking at 26.2% in July, almost two years ago, and 25.9% in August, the percentage of listings with a price reduction dropped to 25.1% in September.

The average delay between listing and acceptance of an offer for a house increased by three days between August and September prior to the epidemic. This year, the median home sold in August took 21 days, compared to 20 days in August last year.

Homebuyers Markets Spreading Across Southeast

According to Zillow’s market heat index, Atlanta has joined an increasing number of sizable Southern metro regions that have shifted in favor of buyers, even while the national housing market stays neutral. Currently, ten of the fifty largest metropolises—all located in Florida, Georgia, Texas, Tennessee, and Louisiana—are regarded as buyers markets.

The reason why certain markets are more competitive than others can be largely explained by the trend in new listings. In several Southeast cities, new listings in September were on par with or even higher than pre-pandemic averages; but, in markets on both coasts, homeowners are continuing to cling onto their existing houses in greater numbers, which means fewer new listings are coming onto the market.

To read the full report, including more data, charts, and methodology, click here.

The post U.S. Rental Markets Experiencing ‘Regional Divide’ first appeared on The MortgagePoint.