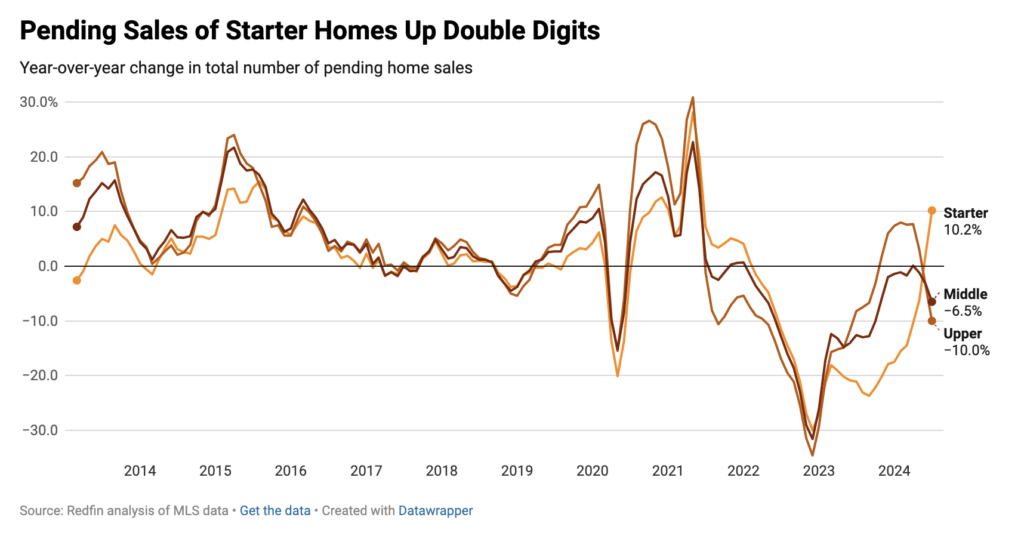

In July, pending sales of starter homes increased 10.2% year-over-year to the highest level since October 2022, per a new report from Redfin. This indicates that in the lower end of an otherwise “stagnant market”, there might be hope for first-time homebuyers.

Middle-class homes (those with sales prices in the 35th–65th percentile of the market) saw a 6.5% decline in pending sales in July over the same month last year, while upper-class homes (those in the 65th–95th percentile) saw an even greater decline of 10%.

The recent decline in mortgage rates, which started in mid-July, is one reason why pending sales of starter homes might be improving. Since they are less likely to have a sizable down payment, first-time buyers, who account for a sizable share of the starter-home market, are more susceptible to rate reductions. As a result, rate adjustments have a greater effect on their monthly payments.

“The overall market remains sluggish, but we are beginning to see first-time homebuyers come off the sidelines, buoyed by falling mortgage rates and an increased number of homes hitting the market,” said Sheharyar Bokhari, Senior Economist at Redfin. “Not only do you have young families and investors looking at starter homes, you also have buyers who have been forced to consider less-expensive options due to near-record home prices. More buyers means more sales, but so far we aren’t seeing prices skyrocket, because the rising number of homes hitting the market is enough to satisfy the increased demand—a positive outcome for both buyers and sellers.”

Starter Home Sales Dip Slightly, but Outperformed Other Price Tiers

Starter home closed sales down 0.6% last month from the same month previous year, but they were still greater than those of middle- and upper-class properties, which decreased 3.9% and 3.4%, respectively.

Because home sales take time to close, movement in sales outcomes usually lags pending sales by one month or more. This indicates that because of July’s surge in pending sales, future starter home sales should rise even more in August.

“Lower-priced homes are really moving right now, especially since rates went down to around 6.5%,” said Derrell Skillman, a Redfin Premier agent in San Antonio, where pending sales of starter homes rose 22% last month. “We are seeing a lot of younger buyers looking at smaller starter homes. They don’t want a big backyard and a pool, they just want something efficient, with minimal ongoing maintenance required.”

In July, the average U.S. starter house sold for a record $250,000, an increase of 4.2% from the previous year. The price growth for the intermediate and upper price brackets was 4.6% and 5%, respectively, faster than this one.

The growth in starting home prices was restrained compared to other price categories due to higher inventory levels. Driven by an 18.8% increase in new listings, the number of starter houses on the market surged 18.9% year over year to the highest level recorded since October 2022. In contrast, there was only a 1.6% and 4.1% rise in inventories in the intermediate and upper price categories, respectively.

It’s important to remember that inventory is still far below pre-pandemic levels even with the rise. For instance, compared to July of this year, there were around 30% more starter homes available.

Starter Home Prices Fall in Texas and Florida Metros as Inventory Soars

Major Texas and Florida metros saw some of the biggest declines in home prices in July, year over year, aided by significant spikes in inventory. The five metros which saw the biggest decline in price were:

- Austin, TX (-3.9% sales price, +17.4% active listings)

- San Antonio (-2.6% sales price, +50.2% active listings)

- West Palm Beach, FL (-2% sales price, +34.8% active listings)

- Fort Lauderdale, FL (-1.9% sales price, +47.5% active listings)

- Dallas (-1.6% sales price, +38.5% active listings)

Metro-Level Starter Home Highlights: May-July 2024

- Prices: The median sale price of starter homes rose most in Detroit (15.6% increase to $67,500), Newark, NJ (15.4% increase to $375,000) and Pittsburgh (13.6% increase to $117,000). Its largest falls were in Austin, TX (-3.9% to $326,700), San Antonio (-2.6% to $202,500) and West Palm Beach, FL (-2% to $245,000).

- Sales: Starter home sales increased most in San Francisco (18.7%), San Jose, CA (14.5%) and Cincinnati, OH (12.4%). They decreased most in Fort Lauderdale, FL (-19.6%), West Palm Beach, FL (-17.2%) and Phoenix (-11.9%).

- Active listings: The total number of starter homes for sale increased most in San Antonio (50.2%), Fort Worth, TX (49.6%) and Tampa, FL (48.1%). Only one metro—Milwaukee—saw a fall in active listings (-4.1%).

- New listings: New listings of starter homes increased most in Fort Worth, TX (40.4%). Nassau County, NY (39.5%) and San Antonio, TX (38.3%). New listings fell in Atlanta (-6.5%) and Milwaukee (-5.2%).

- Speed of sales: Starter homes sold fastest in Seattle with a median of seven days, followed by Montgomery County, PA (11 days) and Warren County, MI (12 days). They sold slowest in Fort Lauderdale, FL (81 days), West Palm Beach, FL (77 days) and Miami (67 days).

To read the full report, including more data, charts, and methodology, click here.

The post Pending Sales for Starter Homes Up by Double Digits first appeared on The MortgagePoint.